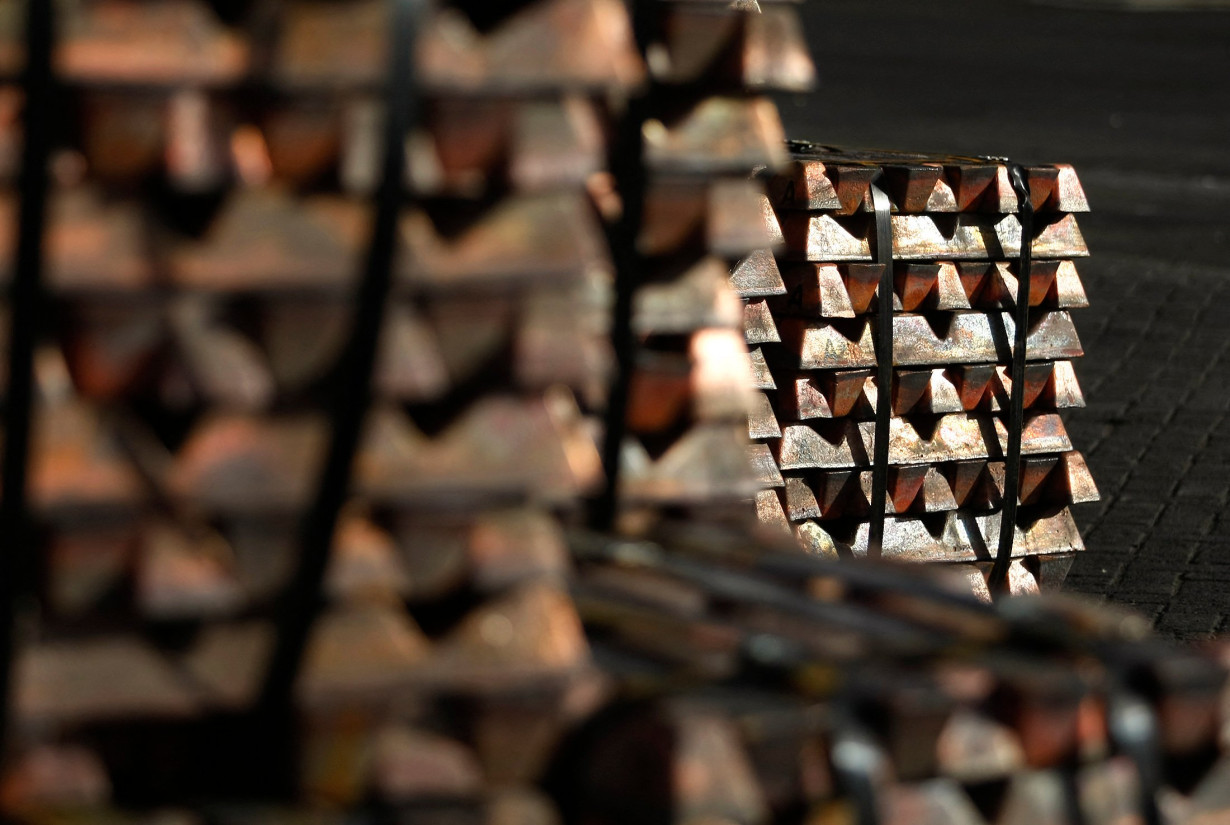

(Reuters) - Citi forecast on Tuesday a slower drop in copper prices over the next three months, noting that U.S. President Donald Trump relaxed tariffs over the past week, China has bought on dips, and scrap supply remains tight due to U.S. stockpiling.

"All point to a more gradual copper price decline through 2Q'25 versus the deeper and faster investor sell-off we previously anticipated, with funds still positioned net bullish," Citi added in a note.

The investment bank raised its three-month copper forecast to $8,800 per tonne. On April 7, it reduced its forecast to $8,000 following Trump's tariff announcements.

The bank estimated average copper prices of $9,000 per tonne in the second quarter.

Citi said it remains bearish over the next three to six months as physical copper consumption and manufacturing activity slow down due to U.S. tariffs, especially the 145% levy on manufacturing hub China.

"We are unsure exactly how far copper prices can fall but our view is still to wait to buy until President Trump reverses tariffs, fully redistributes tariff revenue, or Fed or China "policy puts" kick in," Citi said.

Citi also raised its aluminum price forecast to $2,300 per tonne from $2,200 for the second quarter, with an average of $2,400.

(Reporting by Sarah Qureshi and Anmol Choubey in Bengaluru; Editing by Richard Chang)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness