WASHINGTON (AP) — The Federal Reserve kept its key interest rate unchanged Wednesday for a third straight time, and its officials signaled that they expect to make three quarter-point cuts to their benchmark rate next year.

The Fed’s message Wednesday strongly suggested that it is finished with rate hikes — after the fastest increases in four decades — and is edging closer to cutting rates as early as next summer.

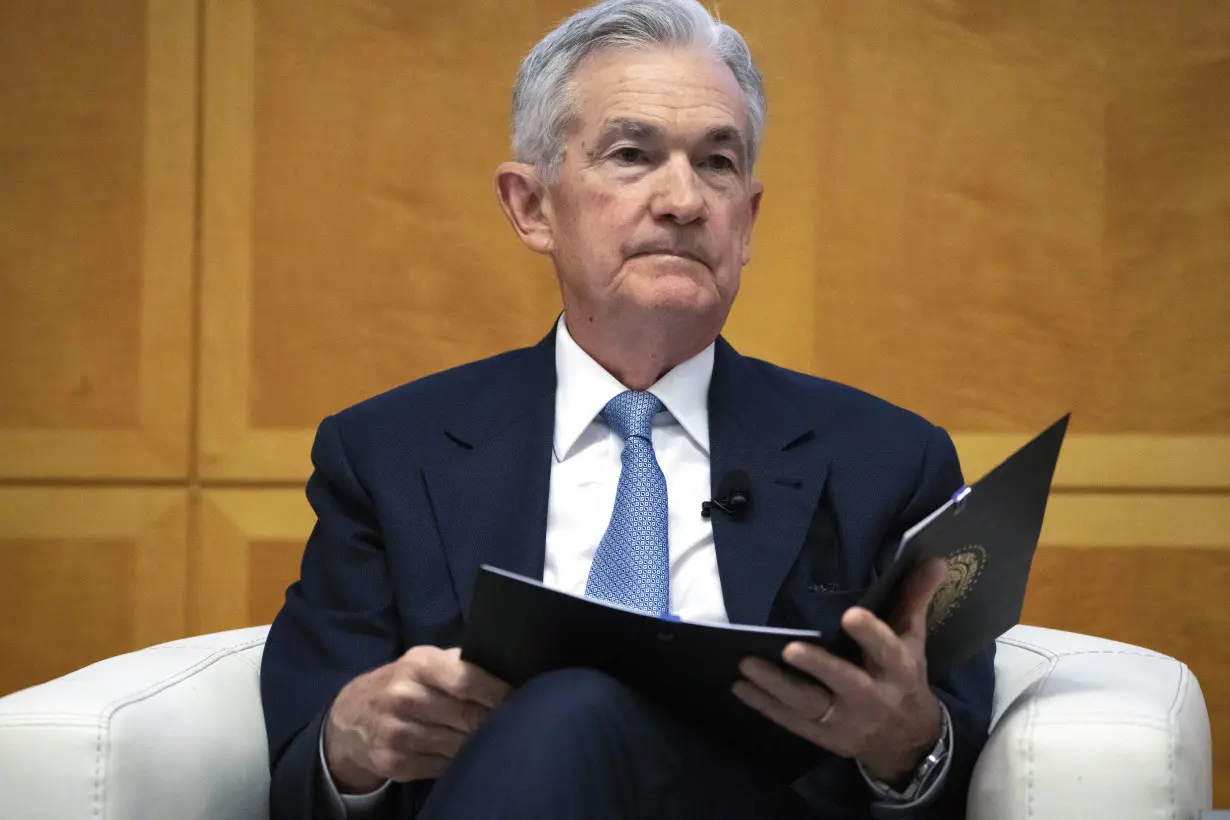

Speaking at a news conference, Chair Jerome Powell said that Fed officials are likely done raising rates because of how steadily inflation has cooled.

"Inflation keeps coming down, the labor market keeps getting back into balance and, it’s so far, so good,” Powell said after the Fed’s 19-member policy committee ended its latest meeting.

On Wall Street, traders celebrated the prospect of lower rates ahead. Stock prices soared and bond yields sank after the Fed issued its statement and Powell held his news conference.

Wednesday marked a major shift in the central bank's outlook on interest rates and the economy. Just two weeks ago, Powell had said it was “premature” to conclude that the Fed has finished raising its key benchmark rate or to “speculate” about cuts in that rate.

But on Wednesday, he signaled that the Fed is almost certainly done raising rates. And he acknowledged that the officials had discussed the prospect of rate reductions in their meeting.

He also conceded that his warning, in a high-profile speech last year, that the “pain” of higher unemployment would accompany a sharp decline in inflation, was overly pessimistic. Instead, inflation has slowed significantly toward the Fed's 2% target, even while unemployment, at 3.7%, and the pace of layoffs, have remained low.

In response to a question, Powell said the Fed recognizes that keeping rates high for too long, and waiting too long to cut them, could endanger the economy.

“We’re aware of the risk that we would hang on too long” before reducing borrowing rates, the Fed chair said. “We know that’s a risk, and we’re very focused on not making that mistake.”

Diane Swonk, chief economist at KPMG, said she thought the Fed's message Wednesday was: “We're done.”

The Fed, she said, has the “luxury” of leaving rates elevated, for now, in case the economy and inflation reaccelerate, “while declaring that they’re done hiking, and that cuts are in the making."

Wall Street investors are betting that rate cuts could begin as soon as March, while economists generally foresee them beginning in May or June.

Throughout his news conference, Powell expressed optimism that inflation, which has bedeviled American consumers and businesses for more than two years, is edging down toward the Fed’s 2% target. He noted, by example, that inflation has eased in goods, housing and services — three categories the Fed has been closely monitoring.

The Fed chair downplayed one concern that some economists have expressed — that the final step down to 2% inflation, from its current level of about 3%, could be harder than the previous slowdowns in price increases.

“We kind of assume that that it will get harder from here," he said. “But so far it hasn’t.”

The Fed kept its benchmark rate at about 5.4%, its highest level in 22 years, a rate that has led to much higher costs for mortgages, auto loans, business borrowing and many other forms of credit. Higher mortgage rates have sharply reduced home sales. Spending on appliances and other expensive goods that people often buy on credit has also declined.

Conversely, interest rate cuts by the Fed, whenever they happen, would reduce borrowing costs across the economy. Stock prices could rise, too, though share prices have already rallied in expectation of rate cuts, potentially limiting any further increases.

So far, the Fed has achieved what few observers had thought possible a year ago: Inflation has tumbled without an accompanying surge in unemployment or a recession, which typically coincide with a central bank’s efforts to cool the economy and curb inflation. Though inflation remains above the Fed’s 2% target, it has declined faster than Fed officials had expected, allowing them to keep rates unchanged and wait to see if price increases continue to ease.

On Wednesday, the Fed’s quarterly economic projections showed that its officials envision a “soft landing” for the economy, in which inflation would continue its decline toward the central bank’s 2% target without causing a steep downturn. The forecasts showed that the policymakers expect to cut their benchmark rate to 4.6% by the end of 2024 — three quarter-point reductions from its current level.

A sharp economic slowdown could prompt even faster rate reductions. So far, though, there is no sign that a downturn is imminent.

In its quarterly projections, the Fed's policymakers now expect “core” inflation, according to its preferred measure, to fall to just 2.4% by the end of 2024, down from a 2.6% forecast in September. Core inflation, which excludes volatile food and energy costs, is considered a better gauge to inflation’s future path.

The policymakers foresee unemployment rising to 4.1% next year, from its current 3.7%, which would still be a low level historically. They project that the economy will expand at a modest 1.4% next year and 1.8% in 2025.

One reason the Fed could be able to cut rates next year, even if the economy plows ahead, would be if inflation kept falling, as expected. A steady slowdown in price increases would have the effect of raising inflation-adjusted interest rates, thereby making borrowing costs higher than the Fed intends. Reducing rates, in this scenario, would simply keep inflation-adjusted borrowing costs from rising.

The Fed is the first of several major central banks to meet this week, with others also expected to keep their rates on hold. Both the European Central Bank and the Bank of England will decide on their next moves Thursday.

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness