By Megan Davies and Divya Chowdhury

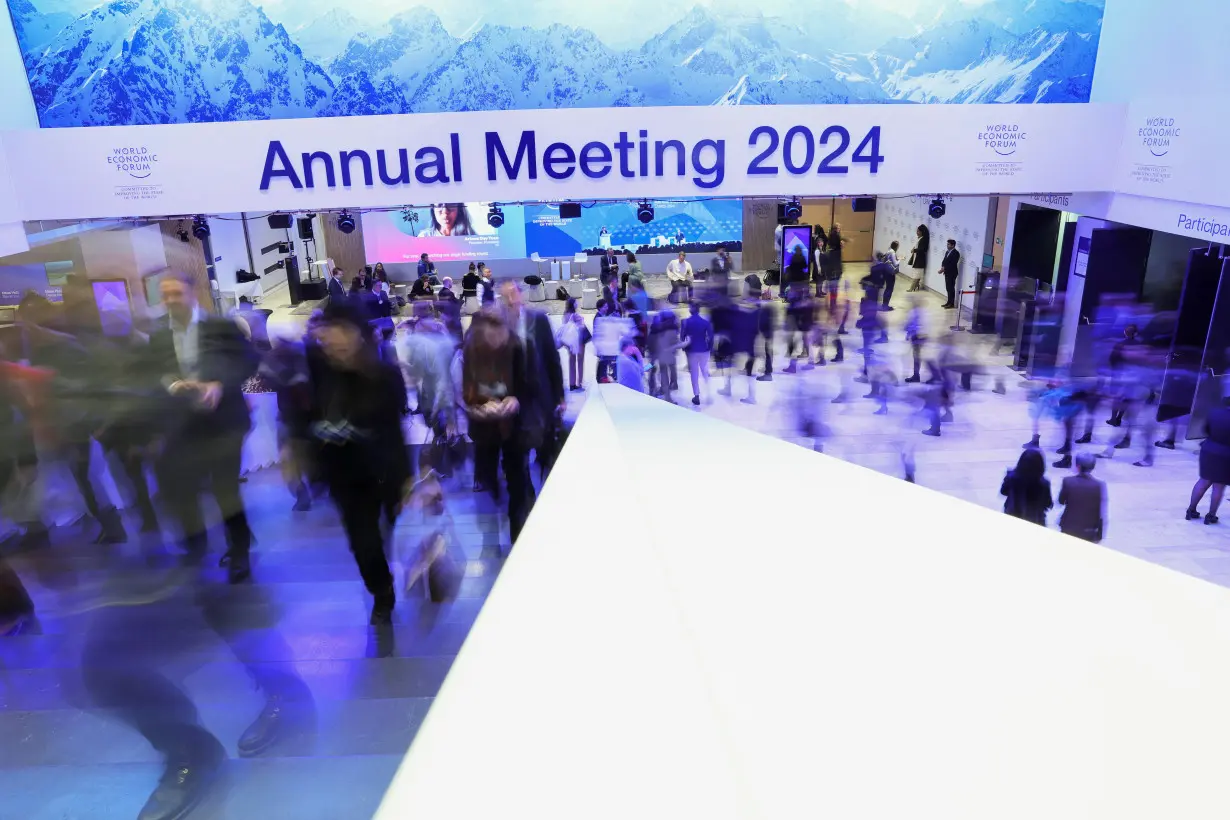

DAVOS, Switzerland (Reuters) - Business leaders in Davos say they are increasingly turning to scenario planning to safeguard supply chains and lessen the potential hit from unexpected geopolitical crises.

Many CEOs and executives told Reuters they foresee an upbeat U.S. economy in 2024, but are concerned about China and Europe, and the impact of unexpected global shocks on inflation.

The World Economic Forum (WEF) this year took place against the backdrop of conflicts in the Middle East and Ukraine, as well as impending elections in dozens of countries.

"Just when governments and companies get their arms around how to deal with one flare-up, another emerges," said David Garfield, Global Head of Industries, adding a big issue at board level and executive leadership level is scenario planning.

"Sophisticated companies are saying: 'What happens if raw materials for critical production cuts off?" Garfield added.

With supply chain disruptions caused by the pandemic barely in their rear-view mirrors, CEOs are now grappling with the impact of Houthi militant attacks in the Red Sea.

Many described the global situation as unusually worrisome.

"In terms of scenario planning, the last few years has upped the ante," said Ishaan Seth, Senior Partner at global consulting group McKinsey. "It is not about forecasting the future but it is about having a perspective on how the world may play out. The key is: How do you pivot an organization quickly?"

An Alix Partners survey showed 68% of CEOs report U.S.-China tensions are causing them to adjust their strategy, while 66% worry about the U.S. presidential election.

