By Melanie Burton and Sameer Manekar

MELBOURNE (Reuters) -BHP Group will focus on growing its copper business through existing and incoming projects after its failed attempt to buy Anglo American, it said as it reported a better-than-expected 2% rise in annual underlying profit.

The world's biggest listed miner is pushing hard to expand in copper, given the commodity's outsize role in the energy transition and a tougher outlook for its top revenue generator, iron ore, as China's economic growth slows and supply rises.

BHP walked away in May from its blockbuster $49 billion bid for Anglo that would have significantly boosted its copper business and is now turning to other options.

"I was very clear at the time, it wasn't Plan A for us. Plan A is everything that you see outlined in these results," BHP CEO Mike Henry told reporters. "We continue with Plan A."

BHP unveiled more details around its spending and growth plans for key copper provinces in Chile, South Australia and Argentina after it posted an underlying attributable profit for the year ended June 30 of $13.66 billion, which excludes exceptional items.

That beat a Visible Alpha consensus of $13.26 billion and was ahead of the $13.42 billion profit a year ago, though on a bottom-line level it took a $5.7 billion hit from impairments to its nickel business in Western Australia and the 2015 dam collapse at Samarco in Brazil.

BHP shares were about 2% higher in early trade, outpacing the flat Australian benchmark index.

"They have clearly laid out capex and growth expectations for copper where they are still looking at copper as a key commodity, clearly," said Andy Foster, a portfolio manager at Argo Investments. "It's just been so hard to execute large-scale acquisitions so you have to make the most of your existing assets and then look at other opportunities."

Copper accounts for about 30% of the miner's profits but that is set to increase. In South Australia it is assessing options to produce more than 500,000 metric tons of copper annually in the early 2030s, up from 322,000 tons in the last financial year.

BHP said last month it would jointly take over Filo Corp for its copper growth projects near the Argentine-Chilean border, paying C$4.5 billion ($3.25 billion) with Canada's Lundin Mining.

UK regulations bar BHP from making another offer for Anglo until November, should it still want to do so. Henry said BHP had no interest in a separate purchase of Anglo's coking coal assets.

Still, BHP said it was keeping its balance sheet flexible.

"We are comfortable to move above our net debt target temporarily to execute value accretive opportunities in the portfolio," the miner said.

Net debt stood at $9.1 billion as of June 30, roughly at the midpoint of its target range of $5 billion and $15 billion.

BHP's profit was underpinned by record iron ore output for a second year and resilient prices, which offset weak coal prices and the sale of two of its coal mines.

The miner said the outlook for iron ore in the current financial year would depend in part on how quickly and effectively Chinese policies were able to stabilise its weak property sector as well as Beijing's approach to regulating steel production.

BHP declared an interim dividend of 74 cents per share, for a full-year dividend of $1.46 per share. That was its lowest full-year dividend since the 2020 financial year but still among the top four it has declared in its history.

(Reporting by Sameer Manekar in Bengaluru and Melanie Burton in Melbourne; Editing by Arun Koyyur and Jamie Freed)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

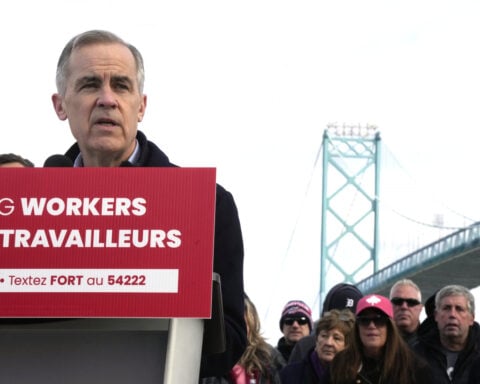

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness