By Scott Murdoch

(Reuters) -China's largest express delivery company S.F. Holding said on Tuesday it plans to raise up to HK$6.17 billion ($792.71 million) in a Hong Kong listing, the latest sign of a revival in the city's capital markets.

The Shenzhen-listed company will issue 170 million shares in a price range of HK$32.30 to HK$36.30 per share, according to its regulatory filings.

The final price will be set on Nov. 25, and the stock is due to start trading on Nov. 27.

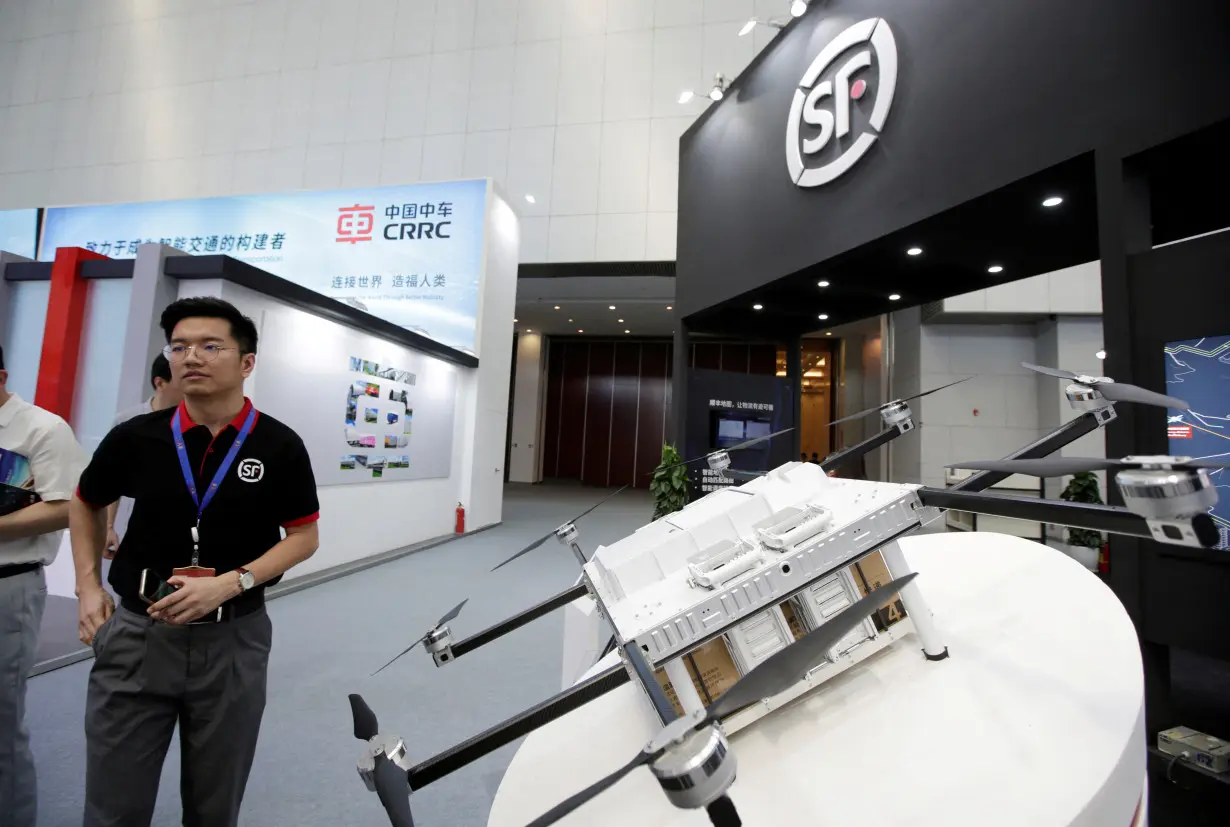

The courier group, known for its flagship SF Express delivery business, is regarded as China's answer to FedEx and DHL.

The listing has attracted ten cornerstone investors, led by Oaktree Capital Management, which have subscribed for up to HK$204.8 million worth of stock, the filings showed.

The company said about 45% of the funds raised in the listing would be spent on growing its international business, especially across South-east Asia. It added it has earmarked about HK$1.1 billion for buyout activity, forming joint ventures or making minority investments in businesses.

S.F. Holding, initially filed for a Hong Kong listing in August last year. Reuters reported in May last year the company was aiming to raise between $2 billion and $3 billion.

There have been $9.1 billion worth of new listings in Hong Kong in 2024, according to Dealogic data, compared to $5.88 billion in 2023.

While well off the 2020 peak of $51.6 billion, the prospect of lower global interest rates has prompted some revival in the city's listing market.

S.F. Holding's Shenzhen-listed share price has risen 4.75% this year.

($1 = 7.7834 Hong Kong dollars)

(Reporting by Scott Murdoch in Sydney and Sherin Sunny in Bengaluru; Editing by Alan Barona and Sonali Paul)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness