(Reuters) -Washington Federal Bank agreed on Friday to sell a portfolio of commercial multi-family real estate loans to Bank of America for about $2.9 billion, helping the regional lender cut its exposure to the troubled sector.

The commercial real estate (CRE) sector, which has been roiled by higher borrowing costs and lower occupancy, has become a key cause of concern for investors and has drawn tough regulatory scrutiny for regional lenders.

Parent company WaFd, in a regulatory filing, disclosed the portfolio of 2,000 commercial multi-family real estate loans had an aggregate unpaid principal balance of $3.2 billion.

After the deal is closed, WaFd said BofA is planning to enter into a structured transaction or loan sale with one or more funds of Pacific Investment Management.

WaFd shares were marginally up in morning trading on Friday. The stock is down around 9% so far this year.

(Reporting by Manya Saini in Bengaluru; Editing by Krishna Chandra Eluri)

Santa Cruz County ballot errors impact more than 1,100 voters

Santa Cruz County ballot errors impact more than 1,100 voters

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Google defeats lawsuit over gift card fraud

Google defeats lawsuit over gift card fraud

Delay in Chile mining permits a serious problem, says local head of Freeport

Delay in Chile mining permits a serious problem, says local head of Freeport

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

Malaysia central bank set to manage market volatility, monitoring US election

Malaysia central bank set to manage market volatility, monitoring US election

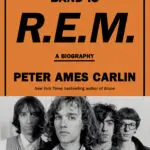

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury