Washington (CNN) — Americans fear faster inflation is on the horizon.

The University of Michigan’s latest consumer survey, released Friday, showed that Americans’ inflation expectations for the year ahead surged this month to 4.3%, up a full percentage point from January to the highest level since November 2023.

“This is only the fifth time in 14 years we have seen such a large one-month rise (one percentage point or more) in year-ahead inflation expectations,” said Joanne Hsu, the survey’s director, in a release.

The survey’s sentiment index also declined in February for the second consecutive month, down 5% from January to its lowest reading since July 2024.

“The decrease was pervasive, with Republicans, Independents, and Democrats all posting sentiment declines from January, along with consumers across age and wealth groups,” Hsu said.

The interviews for the Michigan survey were concluded on February 4, just days after the Trump administration announced 25% tariffs on Mexico and Canada.

The three countries reached a deal shortly after the announcement to delay President Donald Trump’s tariffs for 30 days, which leaves consumers and businesses still dealing with the uncomfortable possibility of higher costs in the future.

Meanwhile, Trump’s levy of an extra 10% duty on Chinese goods went into effect Tuesday, and was immediately met with retaliation by China.

“The consumer sent a warning shot over the bow of the new Trump administration that imposition of import tariffs will boost inflation over a percentage point this year and, as a result, consumer sentiment tumbled,” Christopher Rupkey, chief economist at FwdBonds, said in an analyst note Friday.

“The consumer is confident of one thing and one thing only and that is the pro-growth policies of Trump 2.0 are inflationary,” he added.

Not a nightmare for the Fed — yet

The Federal Reserve, tasked with managing interest rates, pays close attention to Americans’ perception of prices. That’s because inflation expectations can sometimes be self fulfilling, so if consumers expect inflation to pick up, they could modify their spending.

The Fed focuses specifically on longer-term inflation expectations, based on various surveys and measures, including the closely watched Michigan survey. That latest figure wasn’t as unsettling as the year-ahead one: Long-term inflation expectations edged higher this month to 3.3% from January’s 3.2%, remaining “elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.”

In 2018, after the first Trump administration slapped tariffs on various goods, Fed economists devised simulations on the appropriate path for monetary policy based on different tariff scenarios. In a situation where inflation expectations climbed, the Fed saw it appropriate to hike interest rates.

The Fed paused rate cuts last month after it slashed its key interest rates a full percentage-point over three meetings last year. Fed officials have signaled that they want to be cautious with further rate cuts. Wall Street isn’t expecting a rate cut in March, according to futures.

The-CNN-Wire

™ & © 2025 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.

Asia shares steady; gold at record high as trade war ratchets up

Asia shares steady; gold at record high as trade war ratchets up

Japan inflation likely cooled in Feb on energy subsidy resumption: Reuters poll

Japan inflation likely cooled in Feb on energy subsidy resumption: Reuters poll

Airlines that have updated their lithium battery policies

Airlines that have updated their lithium battery policies

US and Israel look to Africa for resettling Palestinians uprooted from Gaza

US and Israel look to Africa for resettling Palestinians uprooted from Gaza

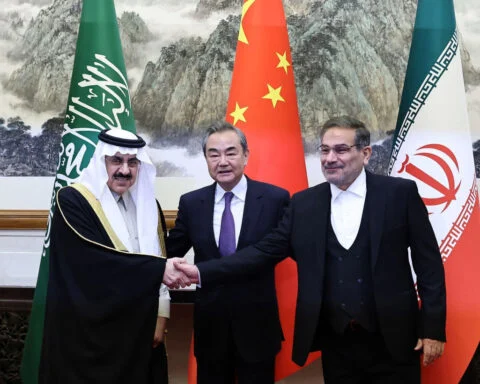

China, Iran, Russia kick off talks in Beijing over Iran's nuclear issues

China, Iran, Russia kick off talks in Beijing over Iran's nuclear issues

Florida mayor seeks to evict cinema for screening Israeli-Palestinian film

Florida mayor seeks to evict cinema for screening Israeli-Palestinian film

Heartbreak for DePaul as 1st trip to Big East semifinals slips away with late collapse at MSG

Heartbreak for DePaul as 1st trip to Big East semifinals slips away with late collapse at MSG