By Shariq Khan and Nicole Jao

NEW YORK (Reuters) - At least four U.S. gasoline marketers are preparing legal and regulatory challenges to the Colonial Pipeline over proposed changes in fuel shipping terms which the companies say will hurt their margins and drive up fuel prices at the pump, sources familiar with the discussions said.

The Colonial Pipeline is a key artery for shipping fuel from the U.S. Gulf Coast to the East Coast, where refining capacity has shrunk and pipeline shipments are the most cost-effective way to meet regional demand. Changes to the pipeline's operations can have major impacts on markets in the world's largest motor fuel consuming nation.

Colonial last week sought approval from the Federal Energy Regulatory Commission to stop shipping different gasoline grades at the same time, and to eliminate shipments of so-called Grade 5 gasoline. A Colonial spokesperson said the changes would streamline its operations and minimize slowdowns.

Two U.S. gasoline traders said their firms were exploring options for court challenges if Colonial follows through with the changes. Two others said they plan to file protest notices asking FERC to block Colonial's proposed changes due to potential harm to shippers and consumers.

Colonial said the changes proposed last week, and those proposed last month for Midwest markets, should add 15,000 to 20,000 barrels per day of capacity to its main gasoline line. Colonial believes this will help shippers and consumers by moving more fuel on a pipeline that ran full throughout last year, a spokesperson said.

However, Colonial shippers that Reuters spoke with said the changes will hurt their margins, and restrict the overall U.S. gasoline supply pool. They said Gulf Coast refiners would have to reduce blending of additives during times when regulators allow sale of gasoline with a higher Reid Vapor Pressure, or RVP.

The traders requested anonymity as the deliberations are confidential and they are not authorized spokespersons for their firms. A number of Gulf Coast refiners contacted by Reuters, including ExxonMobil, BP, and Phillips 66, refused to comment about the proposed changes.

Colonial said it finds it unlikely a direct link could be found between its proposed changes and increased consumer prices, but added it cannot speak to how and whether shippers pass incremental costs to consumers at the pump.

The company said it does not discuss specific volumes shipped of specific products, although it did that last month when it requested changes to gasoline grades traded in the U.S. Midwest. A number of Colonial shippers have filed protests with FERC about those changes too, citing similar arguments.

BLENDING BATTLE

RVP ratings denote fuel volatility. Blending gasoline with butane, naphtha or other cheap additives raises the fuel's RVP rating but lowers production costs and increases the amount of fuel available for sale, allowing refiners to sell the fuel at cheaper prices.

Three Colonial shippers told Reuters that refiners will have to pump more expensive grades to meet Colonial's proposed new specifications, so prices will ultimately rise for consumers at the pump.

Shippers have a valid argument that the proposal could boost pump prices by limiting their ability to take advantage of higher RVP blending, said Alex Hodes, oil analyst at brokerage StoneX.

Colonial is also seeking to amend its rules to specify that it can deliver fuel that meets local regulations.

Shippers say that would take away their blending opportunity and shift it to Colonial, which will then be able to deliver higher RVP grades by adding butane to the fuel through a joint-venture company Colonial set up a decade ago. Margins would rise for that joint venture, shippers claimed, and the venture can then sell more excess gasoline created from its blending.

"Blending already occurs across the supply chain and fuels system, and these changes align with industry practices as well as state and federal standards," a Colonial spokesperson said, without saying whether the proposed changes would benefit Colonial's blending operations and gasoline sales.

Shippers said more blending by Colonial would raise pump prices because its butane blending operations are more expensive than those of Gulf Coast refiners and blenders, who produce and store the additive or take deliveries through pipelines. That is at least 8 to 10 cents a gallon cheaper, they say, than Colonial's joint venture which takes butane deliveries through railway, then trucks the additive to its terminal and injects it into the pipeline in Atlanta.

StoneX's Hodes said that estimate is in line with the typical increase for rail deliveries of any fuel when compared to pipeline movements.

"We cannot comment on blending logistics costs along the supply chain and dwelling on a specific aspect like this ignores the larger benefits these changes bring to shippers, Colonial, and the markets we serve," the Colonial spokesperson said.

(Reporting by Shariq Khan and Nicole Jao in New York; Editing by Liz Hampton and David Gregorio)

Depardieu testifies at his trial on sexual assault charges, saying, 'I won’t hide, it’s hard'

Depardieu testifies at his trial on sexual assault charges, saying, 'I won’t hide, it’s hard'

Sepp Blatter and Michel Platini acquitted again at second trial of financial wrongdoing at FIFA

Sepp Blatter and Michel Platini acquitted again at second trial of financial wrongdoing at FIFA

Brazil top court to weigh whether Bolsonaro will stand trial

Brazil top court to weigh whether Bolsonaro will stand trial

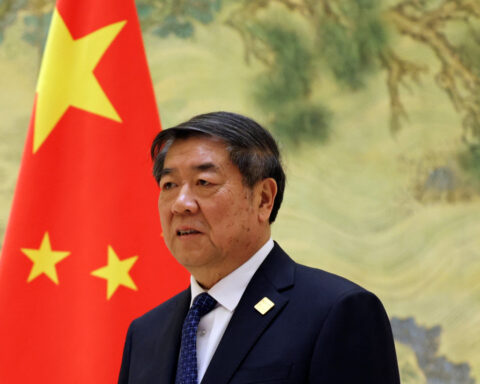

China's vice premier meets Blackstone chairman in Beijing

China's vice premier meets Blackstone chairman in Beijing

Relief rally starts to fizzle

Relief rally starts to fizzle

Citigroup appoints Akira Hoshino as head of markets for Japan

Citigroup appoints Akira Hoshino as head of markets for Japan

Josh Pastner agrees to become UNLV's coach, AP sources say

Josh Pastner agrees to become UNLV's coach, AP sources say