By Davide Barbuscia and David Randall

NEW YORK (Reuters) - Wall Street's bond investors received a much-needed shot in the arm on Wednesday, thanks to smaller-than-expected government borrowing from the Treasury and signs that the Federal Reserve may be closer to wrapping up its monetary policy tightening.

The Fed left rates unchanged for the second straight meeting and Fed Chair Jerome Powell nodded to positive developments in bringing down inflation at the end of the central bank’s policy review on Wednesday - though he gave little indication that policymakers were getting closer to cutting rates.

Earlier in the day, the U.S. Treasury said it will slow the pace of increases in its longer-dated debt auctions in the next three months, at least temporarily assuaging concerns that investors will require higher yields to absorb an expected torrent of government debt.

Plenty of bond investors have been burned calling a bottom in a selloff that has taken Treasuries to the cusp of an unprecedented third straight year of losses. One potential near-term pitfall is Friday’s U.S. payrolls data, which could revive expectations of Fed hawkishness if they come in stronger than expected.

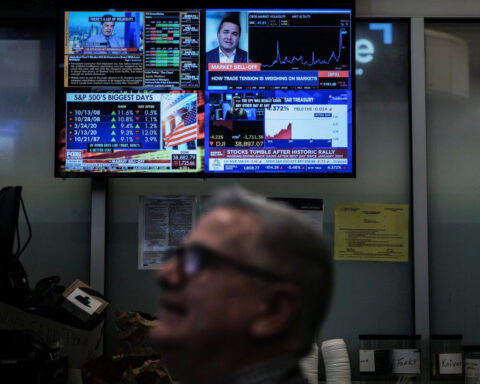

Nevertheless, some are betting that risks have finally tilted towards the upside. Yields on the benchmark U.S. 10 year Treasury - which move inversely to prices - dropped 15 basis points on Wednesday to their lowest in two weeks after breaking above 5% for the first time in 16 years last month. U.S stocks jumped with the S&P up more than 1%.

“Bonds are starting to show a little bit of life,” said Jack McIntyre, portfolio manager at Brandywine Global. However, if Friday’s payroll number exceeds expectations, “then that bullishness will get tested.”

McIntyre is bullish on longer-dated Treasuries but will wait for Friday’s payroll data to decide whether to add more exposure.

Others have sounded bullish as well. Among them is billionaire investor Stanley Druckenmiller, founder of the Duquesne family office, who said last month that he bought a “massive leveraged position” in two-year U.S. Treasury bonds because of rising concerns about the health of the U.S. economy.

Bond bulls argue investors should increase exposure to long-term securities partly because they could appreciate in price if an economic slowdown pushes the Fed to eventually cut rates.

Some have been focusing on signs that the economy has been slowing below the surface, with dwindling savings accumulated during the COVID-19 pandemic, the resumption of student loan repayments and higher borrowing costs, set to hurt consumers and companies in the months ahead.

The rise in Treasury yields has reached far beyond the bond market. The S&P 500 is down nearly 8% from its July high, as rising bond yields offer investment competition to equities while threatening to raise the cost of capital for companies. The index is up more than 10% year-to-date. Mortgage rates, which are guided by yields, rose to a more-than 23-year high in October.

"We’ve been trading out of equities and increasing bonds," said Josh Emanuel, chief investment officer at Wilshire. "The premium that investors are earning incrementally for taking equity risk is very low today relative to what they earn in government bonds."

The U.S. economy grew almost 5% in the third quarter, so far defying earlier predictions of a slowdown.

RESTRICTIVE ENOUGH?

Fed funds futures late on Wednesday indicated a 23% probability of a rate hike in December, down from a 29% probability on Tuesday. The Fed has already raised rates by 525 basis points since March last year.

Not everyone took Powell's comments as dovish, however, and some investors cautioned the market was too quick to dismiss the possibility of more hikes.

Powell said on Wednesday that it remained unclear whether overall financial conditions were yet restrictive enough to tame inflation, which is still far above the central bank's 2% target. "We've been achieving progress on inflation ... The question is, how long can that continue?," he said.

Greg Wilensky, head of U.S. fixed income at Janus Henderson Investors, said that while the Fed is not saying it is done raising rates, “they will need to see data surprise meaningfully to the upside to get them to raise rates in December.”

Wilensky, who has been moving from bets on shorter-term bonds to longer-term ones, does not expect rates to rise significantly from current levels but reckons that bond market volatility will remain given the high level of geopolitical risks.

Noah Wise, a senior portfolio manager at Allspring Global Investments, warned against getting too bullish on bonds, as there was a “heightened risk” that 10-year Treasury yields could once again top 5% if the Fed feels it has to push back against a dovish narrative.

“The market is running with the idea that the Fed is done hiking, which they may or may not be,” he said. “The more the market runs with this narrative, the more it will push the Fed to take more cuts out of their 2024 forecasts."

(Reporting by Davide Barbuscia and David Randall; Editing by Ira Iosebashvili and Shri Navaratnam)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness