By Sruthi Shankar and Johann M Cherian

(Reuters) -European stocks closed at a one-week low on Wednesday, hurt by a sell-off in automakers following a report about possible Chinese tariffs on imported cars, while tech stocks ticked higher ahead of U.S.-based Nvidia's results.

European automakers fell 1.4% to a more than three-month low, with shares of Mercedes-Benz, BMW and Volkswagen falling between 0.7% and 1.7%.

China should raise its import tariffs on large gasoline-powered cars to 25%, a government-affiliated auto research body expert told China's Global Times newspaper, as the country faces sharply higher U.S. auto import duties and possibly additional duties to enter the European Union.

The European Commission launched an investigation in October into whether fully-electric cars manufactured in China were receiving unfair subsidies and warranted extra tariffs. The EU could impose provisional duties in July.

The Europe-wide STOXX 600 index dipped 0.3%, also pressured by a tick up in sovereign bond yields after data showed UK inflation eased less than expected in April. [GVD/EUR]

Tech stocks were a bright spot, up 0.6% as investors awaited quarterly results from AI darling Nvidia later in the day to gauge if the recent market rally could continue.

"Global semiconductors is definitely one area that we see strongly benefiting from this sustained AI demand and to some extent some European companies can benefit," said Maximilian Kunkel, chief investment officer for Global Family & Institutional Wealth at UBS.

"The big story that we've seen in terms of earnings delivery so far is that we're seeing a narrowing of the gap between the United States and the euro zone."

A surge among European tech stocks following an upbeat outlook from Nvidia in February helped the benchmark STOXX index hit an all-time high for the first time this year.

However, a Reuters poll showed a rally in European shares has made them more vulnerable to possible pull-backs in the latter part of 2024, although signs of economic recovery and the start of a rate-cutting cycle could push them back to new peaks in the following year.

Elsewhere, the luxury sector dropped over 2% to mark its worst day in over three months.

Swiss Life dipped 2% after Switzerland's largest life insurer narrowed its 2024 outlook for fee income.

Marks & Spencer jumped 5.1% after the British retailer beat forecasts with a 58% rise in annual profit.

(Reporting by Sruthi Shankar and Johann M Cherian in Bengaluru; Editing by Krishna Chandra Eluri and Mark Potter)

Santa Cruz County ballot errors impact more than 1,100 voters

Santa Cruz County ballot errors impact more than 1,100 voters

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Google defeats lawsuit over gift card fraud

Google defeats lawsuit over gift card fraud

Delay in Chile mining permits a serious problem, says local head of Freeport

Delay in Chile mining permits a serious problem, says local head of Freeport

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

Malaysia central bank set to manage market volatility, monitoring US election

Malaysia central bank set to manage market volatility, monitoring US election

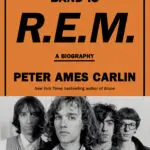

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury