By Aditya Soni and Roshan Abraham

(Reuters) - Several Wall Street brokerages started coverage of Arm Holdings with their top ratings on Monday, saying the chip designer's dominance in the smartphone market and potential for expansion into data centers could power earnings growth.

The flurry of recommendations marked the end of the quiet period for the nearly 30 banks that underwrote Arm's initial public offering, which raised $4.87 billion for owner SoftBank Group last month in the biggest listing of the year.

The "buy" or equivalent ratings, from brokerages including J.P. Morgan and Goldman Sachs, are a vote of confidence for Arm's plan to grow revenue by charging higher royalty fees and increasing its share of the cloud and automotive markets.

The British company's growth has been shackled in the past year by a slump in the smartphone market, in which it has a 99% share across Google's Android and Apple's iOS devices.

"We expect Arm to not only expand on its presence in the smartphone market primarily through higher royalty rates, but to also extend its reach across applications to which it is under-indexed," Goldman Sachs said, setting a price target of $62.

Other brokerages including Citi, Deutsche Bank, Mizuho and TD Cowen set price targets in the range of $60 to $70, with the most bullish view coming from J.P. Morgan. Arm shares last closed at $54.08, compared with the IPO price of $51.

TD Cowen said Arm faces some challenges from the weak smartphone market, but its current revenue represented an "under-monetization of its importance to the industry".

Citi predicted that Arm could become one of the fastest-growing large chip companies with a compounded annual revenue increase of 18% through fiscal year 2027.

Such growth would benefit SoftBank, which told investors ahead of the Arm IPO that it plans to remain the majority owner in the company it considers its crown jewel.

But some brokerages, including HSBC, urged caution, saying Arm's shares could remain range-bound as uncertainty over a smartphone market recovery pressures earnings.

Before Monday, only analysts at brokerages that did not work on Arm's IPO were allowed to offer recommendations on the stock, and their opinion was generally more skeptical. Three of them initiated Arm with a "hold" rating and the other one with a "strong sell," LSEG data showed.

But by 8 am ET on Monday, at least 15 brokerages started covering Arm with a mean rating of "buy" and a $60 median price target.

(This story has been corrected to fix the IPO price to $51 from $56.10 in paragraph 2)

(Reporting by Roshan Abraham in Bengaluru; Editing by Savio D'Souza and Anil D'Silva)

The long struggle to establish Martin Luther King Jr. Day

The long struggle to establish Martin Luther King Jr. Day

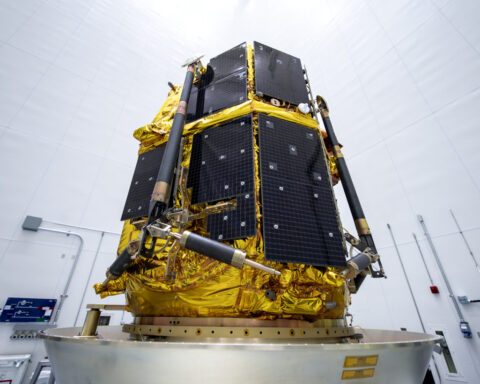

Two private lunar landers head toward the moon in a roundabout journey

Two private lunar landers head toward the moon in a roundabout journey

TikTok preparing for U.S. shut-off on Sunday, The Information reports

TikTok preparing for U.S. shut-off on Sunday, The Information reports

Trump's Greenland bid stirs debate in China about what to do with Taiwan

Trump's Greenland bid stirs debate in China about what to do with Taiwan

Japan's Makino Milling requests changes to unsolicited bid from Nidec

Japan's Makino Milling requests changes to unsolicited bid from Nidec

As Los Angeles burns, Hollywood's Oscar season turns into a pledge drive

As Los Angeles burns, Hollywood's Oscar season turns into a pledge drive

As fires ravage Los Angeles, Tiger Woods isn't sure what will happen with Riviera tournament

As fires ravage Los Angeles, Tiger Woods isn't sure what will happen with Riviera tournament

Antetokounmpo gets 50th career triple-double as Bucks win 130-115 to end Kings' 7-game win streak

Antetokounmpo gets 50th career triple-double as Bucks win 130-115 to end Kings' 7-game win streak