"The (board level) concerns are geopolitics and elections around the world," said BCG Global Chair Rich Lesser. "When there is so much uncertainty, CEOs and boards ask 'What can I do to be better prepared,'" he added.

Some have been looking to diversify supply chains.

"Every Japanese company is seriously considering (changing) the origins of over reliance – it is so risky," Takeshi Niinami, CEO of Suntory, Japan's second-biggest domestic drinks group, told the Reuters Global Markets Forum.

"So we like to move to, for example, India or some other countries like Vietnam, but it can't be done overnight."

ABB Chairman Peter Voser said geopolitical risks, including China and Taiwan, were part of boardroom scenario planning.

"One takes steps to deal with it on a day-to-day basis, but also as a Plan B or C depending on what is going to happen," said Voser, adding: "There should be no board in the world who takes this very lightly at this stage."

INFLATION

Some bankers and CEOs were concerned about the potential for supply chain dislocations to reignite inflation. Most were upbeat about the U.S., but concerned about Europe and China.

"I will be cautiously optimistic," said Srini Pallia, an executive at technology services and consulting company Wipro, adding: "People expected U.S. to be in recession, now it's a soft landing."

The WEF meeting came as the global economy shows mediocre growth, while central banks hold interest rates high.

"Clients are cautiously optimistic. We are getting back to more of a normal environment. There is slower growth but sustainable growth," Bank of America's Chief Financial Officer Alastair Borthwick said.

The International Monetary Fund in October forecast that global GDP growth in 2024 would be 2.9%, a dip from 2023's 3%. It cut its 2024 growth forecast for China, which has been hit by a property crisis, to 4.2% and the Euro area to 1.2%, but raised its U.S. forecast to 1.5%.

Goldman Sachs CEO David Solomon expects the U.S. to avoid a big slowdown this year, but warned that inflation could remain more stubborn than expected and weigh on growth.

"I still think there's a risk, particularly around labor, food, gas, that inflation could be stickier than people expect," Solomon told Reuters.

Many doubted that the U.S. Federal Reserve will cut interest rates as rapidly as markets forecast. The Fed is gauging whether inflation is headed firmly enough back to its 2% target to cut.

After 525 basis points of hikes since March 2022, the U.S. rate futures market has priced a rate cut as early as at the Fed's March policy meeting.

CEOs said they had hopes the economy would be resilient.

"We are slightly optimistic about the coming 18-24 months that economies can turn, interest rates can come down," Jesper Brodin, CEO at IKEA-owner Ingka Group.

But some sectors are challenged. Aggressive rate hikes, combined with reduced office space demand after the pandemic, have hit commercial real estate in particular.

"I talk to people who say, this is the worst time ever," said JLL CEO Christian Ulbrich. "And my next meeting could be with somebody who says, this is the best time ever - we will see some of our best deals ever over the next 12 to 24 months."

The mood was uneven, with Europe lagging on growth.

Siemens sees some markets in the euro zone slowing, said executive board member Matthias Rebellius.

"As a global company, we can balance this, but from a local perspective, there's always I would say higher positive notion on Asia and on Americas," he added.

(Join GMF, a chat room hosted on LSEG Messenger, for live interviews: https://lseg.group/3TN7SHH)

(Additional reporting by Stefania Spezzati and Jeffrey Daskin; Editing by Alexander Smith)

Missing teen with autism found safe after volunteers, homeless woman help

Missing teen with autism found safe after volunteers, homeless woman help

Remember Me? ‘Coco 2’ in the works at Disney and Pixar

Remember Me? ‘Coco 2’ in the works at Disney and Pixar

Democratic Gov. Beshear vetoes GOP bill aimed at dismantling DEI efforts in public universities

Democratic Gov. Beshear vetoes GOP bill aimed at dismantling DEI efforts in public universities

An Italian beach town in Tuscany is invaded by midges. Residents seek emergency declaration to cope

An Italian beach town in Tuscany is invaded by midges. Residents seek emergency declaration to cope

Erdogan dismisses as 'theatrics' criticism of Istanbul mayor detention

Erdogan dismisses as 'theatrics' criticism of Istanbul mayor detention

Columbia up against Trump deadline for meeting demands over campus protests

Columbia up against Trump deadline for meeting demands over campus protests

Trump extends deadline for New York to end congestion toll for Manhattan drivers

Trump extends deadline for New York to end congestion toll for Manhattan drivers

Train stuck after sparking brush fire then catching fire itself

Train stuck after sparking brush fire then catching fire itself

GM, Hyundai in talks to share pickups and electric vans in North America, sources say

GM, Hyundai in talks to share pickups and electric vans in North America, sources say

Kaufman-Renn scores 21 to help Purdue hold off High Point in the NCAA Tournament

Kaufman-Renn scores 21 to help Purdue hold off High Point in the NCAA Tournament