By David Milliken and William Schomberg

LONDON (Reuters) -Bank of England Governor Andrew Bailey set out an outline for how the central bank intends to keep money markets stable as it sells more of the 875 billion pounds ($1.11 trillion) of government bonds it bought between 2009 and 2021.

Bailey said in a speech on Tuesday that as the BoE reduced its bond holdings - currently at a pace of 100 billion pounds a year - it would become clearer how much cash banks and other financial institutions wanted to hold with it.

The size of the BoE's balance sheet has surged because of the cash created under its bond-buying - or quantitative easing - operations, which it used to help the economy through the shocks of the global financial crisis and the COVID pandemic.

But the central bank has long said it does not expect its balance sheet to return all the way down to its size before the 2008 financial crisis.

Instead, Bailey said he expected what the BoE calls the 'preferred minimum range of reserves' to be somewhere between 345 billion pounds and 490 billion pounds, which could be reached as soon as the second half of next year.

"We will have headroom should we need to use the balance sheet again, and we can maintain monetary control through the use of Bank Rate," Bailey said in the speech at the London School of Economics.

Reserves currently stand at around 760 billion pounds, down from a peak of nearly 1 trillion pounds in January 2022 but far above their pre-financial crisis level of around 20 billion pounds.

FULL QE UNWIND?

Once the level of reserves had fallen to the new minimum range, the BoE would not need to stop its programme of bond sales, which reduce the level of reserves held at the BoE.

Bailey said reaching this point would bring "a natural point of reflection" about the pace of bond sales, but it could well continue them and bring in a system where banks and others that wanted to hold reserves took part in BoE repo operations.

Without adequate reserves, market interest rates tend to rise above the rate set by the BoE to control inflation and at worst, banks can struggle to make payments to each other.

Repo operations allow participants temporarily to swap high-quality assets such as government bonds for central bank cash, usually in return for a small fee.

"We would expect a significant increase in our repo operations as we look ahead to the future, and the market should continue to ready itself for this," Bailey said.

Repos would reduce the interest rate risk faced by the BoE, which has been significant under QE, Bailey added.

Some British Conservative politicians have criticised the BoE for the losses currently being crystallised by its bond sales, although Bailey argued that systems operated by other central banks had similar costs over the long term.

Bailey said the BoE had not decided if it would make sense to reduce its gilt holdings to zero, or if some holdings were needed to cover gaps that a repo system might struggle to cover.

As the BoE got close to the minimum level of reserves banks wanted to hold, there were likely to be "a few bumps in the road with temporary frictions in money markets", Bailey added.

Last week the BoE allotted a record 14.4 billion pounds at one of its existing repos, but Bailey said this reflected temporary factors.

($1 = 0.7872 pounds)

(Reporting by William Schomberg and David Milliken; editing by William James, Kevin Liffey and David Gregorio)

Santa Cruz County ballot errors impact more than 1,100 voters

Santa Cruz County ballot errors impact more than 1,100 voters

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Google defeats lawsuit over gift card fraud

Google defeats lawsuit over gift card fraud

Delay in Chile mining permits a serious problem, says local head of Freeport

Delay in Chile mining permits a serious problem, says local head of Freeport

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

Malaysia central bank set to manage market volatility, monitoring US election

Malaysia central bank set to manage market volatility, monitoring US election

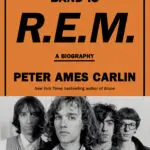

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury