SYDNEY (Reuters) - Australian consumer sentiment remained in the doldrums in February, a survey showed on Tuesday, failing to benefit from slowing inflation or speculation about an imminent cut in interest rates.

The Westpac-Melbourne Institute index of consumer sentiment edged up a bare 0.1% in February from January, when it dipped 0.7%. The index was 7.2% higher on a year earlier, and at 92.2 showed pessimists again outnumbered optimists.

The cautious outlook should reassure the Reserve Bank of Australia that consumers were not rushing to spend and stoke inflation, leaving the door open for an easing in monetary policy perhaps as soon as next week.

"The consumer mood improved materially over the second half of 2024, but the recovery has stalled in the last three months as continued pressures on family finances and a more unsettled global backdrop weigh against firming expectations of rate cuts domestically," said Matthew Hassan, Westpac's head of Australian macro-forecasting.

Of all respondents, 36% expected mortgage rates to decline over the next year, while 21% saw no change and 28% looked for a rise in rates.

Financial markets are far more confident about an easing, implying a 95% chance the RBA will cut its 4.35% cash rate when it meets on February 18.

The breakdown of the survey showed the main pressure point was the assessment of family finances compared to a year ago, which fell 3.4% to 75.1, extending a 7.8% drop in January.

The outlook was a little brighter with the index of family finances for the next 12 months up 0.6% at 105.0, showing optimists were in the majority.

The survey's measure of the economic outlook for the next 12 months firmed 1.9%, while the outlook for the next five years edged up by 0.9%.

The measure of whether it was a good time to buy a major household item rose 0.1%, and remains historically weak at 90.9.

(Reporting by Wayne Cole; Editing by Sonali Paul)

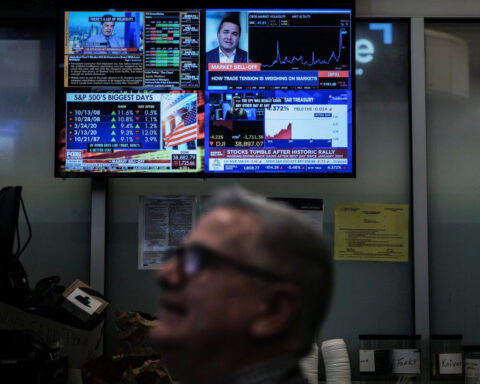

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness