By Alberto Alerigi and Gabriel Araujo

SAO PAULO/WASHINGTON (Reuters) - Two of Brazil's biggest industrial firms, steelmaker Gerdau and plastics producer Braskem, are already touting their substantial U.S. operations as a hedge against the risk of protectionism from President-elect Donald Trump.

Trump has floated the idea of a 10% or higher tariff on all goods imported into the United States, a move he says would eliminate the trade deficit, while threatening a 200% tariff on some imported cars, particularly from Mexico.

On calls with investors this week, Gerdau and Braskem were quick to point out that a large chunk of their businesses are located in the United States, positioning them to actually boost profits if those policies take effect.

Gerdau's Chief Financial Officer Rafael Japur told an earnings call that Trump's measures are expected to be positive for U.S. steel demand, helping its steelmaking plants there.

The Brazilian steelmaker, which operates 11 long and special steel production units in the U.S. and Canada, also touted the benefits of a stronger dollar for its Brazilian operations, where it would compete with more expensive imports.

Gerdau shares jumped in Sao Paulo on the U.S. election results, outperforming peers with more exposure to the Brazilian market such as Usiminas and CSN.

"Following Trump's victory, we see Gerdau as a key beneficiary in the region," analysts at BTG Pactual said in a note to clients, adding that the Republican's trade policy could mean a stronger-for-longer pricing environment.

Trump's protectionist approach and focus on bolstering U.S. industry would further curb direct and indirect steel imports, the analysts said, noting that potential corporate tax cuts could also support Gerdau's financial performance.

Petrochemical producer Braskem, which is owned by state-run oil giant Petrobras and engineering group Novonor as major shareholders, could also gain from Trump's policies.

Braskem CFO Pedro de Freitas told reporters on Thursday that it was a key domestic supplier of polypropylene to the U.S. automotive industry, which stands to benefit from Trump's protectionism.

Braskem has five polypropylene plants in U.S. states from Pennsylvania and West Virginia to Texas - all of which threw their support to Trump in his election win against Democratic Vice President Kamala Harris this week.

The U.S. accounts for 15% to 20% of Braskem's core earnings, Freitas said.

Both Braskem and Gerdau also urged Brazil to lean into what could be a new trade war, imposing tariffs to protect the Brazilian market in the face of U.S. protectionism.

Brazilian steelmakers have long urged the government to impose taxes to combat what they consider "dumping" practices from Chinese suppliers who have flooded the market with cheap products. Last month, Brazil's government responded with roughly 25% import tariffs.

Gerdau CEO Gustavo Werneck said those tariffs should rise to "at least 35%" as steel that was being sold to the U.S. may now be directed to other locations, including Brazil. China has managed to sell steel to Brazil even with the 25% levy, he said.

Braskem's Freitas had a similar view.

"If the U.S. is more closed, those who were selling there will sell elsewhere - and products will come to Brazil," he said.

New tariffs in Brazil should offer Braskem some short-term help, analysts say, pointing to the increase in the import tax for polyethylene, polypropylene and PVC from 12.6% to 20%.

(Reporting by Alberto Alerigi Jr in Sao Paulo and Gabriel Araujo in Washington; Editing by Brad Haynes and Andrea Ricci)

Brazil top court to weigh whether Bolsonaro will stand trial

Brazil top court to weigh whether Bolsonaro will stand trial

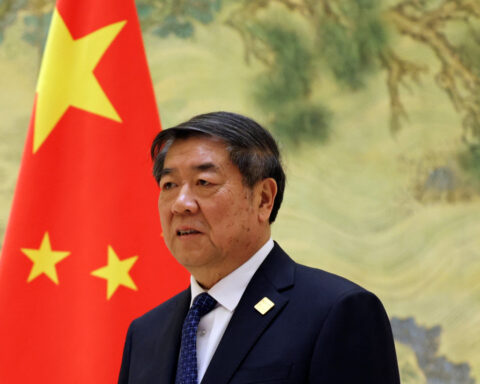

China's vice premier meets Blackstone chairman in Beijing

China's vice premier meets Blackstone chairman in Beijing

Relief rally starts to fizzle

Relief rally starts to fizzle

Citigroup appoints Akira Hoshino as head of markets for Japan

Citigroup appoints Akira Hoshino as head of markets for Japan

Josh Pastner agrees to become UNLV's coach, AP sources say

Josh Pastner agrees to become UNLV's coach, AP sources say

Baseball star Shohei Ohtani’s ex-interpreter has prison start postponed

Baseball star Shohei Ohtani’s ex-interpreter has prison start postponed

Greenlanders unite to fend off the US as Trump seeks control of the Arctic island

Greenlanders unite to fend off the US as Trump seeks control of the Arctic island