NEW YORK (AP) — Shares of U.K. chip designer Arm Holdings rose almost 25% in their stock market debut, in the largest initial public offering of shares in nearly two years.

The shares opened at $56.10 on the Nasdaq Thursday after having been priced at $51. They closed at $63.59, giving Arm a market value of $68 billion.

Most consumers use at least one product that contains Arm's chips, though many people may not be familiar with the company itself. Its chip design is used in virtually all smartphones, the majority of tablets and digital TVs. More recently, Arm has expanded into artificial intelligence, smart devices, cloud computing, the metaverse and autonomous driving.

Arm's offering is an important development for the IPO market, which has seen relatively few companies go public the past two years. It's also a key moment for the Japanese technology investor Softbank, which acquired Arm in 2016, as well as investments banks such as Goldman Sachs that recently have taken in far less revenue from underwriting and advisory fees.

Softbank will retain a nearly 90% stake in the Arm. It’s the biggest IPO since the electric truck maker Rivian debuted in November 2021.

Arm’s business centers on designing chips and licensing the intellectual property to customers, rather than chip manufacturing, for which it relies on partners. The company recorded $2.68 billion of revenue in its last fiscal year, which ended in March, and had $524 million in profit for that period.

Nearly 400 companies went public in 2021 as the stock market rallied for a third straight year, according to IPO tracker Renaissance Capital. Helping to boost that figure was a proliferation of deals involving special purpose acquisition companies, or SPACs. Also know as blank-check companies, SPACs exist solely to buy a private company and take it public. Some companies prefer SPAC deals because there are fewer disclosure requirements.

Then last year the Federal Reserve rapidly raised interest rates to combat high inflation and the stock market went into reverse, with the S&P dropping nearly 20% and the Nasdaq composite falling more than 30%. Private companies became hesitant to go public, and the number of IPOs sank to 71. This year, with the economy showing unexpected resilience, 70 companies had gone public by early September, although very few companies are choosing to go public via a SPAC deal.

Arm was previously a public company from 1998 to 2016. SoftBank Group Chief Executive Masayoshi Son announced the Arm acquisition for $32 billion in 2016 with great fanfare, stressing it highlighted his belief in the potential of IoT, or the “Internet of Things” technology.

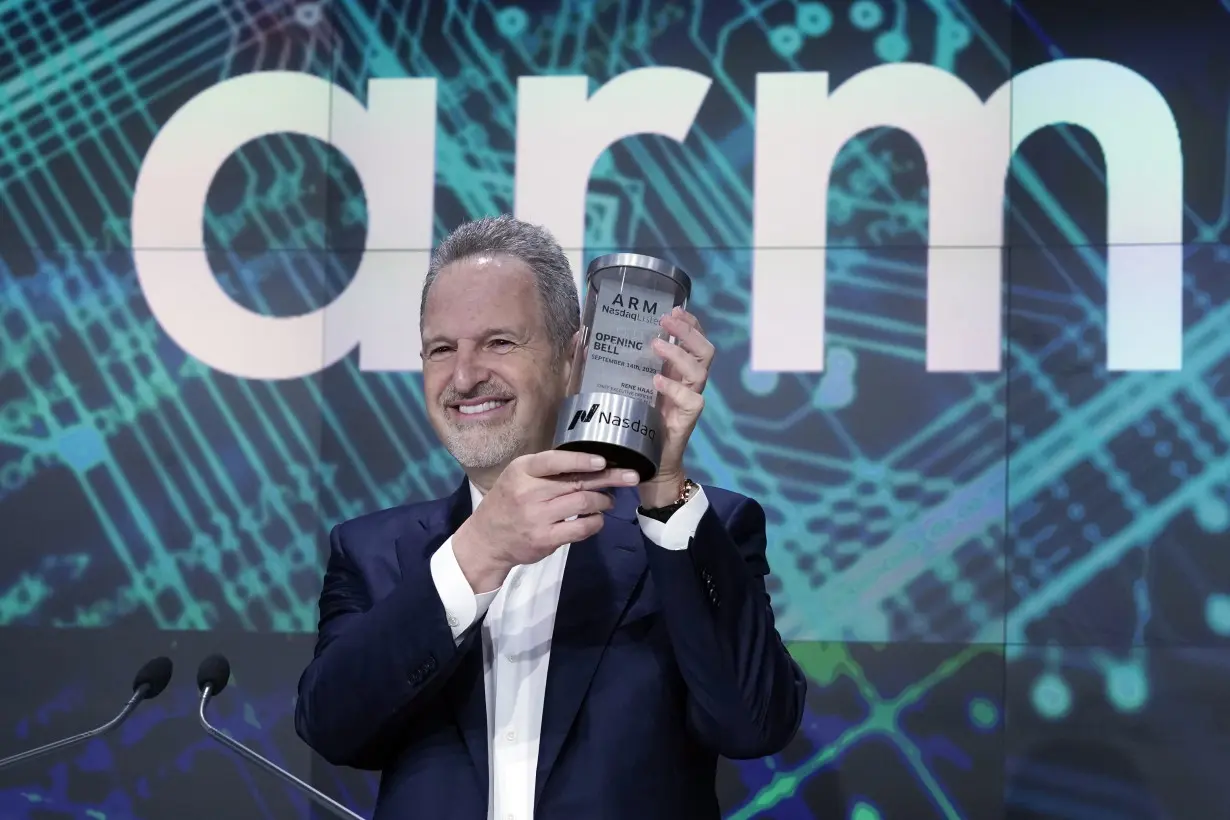

Softbank announced a deal to sell Arm to the U.S. chipmaker Nvidia for $40 billion in 2020, but the deal was called off last year because of regulatory obstacles. At that time, Son had said he expected Arm to grow “explosively” as its products got used in electric vehicles as well as cell phones. After the deal fell through, Son installed Rene Haas as CEO of Arm. Haas is a veteran of the semiconductor industry, who previously did a stint at Nvidia.

Son, who founded SoftBank, is one of the most famous rags-to-riches successes in Japan’s business world. He has enjoyed both victories and defeats in his array of technology investments, although he insists he has had more long-term wins than failures. A graduate of the University of California Berkeley, he latched on to the potential of the internet decades ago.

The slump in IPOs, as well as mergers and acquisitions, has contributed to a decline in revenue at some of Wall Street's storied institutions, including Goldman Sachs. Goldman is one of the lead underwriters for the Arm IPO, as well as an offering from grocery delivery service Instacart, expected next week.

___

Kageyama reported from Tokyo.

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness