By Sruthi Shankar and Johann M Cherian

(Reuters) -European stocks slipped on Friday, taking the main benchmark to its first weekly decline in three, as investors sought clarity on the pace of monetary easing in the euro zone next year amid concerns over slowing economic growth and a potential trade war.

The pan-European STOXX 600 index lost 0.5% to hit a more-than one-week low and ended the week about 0.8% lower.

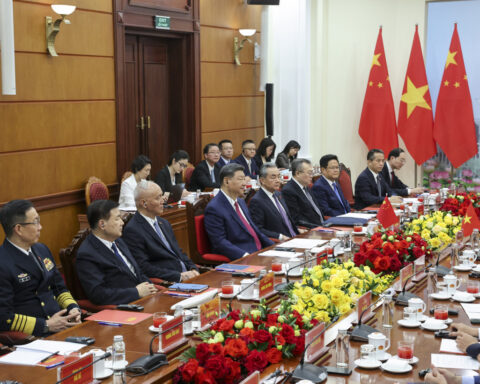

Stock markets have been choppy this week as investors digested stimulus updates from China, inflation data from the U.S. and euro zone as well as the European Central Bank's fourth rate cut of the year on Thursday.

Four European Central Bank policymakers backed further interest rate cuts on Friday provided that inflation settles at the ECB's 2% goal as expected. Traders are pricing in rate cuts of 112 basis points by the end of next year.

"The bar for a 50bp cut at the next meeting in January feels high, but a larger cut or cuts beyond January cannot be ruled out," Deutsche Bank analysts said.

"A group on the Council is already proposing 50, the policy stance is still restrictive, tariffs have not been factored into the ECB forecasts yet and the new language allows for the possibility of rates having to fall below neutral."

France's CAC 40 slipped 0.1% as investors assessed whether a new government led by Francois Bayrou can tackle France's fiscal problems.

His immediate priority will be passing a special law to roll over the 2024 budget, with a nastier battle over the belt-tightening 2025 legislation looming early next year.

Healthcare stocks were among top sectoral decliners, with Novo Nordisk's 3.9% drop, weighing the most on STOXX 600. Britons paying privately for obesity drugs are increasingly choosing Eli Lilly's Mounjaro over Novo Nordisk's Wegovy, Reuters reported based on views from online pharmacies.

On the flip side, insurers rose 1.2% and led sectoral gains as Munich Re climbed 5.5% after saying that it is targeting 6 billion euros ($6.27 billion) in net profit for next year, with its reinsurance business alone anticipated to make up 5.1 billion euros.

German politics were also in focus, with German Chancellor Olaf Scholz expected to hold a vote of confidence in parliament on Monday, a move that would pave the way for snap elections following the collapse of his three-way governing coalition.

The Bundesbank said Germany's economy will shrink for the second year in a row this year and its recovery will be lacklustre, potentially exacerbated by a trade war with the United States.

Despite a struggling economy, the DAX is near an all-time high, with most companies listed on the index not heavily exposed to domestic factors.

(Reporting by Sruthi Shankar and Johann M Cherian in Bengaluru; Editing by Mrigank Dhaniwala, William Maclean)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness