By Leika Kihara and Satoshi Sugiyama

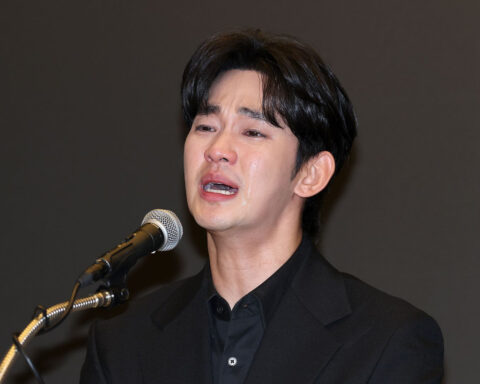

TOKYO (Reuters) -The Bank of Japan may take monetary policy action if yen falls affect prices significantly, governor Kazuo Ueda said on Wednesday, offering the strongest hint to date the currency's relentless declines could trigger another interest rate hike.

Ueda also said the BOJ could raise interest rates sooner than expected if inflation overshoots its forecasts, or risks to the price outlook increases.

Finance Minister Shunichi Suzuki voiced "strong concern" on Wednesday over the negative impact of a weak yen, such as boosting import costs, and repeated Tokyo's readiness to intervene in the market to prop up the sagging currency.

The remarks, which followed a meeting between Ueda and Prime Minister Fumio Kishida on Tuesday, underscore the resolve of the government and central bank to cooperate in keeping damaging yen falls in check.

"We need to be mindful of the risk that the impact of currency volatility on inflation is becoming bigger than in the past," as firms are already becoming more keen to raise prices and wages, Ueda told parliament on Wednesday.

"Exchange-rate moves could have a big impact on the economy and prices, so there's a chance we may need to respond with monetary policy," he said.

The remarks compared with those Ueda made after the BOJ's policy meeting on April 26, when he said the yen's recent falls did not have an immediate impact on trend inflation.

Ueda's post-meeting comments have been cited by some traders as having accelerated the yen's declines by heightening market expectations the BOJ will hold off on raising interest rates from current levels around zero for some time.

After the yen hit a 34-year low of 160.245 per dollar on April 29, Japanese authorities are suspected to have spent more than 9 trillion yen ($58.4 billion) intervening in the market last week to prop up the currency.

The dollar stood at 155.40 yen on Wednesday, creeping up from a roughly one-month high of 151.86 on May 3.

ON TRACK FOR RATE HIKES

Speaking at a seminar later on Wednesday, Ueda said "sharp, one-sided" yen falls were undesirable as they hurt the economy.

He also said trend inflation was moving "firmly" towards the BOJ's 2% target as a virtuous wage-inflation cycle becomes more solid, highlighting the central bank's conviction that conditions for additional rate hikes were falling into place.

The BOJ will "adjust the degree of monetary accommodation" - code for rate hikes, according to BOJ watchers - if trend inflation accelerates toward its 2% target as it projects, Ueda said, signaling the chance of raising rates in the near-term and in several stages in coming years.

"If inflation overshoots our forecasts or if upside risks become high, it will be appropriate for us to adjust interest rates earlier," he said.

"On the other hand, if inflation undershoots or downside risks heighten, we must maintain current accommodative financial conditions for a longer period."

The BOJ ended negative interest rates and other remnants of its radical stimulus in March. Many market players expect the BOJ to raise rates from current levels around zero sometime later this year.

On the BOJ's bond buying, Ueda said the central bank will maintain the size of purchases for the time being to scrutinise how markets absorb its March policy shift.

All the same, he said it was appropriate to reduce the size of bond purchases in the future.

(Reporting by Leika Kihara and Satoshi Sugiyama; Additional reporting by Tetsushi Kajimoto and Makiko Yamazaki; Editing by Himani Sarkar, Sam Holmes and Shri Navaratnam)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness