By Karen Brettell

NEW YORK (Reuters) -The dollar was mixed on Thursday as traders mulled how severe tariffs scheduled to be revealed by U.S. President Donald Trump next week are likely to be, while the Canadian dollar and Mexican peso weakened after Trump announced auto trade levies.

Rising optimism that Trump will be flexible in determining tariffs boosted risk sentiment and the greenback earlier this week, but traders remain nervous ahead of his planned April 2 announcement on reciprocal tariffs.

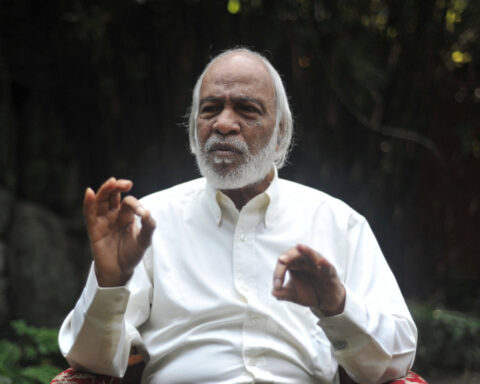

“The pendulum that seems to be swinging right now for markets is initially having a knee-jerk reaction to the worst possible kind of expression of whatever's announced, and then slowly digesting the fact that it might not be as bad as feared and it might not even be as announced because it's part of a broader negotiation,” said Eric Theoret, FX strategist at Scotiabank in Toronto.

Trump on Wednesday placed a 25% tariff on imported cars and light trucks due to take effect next week and governments from Ottawa to Paris threatened retaliation.

The Mexican peso weakened 1.03% to 20.329 per U.S. dollar. The Canadian dollar fell 0.33% to C$1.43 per dollar.

The U.S. imported $474 billion of automotive products in 2024, including passenger cars worth $220 billion. Mexico, Japan, South Korea, Canada and Germany were the biggest suppliers.

Ontario expects the U.S. administration to significantly ease the impact of auto tariffs on Canada, following a phone call from U.S. Commerce Secretary Howard Lutnick to Premier Doug Ford, the Globe and Mail reported on Thursday.

Mexico is also working to carve out an exemption for its autos industry, the economy minister said on Thursday.

The euro, meanwhile, was stronger on the day and is on track to end a bearish streak of six consecutive days of losses against the dollar. It was last up 0.38% at $1.0793, after earlier dropping to a three-week low of $1.0731.

The single currency got technical support after it fell near its 200-day moving average at $1.0726.

The euro bounced earlier this month as German government debt yields surged on German plans to increase spending and overhaul borrowing limits. The euro has retraced some of that gain in the past week.

Central banks including the European Central Bank are also signalling that they are less likely to cut rates in the near term as they gauge the economic impact of tariffs, which could hurt growth but also increase inflation.

“The ECB is getting a little more forceful in terms of wanting to move to a pause. I think they're starting to communicate that they're done with easing for now in the absence of major developments,” said Theoret.

A trade war with the United States could have a fleeting impact on euro zone inflation but a far more detrimental effect on economic growth, ECB Vice President Luis de Guindos said on Thursday.

Economists at Wells Fargo on Thursday said they now expect the ECB to cut rates to a low of 2.0% by September, up from their previous forecast for 1.75%, citing "brightened prospects" for Germany and the eurozone from Germany's fiscal stimulus.

The dollar gained 0.35% to 151.1 Japanese yen, a three-week high, as benchmark 10-year U.S. Treasury yields also reached a one-month high of 4.40%.

There was little reaction to U.S. data on Thursday showing that the number of Americans filing new applications for unemployment benefits slipped last week.

Other data showed that the U.S. economy grew at a slightly more solid clip in the fourth quarter than previously estimated.

Sterling strengthened 0.52% to $1.2953, recovering from the previous session's fall as traders weighed the spring statement from finance minister Rachel Reeves.

Reeves said on Thursday that Britain was working to secure an exemption from U.S. auto tariffs and could review subsidies offered to Tesla, owned by top Trump adviser Elon Musk, to better support its industry.

Elsewhere, the Norwegian crown strengthened after the central bank kept interest rates on hold, as an unexpected resurgence of inflation led policymakers to postpone their previously stated plan for a cut.

The U.S. currency fell 0.41% to 10.48 crown.

In cryptocurrencies, bitcoin fell 0.02% to $87,256.

(Reporting by Karen Brettell; Additional reporting by Ankur Banerjee and Yadarisa Shabong; Editing by Bernadette Baum, Chizu Nomiyama, Sharon Singleton and Deepa Babington)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness