By Promit Mukherjee and David Ljunggren

OTTAWA (Reuters) -The Bank of Canada slashed its key policy rate by 50 basis points to 3.25% on Wednesday to help address slower growth, though Governor Tiff Macklem indicated that further cuts would be more gradual and said he does not expect a recession.

Canada's economy has been shrinking on a per capita basis for six consecutive quarters and most of the growth observed has been supported by an increase in population.

But a planned drop in immigration numbers, a sales tax break from the government, federal and provincial cash handouts and a potential tariff threat from the U.S. are creating a lot of uncertainty for the growth outlook, Macklem said.

"There are some mixed signals in the data... We did chew through that," he told a news conference, but noted monetary policy no longer needed to be clearly in restrictive territory.

Macklem indicated that further cuts would be more gradual, a shift from previous messaging that continuous easing was needed to support growth.

The 50-basis-point cut marks the first time since the pandemic that the central bank has implemented consecutive jumbo-sized cuts. In a Reuters poll of economists, 80%, or 21 out of 27 respondents, predicted that the bank would cut the overnight rate by 50 basis points. The rest forecast a quarter-point reduction.

"With the policy rate now substantially lower, we anticipate a more gradual approach to monetary policy if the economy evolves broadly as expected," Macklem said.

TRUMP TARIFF THREAT

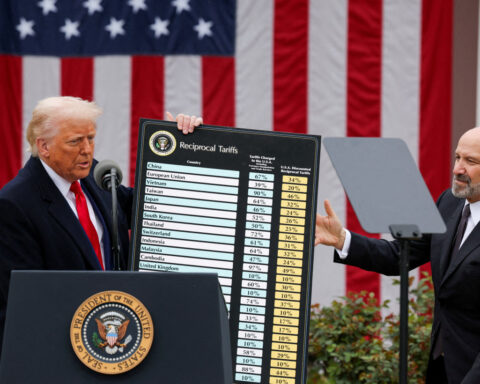

Macklem, for the first time, said that the possibility the new administration of U.S. President-elect Donald Trump might impose tariffs on Canadian exports represented a major new uncertainty.

"If those things happen, certainly they will have a big impact on the Canadian economy, and will have a dramatic effect on our forecast," Macklem said.

Trump has promised to impose tariffs of 25% on all Canadian exports unless Ottawa moves to tighten the border, which Macklem said clouded the economic outlook.

The policy rate is now at the top end of the bank's so-called neutral range, which is considered to be the band within which rates are just enough not to restrict growth but not stimulate it either.

The Canadian dollar firmed up on the messaging around slower rate cuts, with the loonie trading 0.29% stronger at 1.414 against the U.S. dollar, or 70.72 U.S. cents.

Currency markets are pricing in a 70% chance of a 25-basis-point rate cut in January.

Inflation is now at 2%, the bank's target, and Macklem reiterated that he wanted to see growth pick up.

Canada's economy grew at an annualized rate of just 1% in the third quarter, less than the Bank of Canada had predicted. The bank said fourth-quarter growth might be weaker than expected, and that planned reductions in immigration levels could cause 2025 growth to also fall short of forecasts.

As well as analyzing the effect of immigration numbers, the bank will also have to take into account a temporary sales tax rebate and a possible one-time cash handout by the government.

Macklem said the bank would look through the effects that are temporary and focus on underlying trends to guide policy decisions.

"We are retaining our call that the Bank of Canada ultimately needs to take its policy rate down to 2.00% by early 2026 as we expect U.S. tariffs to eventually be applied to some Canadian exports," Royce Mendes, head of macro strategy for Desjardins Group, wrote in a note.

With Wednesday's reduction, the bank has now shrunk benchmark borrowing costs five times in a row by 175 basis points in a space of six months, making it the only major central bank to have reduced borrowing costs at such a rapid pace.

"It says that the economy as a whole is not in an especially strong place," said Andrew Kelvin, head of Canadian and Global Rates at TD Securities.

(Reporting by Promit Mukherjee and David Ljunggren; Additional reporting by Fergal Smith, Divya Rajagopal, Nivedita Balue;Editing by Chizu Nomiyama, Mark Porter, Alexandra Hudson)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness