BEIJING (Reuters) - China will cut interest rates of mortgage loans and down-payment ratios for homebuyers to boost lacklustre property demand, according to three statements released by its central bank on Friday.

China will abolish the floor level of the interest rates for mortgages for the first and second homes at the national level, the central bank said.

Local branches of the central bank can decide the floor of commercial mortgages independently, and financial institutions should properly decide the interest rates based on business operating conditions and client risks, the central bank said.

China will adjust the minimum downpayment ratio for first homebuyers to no less than 15% and for residents' second home purchase to no less than 25%, according to a separate statement from the bank.

(Reporting by Liangping Gao, Ziyi Tang and Ryan Woo; Editing by Muralikumar Anantharaman)

Santa Cruz County ballot errors impact more than 1,100 voters

Santa Cruz County ballot errors impact more than 1,100 voters

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Google defeats lawsuit over gift card fraud

Google defeats lawsuit over gift card fraud

Delay in Chile mining permits a serious problem, says local head of Freeport

Delay in Chile mining permits a serious problem, says local head of Freeport

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

Malaysia central bank set to manage market volatility, monitoring US election

Malaysia central bank set to manage market volatility, monitoring US election

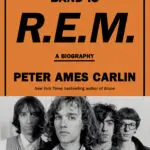

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury