By Isabel Teles

SAO PAULO (Reuters) -Brazilian airline Gol said on Monday it had struck a deal with investors in which they would purchase up to $1.25 billion in debt instruments, a key step toward the carrier's exit from Chapter 11 bankruptcy proceedings in the U.S.

Gol's Sao Paulo-listed shares jumped 9% on the news, before paring gains to stand up around 5%.

Under the deal, the investors committed to purchasing up to $1.25 billion of the $1.9 billion in debt instruments to be issued as part of the process, which will be used to repay Gol's obligations under a debtor-in-possession financing.

Investment advisers Castlelake and Elliott Investment Management committed the funds on behalf of their clients, a court filing from Sunday evening seen by Reuters showed.

The minimum commitment amount from the two comes in at $750 million.

The funds will also be used to pay transaction costs and provide working capital and other support for its business upon emergence from Chapter 11, Gol added.

The carrier has been in bankruptcy proceedings since early 2024.

It noted that in addition to the exit financing, it was weighing other options such as issuing new debt as well as looking for equity investments.

The move would significantly deleverage Gol's balance sheet, the airline said, while also significantly diluting its existing equity.

(Reporting by Isabel Teles. Editing by Bernadette Baum and Mark Potter)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

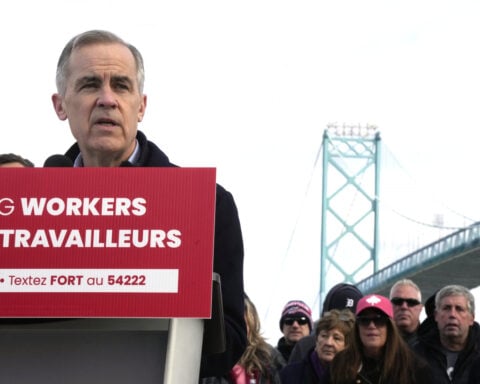

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness