By Karen Brettell

NEW YORK (Reuters) - The U.S. dollar jumped on Wednesday as investors position for U.S. and European inflation data due on Thursday, while the Australian and New Zealand dollars tumbled after New Zealand’s central bank cut its forecast peak for interest rates and Australian consumer price inflation held at a two-year low.

Month-end portfolio rebalancing is also likely to sway market direction, with volatility picking up on Wednesday.

Brad Bechtel, global head of FX at Jefferies in New York, noted that volatility picked up on Wednesday, which may be “hedging in front of the inflation data to come out of the States and the EU,” and also related to month-end flows.

The implied volatility used by banks to price three-month options on the euro against the dollar reached 6.01 on Wednesday, the highest since Feb. 15, and was last at 5.78. Volatility in major currency pairs has been declining, with the euro/dollar measure falling to the lowest since January 2022 on Tuesday.

Traders are focused on data to give further clues on when the U.S. Federal Reserve is likely to begin cutting rates. Those expectations have been pushed to June, from May, on strong economic growth, sticky inflation and more hawkish commentary from Fed officials.

Thursday’s U.S. Personal Consumption Expenditures release is expected to show that headline prices rose 0.3% in January for an annual gain of 2.4%. The core index is forecast to rise by 0.4% for the month, and 2.8% on the year.

Consumer price data for Germany, France and Spain is also due on Thursday, ahead of euro area figures on Friday.

"There's more chance of disinflation ongoing in the euro area, which perhaps could open the door for an earlier cut from the European Central Bank," said Danske Bank FX and rates strategist Mohamad Al-Saraf.

"We think if inflation is stickier in the U.S. than it is in the euro area, then the dollar has to be strong."

The dollar index was last up 0.18% at 104.02. The euro dipped 0.18% to $1.0826.

The yen also continued to weaken against the greenback, approaching the 150.88 level reached on Feb. 13, which was the weakest since Nov. 16.

Strength in the dollar against the yen is “an indicator of carry trades,” and reflects “a very 'risk on,' high-liquidity type of environment that seems to be driving FX at the moment,” Bechtel said.

The dollar was last up 0.17% at 150.75 yen.

The kiwi dropped 1.28% to $0.06090.

The Reserve Bank of New Zealand held rates steady, which was in line with forecasts but defied some outlying market bets for a rate rise.

The RBNZ's rate forecast track and commentary were also slightly more dovish than some traders had anticipated.

The Aussie fell 0.76% to $0.6493.

Australia’s consumer price inflation data for January came despite forecasts for an uptick, reinforcing expectations that rates are unlikely to increase further.

In cryptocurrencies, bitcoin breached $60,000 for the first time in two years, boosted by the launch of new U.S. spot bitcoin exchange-traded products.

Bitcoin was last up 7.03% on the day at $60,711.

(This story has been refiled to fix a typo in paragraph 6)

(Reporting by Karen Brettell; additional reporting by Samuel Indyk in London; editing by Jonathan Oatis)

Tesla sales fall by 49% in Europe even as the electric vehicle market grows

Tesla sales fall by 49% in Europe even as the electric vehicle market grows

Amid a tropical paradise known as ‘Lizard Island,’ researchers are cracking open evolution’s black box – scientist at work

Amid a tropical paradise known as ‘Lizard Island,’ researchers are cracking open evolution’s black box – scientist at work

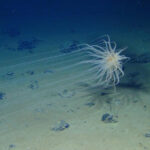

Deep-sea mining threatens sea life in a way no one is thinking about − by dumping debris into the thriving midwater zone

Deep-sea mining threatens sea life in a way no one is thinking about − by dumping debris into the thriving midwater zone

Death of former Yankees star Brett Gardner’s 14-year-old son may have been caused by asphyxiation related to food poisoning

Death of former Yankees star Brett Gardner’s 14-year-old son may have been caused by asphyxiation related to food poisoning

What is Signal?

What is Signal?

Miami Open: Coco Gauff, Danielle Collins and Frances Tiafoe exit tournament on day to forget for the Americans

Miami Open: Coco Gauff, Danielle Collins and Frances Tiafoe exit tournament on day to forget for the Americans

There's no easy answers for slowing down rising level of pitching injuries at all levels of baseball

There's no easy answers for slowing down rising level of pitching injuries at all levels of baseball