By Lawrence Delevingne

(Reuters) -Wall Street kicked off a busy week on Monday by holding on to gains from the surge in stocks that followed Donald Trump's U.S. election victory, while oil prices declined and bitcoin raced to a new record high.

In U.S. equity markets, the Dow Jones Industrial Average rose 0.7%, to 44,293, the S&P 500 rose 0.1%, to 6,001 and the Nasdaq Composite was little changed at 19,298.

Among the winners: Tesla <TSLA.O> gained around 9% after touching $1 trillion in market value on Friday; crypto stocks such as Coinbase Global <COIN.O>, MARA Holdings <MARA.O> and Riot Platforms <RIOT.O> all surged up 15% or more; and big banks Goldman Sachs <GS.N> and JPMorgan Chase <JPM.N> added around 2%.

Stocks head toward year-end on a solid footing, with the benchmark S&P 500 index up about 26% year-to-date as AI enthusiasm and the start of Fed rate cuts support an upbeat outlook.

Focus will be on U.S. consumer price inflation data on Wednesday as well as a raft of other data this week for more indications on the health of the economy and the outlook for interest rates.

The dollar traded not far from last week's four-month peak versus other major currencies, with a parade of Federal Reserve speakers also due to speak this week, including Chair Jerome Powell on Thursday.

Republicans are edging closer to sweeping both chambers of Congress, taking the Senate on election night and with Edison Research projecting them so far to have 214 of the 218 seats needed for control of the House, compared with 205 for Democrats.

Investors expect Trump's second four-year term in office will bring equities-boosting tax cuts and looser regulations.

Scott Bessent, a hedge fund manager, Trump supporter and top contender to be Treasury Secretary, wrote in an opinion piece on Sunday that surging markets were "signaling expectations of higher growth, lower volatility and inflation, and a revitalized economy for all Americans."

Trump's victory and the election of pro-crypto candidates to Congress have pushed bitcoin to the new all-time high above $87,000, spurred by expectations of a lighter regulatory environment.

Europe's main stock index logged its best day in six weeks on Monday as the STOXX 600 added 1.13%. Defense stocks advanced on prospects of higher military spending in Europe under a Trump U.S. presidency, with investors also awaiting key economic data this week.

The euro dropped to its lowest level in 6-1/2 months against the dollar on Monday as investors worried about possible U.S. tariffs that would hurt the euro area's economy. The single currency was down about 0.6% at $1.0656.

Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, wrote in a note on Monday that while equity investors have been bullish on the new Trump administration, "it’s been less joyous for bond investors, with yields backing up sharply midweek over concerns around unfunded tax cuts and the inflationary impact of proposed tariff and immigration policies."

U.S. bond markets were closed on Monday for Veterans Day.

DIVERGING FORTUNES

MSCI's gauge of stocks across the globe was little changed.

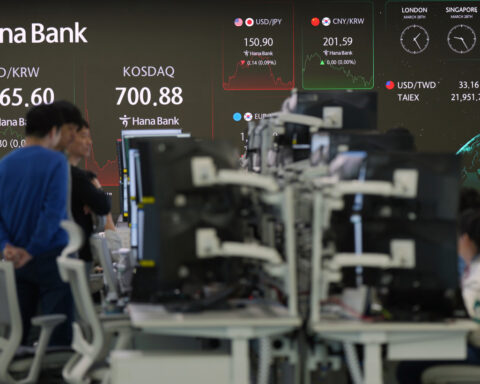

Hong Kong shares slipped to a three-week low as China's local government debt-relief package fell short of investors' expectations for economic support, while a rally in semiconductor stocks pulled Chinese markets slightly higher.

China's blue-chip CSI300 Index closed up 0.6%, led by a 6.8% jump in semiconductor stocks after Reuters reported the U.S. had ordered chipmaking giant TSMC to halt shipments of advanced chips to Chinese customers.

Investors figured that would encourage authorities to support China's industry and bought shares in local makers, sending Semiconductor Manufacturing International Corp stock up 4.7% to a record high.

Japan's Nikkei closed up 0.08% as gains were capped by domestic firms' weak outlook forecasts.

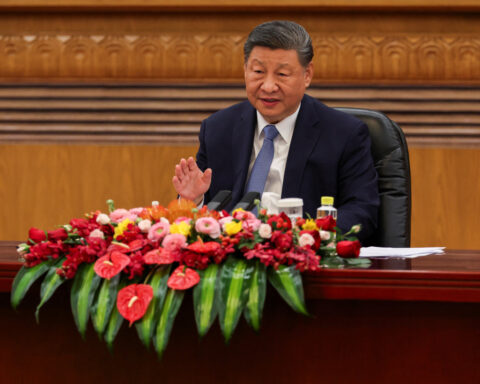

China's National People's Congress Standing Committee unveiled a 10 trillion-yuan ($1.39 trillion) debt package on Friday to ease local government financing strains and stabilize flagging economic growth. However, the stimulus steps lacked the direct injection of money into the economy that some investors had hoped to see, particularly amid the threat of massive tariffs under the incoming Trump administration.

Gold fell 2.3% to $2,622 an ounce, dropping back from last month's record high of $2,790.15.

Oil prices continued to fall on the expectation that Trump's pro-drilling rhetoric will increase world supplies. U.S. crude fell about 3%, while Brent was down 2.5% on the day.

(Reporting by Lawrence Delevingne in Boston, Nell Mackenzie in London and Kevin Buckland in TokyoEditing by Will Dunham, Christina Fincher and Matthew Lewis)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness