By Junko Fujita, Ankur Banerjee, Anton Bridge and Nupur Anand

NEW YORK/TOKYO/LONDON (Reuters) -Bank stocks tanked across the globe on Friday as fears of a recession swept through markets after U.S. President Donald Trump announced the highest tariff walls in a century.

The S&P 500 banks index, which tracks U.S. lenders, fell more than 7%, extending declines after plunging on Thursday. Citigroup and Bank of America were the biggest losers in the index, both dropping more than 7.5%.

JPMorgan Chase, the largest U.S. lender, lost 6.5%, while Goldman Sachs and Morgan Stanley fell 7.1% and 6.8%, respectively.

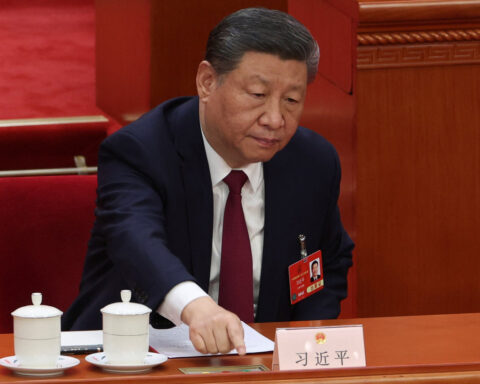

The selloff accelerated after China's finance ministry said on Friday it would impose additional tariffs of 34% on all U.S. goods from April 10 in retaliation for Trump's move.

Banks, which serve as bellwethers for economic activity, saw their shares sink as the U.S. breaks with free trade policies built up over decades. Investors braced for declines in consumer spending, loan demand and dealmaking.

"Bank stock valuations tell us investors are leaning toward the bear case for banks becoming a reality," according to brokerage Raymond James, which pointed to investor expectations for a recession in 2025.

The near-term pain for banks could prompt them to scale back earnings projections given tariffs were more severe than expected, said Mike Mayo, an analyst at Wells Fargo.

"Banks will need to potentially increase reserve for future loan loss provisions," which will weigh on profits, he said.

Citigroup was among the largest decliners, falling more than 10.5% today before paring losses to about 8%. On Thursday, it lost 11%.

"Citi has been undergoing a restructuring exercise for the last two years, and the expectation was that the profitability would go up," said Octavio Marenzi, CEO of consulting firm Opimas.

"That has been disappointing so far, but the stock got a lot of headway... and now that investors are seeing some stress in the market, the inflated stocks are correcting more," he said.

The tremors were felt across regions. European banking stocks tumbled 8% and the financials sector was the biggest drag on the STOXX Europe 600.

In Asia, Japanese megabanks ended the week with the biggest losses since the 2008 financial crisis, an unsettling signal about the consequences of Trump's trade war that rattled investors.

A universal 10% tariff on U.S. imports is set to take effect on April 5, followed by further levies on dozens of countries.

Mounting fears of retaliation, which Trump officials have warned could escalate the dispute further, have led some to shorten their odds on a recession coming to pass.

"Banks are in a precarious situation," said Anthony Georgiades, founder at investment firm Innovating Capital. "They are going to have a crazy margin compression and credit risk will increase, especially in auto and consumer loans."

The drop in shares is a sharp reversal for the sector, which a few months ago was riding high on post-election optimism. While the tariffs don't hit banks directly, they may prompt companies to pause M&A plans and erode consumer sentiment, which can ultimately hit investment banking fees and slow loan demand.

U.S. banking giants will be quizzed about the turmoil when they begin to report earnings next week, with JPMorgan, Morgan Stanley, Wells Fargo and BNY set to announce their results on Friday.

'THE WORLD HAS CHANGED'

In Europe, shares of Germany's Deutsche Bank 9%, and Italy's UniCredit tumbled 10.1%. France's Societe Generale lost 10.3%.

Japanese bank stocks logged their biggest weekly loss in at least 40 years, while investors sought safety in government bonds.

"The world has changed, and in few economies do these changes reverberate as strongly as in Japan," said Fred Neumann, chief Asia economist at HSBC in Hong Kong.

Shares in Japan's biggest bank by market value, Mitsubishi UFJ Financial Group, fell 8.5% on Friday for a weekly loss of 20% - the largest since 2003.

Mizuho Financial Group was down more than 22% for the week, the largest drop since 2008, while shares in Sumitomo Mitsui Financial Group were 20% lower for the week.

"It's a wholesale move out of banking stocks and I think this will continue," said Amir Anvarzadeh, Japan equity strategist at Asymmetric Investors.

Japan's TOPIX banks index is down 24% from a 19-year high it touched only two weeks ago. Its weekly drop of 20.2% is the biggest in LSEG data stretching back to 1983.

(Reporting by Junko Fujita and Anton Bridge in Tokyo, Ankur Banerjee in Singapore and Niket Nishant in Bengaluru and Nupur Anand in New York; Additional reporting by Noor Zainab Hussain and Tom Westbrook; Writing by Tommy Reggiori Wilkes; Editing by Edmund Klamann, Hugh Lawson, Aidan Lewis, Elaine Hardcastle, Nick Zieminski and Lananh Nguyen)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness