By Christian Kraemer, Friederike Heine and Emma-Victoria Farr

BERLIN/FRANKFURT (Reuters) - UniCredit Chief Executive Andrea Orcel has succeeded in uniting Germany's political establishment in opposition to his stakebuilding in Commerzbank, the country's second largest lender.

The bad news for Germany's angry politicians is that they have few options to halt the ambitious Orcel, who appears to have his sights fixed on a transformative deal for the European banking sector.

"Legally, there is nothing we can do. But the government's assessment naturally carries weight," a German government source told Reuters on Tuesday.

Chancellor Olaf Scholz, who leads the Social Democrats, slammed Orcel's latest move as "an unfriendly attack" after UniCredit announced on Monday it had used derivatives to raise its potential stake in Commerzbank to 21%.

Friedrich Merz, the Christian Democrat opposition leader whom many see as Germany's next chancellor, described a potential takeover as a "disaster for Germany's banking market", pointing to the precedent of HVB, the smaller Bavarian bank bought by UniCredit in 2005 and since subject to hefty job cuts.

With an election due in a year, German politicians are wary of potential job losses among Commerzbank's 40,000 staff and the loss of control over a bank that is a key lender to the "Mittelstand", the country's small and medium-sized businesses.

DEFENCE TACTICS

Resistance to such a takeover could normally take two forms - an attempt to rally the shareholder base against UniCredit, or the use of legal steps to block or delay any deal.

German government sources noted that banks are regulated by the European Central Bank (ECB), while laws to protect critical infrastructure do not readily apply to defending Commerzbank.

The ECB has long been clamouring for more cross-border mergers as a way of bolstering the euro zone's banking sector against global rivals. Portuguese central banker Mario Centeno said on Tuesday it was now time to see "results" on that front.

One investor urged Germany to look beyond its narrow national interest.

"This is the fundamental question for the German government: Which God are they going to serve? Are they going to choose socialist control or the free market?" said Cole Smead, CEO of Smead Capital Management, which owns UniCredit shares.

"The longer it takes, the more pressure (there is) on the German government. Patience is the name of the game. The German government will effectively have a smaller stake than Orcel,” once the regulatory hurdles are cleared, he added.

RALLYING THE OPPOSITION

The German government does have some room for manoeuvre as an anchor investor, said Christoph Schalast, an M&A lawyer and professor at the Frankfurt School of Finance & Management, noting its residual 12% stake.

"I can hardly imagine UniCredit carrying out a hostile takeover against the will of Commerzbank's board, shareholders and employees," said Schalast.

"The Commerzbank management and supervisory boards must do their homework in parallel: they must present a strategy at the next annual general meeting that will be supported by the other anchor investors. This strategy has to be an economically more interesting option than a takeover by UniCredit," he added.

Commerzbank supervisory board members on Tuesday voiced fierce opposition to a takeover, criticising Orcel and saying they were prepared for a long fight.

For now, the ball is in the court of the ECB which must assess a request from UniCredit for clearance to increase its Commerzbank holding to just below the 30% which triggers a mandatory takeover under German corporate laws.

"Of course the German government can put pressure on Italy informally to hinder/stop a deal but otherwise it has little power to stop Orcel," said a senior M&A banker, who is not part of the deal.

However, there is no sign of that, with Italian Foreign Minister Antonio Tajani on Monday praising UniCredit for its boldness.

"UniCredit is a big Italian bank and it is doing well to act within the internal market," said Tajani, who leads the pro-business Forza Italia party.

(Additional reporting by John O'Donnell and Francesco Canepa in Frankfurt, Stefania Spezzati in London and Maria Martinez in Berlin; Writing by Keith Weir; Editing by Mark Potter)

US weighing in on Lebanon's next central bank chief, sources say

US weighing in on Lebanon's next central bank chief, sources say

Tornadoes, wildfires and blinding dust sweep across US as massive storm leaves at least 32 dead

Tornadoes, wildfires and blinding dust sweep across US as massive storm leaves at least 32 dead

Astronaut crew docks with space station to replace 'Butch and Suni'

Astronaut crew docks with space station to replace 'Butch and Suni'

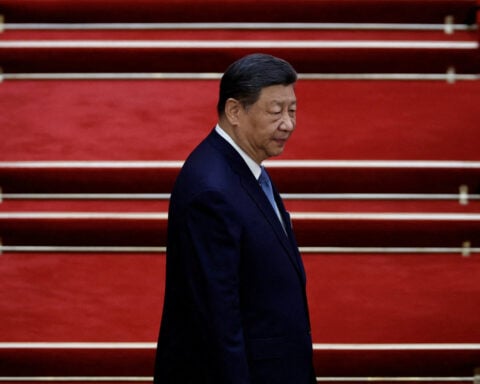

China's Xi declines to EU invitation to anniversary summit, FT reports

China's Xi declines to EU invitation to anniversary summit, FT reports

Young scientists see career pathways vanish as schools adapt to federal funding cuts

Young scientists see career pathways vanish as schools adapt to federal funding cuts

McLaren's Lando Norris wins wet and wild Australian Grand Prix. Hamilton finishes 10th

McLaren's Lando Norris wins wet and wild Australian Grand Prix. Hamilton finishes 10th

St. Patrick's Day parade celebrates Boston heritage in America’s most Irish big city

St. Patrick's Day parade celebrates Boston heritage in America’s most Irish big city

Bickerstaff blasts officials after Pistons receive 5 technical fouls in loss to Thunder

Bickerstaff blasts officials after Pistons receive 5 technical fouls in loss to Thunder