By David Gaffen and Manas Mishra

(Reuters) - Healthcare companies who profit from treating obese and overweight patients are trying to convince investors that powerful new weight-loss drugs won't shrink their businesses.

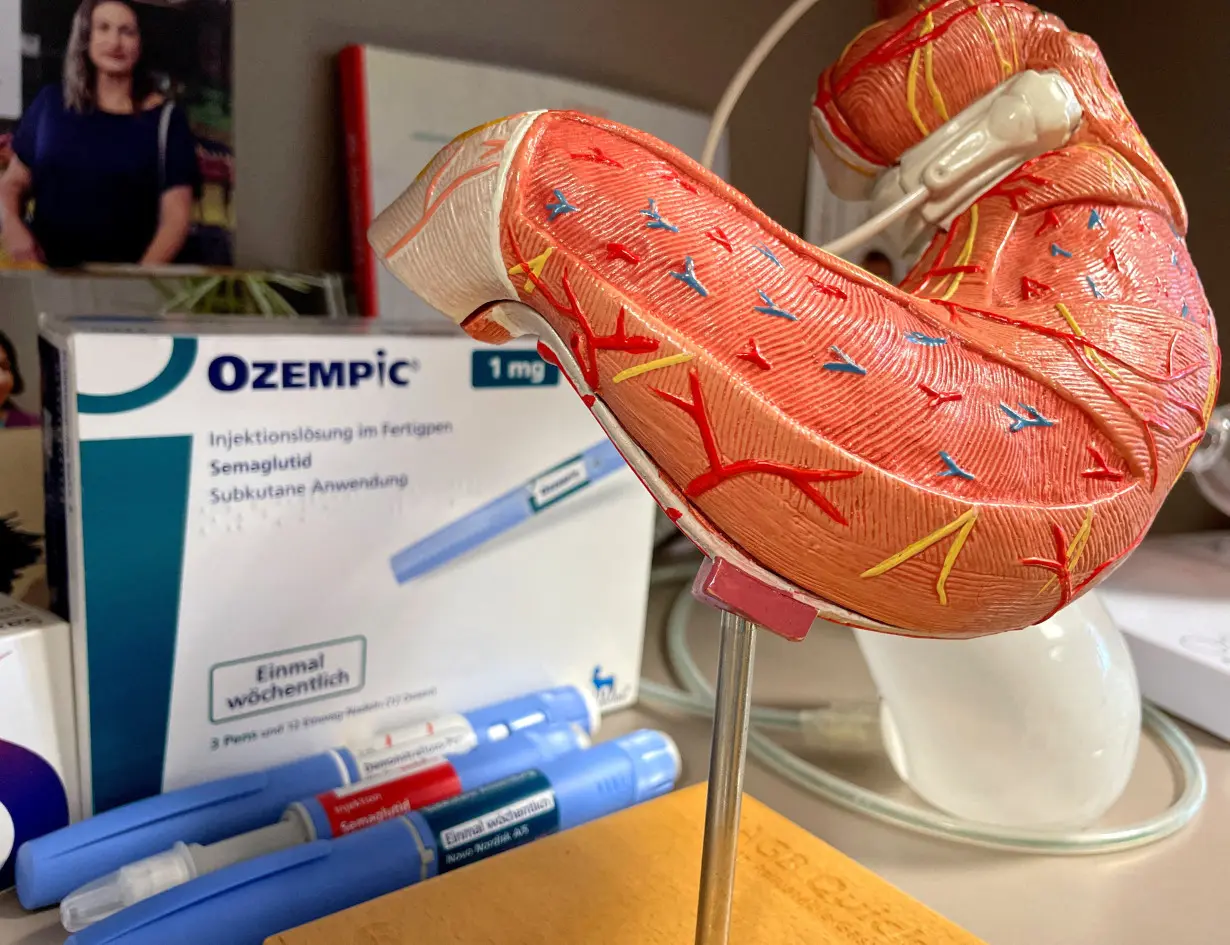

The global market for obesity drugs could reach as much as $100 billion within a decade due to the effectiveness of Novo Nordisk's Wegovy and similar medicines.

Such forecasts have prompted a sell-off in a wide range of companies from makers of bariatric surgery devices to companies whose products address the health issues created by excess weight, from diabetes to sleep apnea.

However, those companies and analysts point to the high prices of the weight-loss drugs, uncertainty over long-term usage and the potential lack of insurance coverage for the costs as potentially limiting the market for them in the long run.

"The market is in a shoot-first, ask-questions-later mood when it comes to weight-loss drugs," said Nicholas Anderson, manager of the Thornburg International Growth Fund, which holds shares of Novo Nordisk. "What's less clear on the losers side is who will actually be affected and how long will it take to show up in numbers."

Shares of Danish drug company Novo Nordisk are up 28% in the last three months. Eli Lilly, which is expected to soon introduce its own weight-loss drug Mounjaro, is up 25%, ballooning its market value to more than $550 billion, making it the world's most valuable health care company.

By contrast, the iShares U.S. Medical Devices exchange-traded fund has lost more than 22% in the last three months.

Injectable weight-loss drugs, known as GLP-1 receptor agonists, are considered highly effective but are also expensive, costing more than $1,300 per month. Some competitors have questioned the potential reach of the GLP-1 market.

"We expect it will take at least a decade to reach peak penetration of these products in the indicated population," Kenneth Stein, Boston Scientific's global chief medical officer, told investors on Thursday, adding that only a minority of obese American patients will use the drugs. Boston Scientific said the effect on the company's heart devices would be "very limited."

Margaret Kaczor Andrew, a William Blair analyst covering medical technology companies, says she does not expect a meaningful effect on technologies like glucose monitors, which help manage diabetes. She pointed to the emergence of other drug classes like statins that had reduced cardiovascular disease but not decreased the need for heart devices.

"Ultimately, it does not impact device utilization," she said.

Michael Farrell, CEO of Resmed, which makes devices to treat sleep apnea, said on an investor call Thursday that the company is "tracking many thousands of patients on GLP-1 and we're seeing maintenance of adherence. We're seeing maintenance of resupply programs and really no change."

WAIT AND SEE

Some investors said the drugs could reduce the need for invasive weight-loss procedures like bariatric surgery.

"It seems very natural for people to try the drugs, see about the weight loss they get, and how long-lasting it is and then delay bariatric surgery or avoid it all together," said Jeff Jonas, portfolio manager at Gabelli Funds.

Johnson & Johnson said third-quarter medical device sales fell short of analyst estimates due to a slowdown in devices used in bariatric surgeries.

Yet only about one-third of patients prescribed a weight-loss drug like Wegovy were still taking it a year later, Reuters reported in July, citing an analysis of pharmacy claims data.

"We expect that many of them will not stay on the drug for longer than a year or two, and at that time, will consider bariatric surgery," Myriam Curet, chief medical officer at Intuitive Surgical, said on the company's Oct. 19 earnings call. "Overall, we'll see an increased interest in bariatric surgery, but that will get delayed in the short term."

The weight-loss drugs' cost and uncertainty about whether their use will improve the long-term health of patients and reduce healthcare spending will limit near-term expansion of insurance coverage, said Ann Hynes, a healthcare services analyst at Mizuho Securities.

She recently held a call for investors with two health insurers with insight on corporate health plans.

"Nothing is going to change in '24. If anything, I think (insurance) access is going to get stricter. It could evolve in 2025, 2026," Hynes said.

(Reporting by David Gaffen in New York and Manas Mishra in Bengaluru; Additional reporting by Michael Erman and Caroline Humer in New York; Editing by Sonali Paul)

Yellen defends COVID spending, says it saved millions from losing jobs

Yellen defends COVID spending, says it saved millions from losing jobs

Futures flat on caution ahead of bank earnings, key inflation data

Futures flat on caution ahead of bank earnings, key inflation data

Comoros ruling party wins parliamentary elections, opposition rejects results

Comoros ruling party wins parliamentary elections, opposition rejects results

Sweden seeks to change constitution to be able to revoke citizenships

Sweden seeks to change constitution to be able to revoke citizenships

Italy protests to Venezuela over arrest of NGO worker

Italy protests to Venezuela over arrest of NGO worker

Euro zone's depressed industry records small rebound in November

Euro zone's depressed industry records small rebound in November

Bayern Munich signs US youngster Bajung Darboe from LAFC

Bayern Munich signs US youngster Bajung Darboe from LAFC

Novak Djokovic breaks a tie with Roger Federer for the most Grand Slam matches in tennis history

Novak Djokovic breaks a tie with Roger Federer for the most Grand Slam matches in tennis history

China's RedNote: what you need to know about the app TikTok users are flocking to

China's RedNote: what you need to know about the app TikTok users are flocking to