By Patturaja Murugaboopathy

(Reuters) -Funds that invest in gold miners are set to attract their largest net monthly inflows in more than a year in March, as record-high gold prices improve firms' profit outlooks and boost cash flow.

Although gold prices also rose last year, miners still struggled to offset inflation-driven spikes in labour and fuel costs while facing regulatory hurdles such as tax disputes in Mali and project delays in Canada.

As a result, investors mostly shunned equity funds focused on gold miners, opting instead for traditional gold funds that offered a safe haven during the Russia-Ukraine war and escalating trade tariff concerns after Donald Trump won the U.S. election in early November.

According to LSEG Lipper data, funds investing in physical gold and gold derivatives attracted a net $17.8 billion in 2024, the highest in five years, while funds investing in gold miners lost a net $4.6 billion, the most in a decade.

With gold up more than 15% this year to a record high above $3,000 an ounce, investors are more optimistic that miners can absorb higher costs, expand margins and generate stronger cash flows.

Shares of top miners such as Newmont and Barrick Gold, have more than reversed 2024 falls of 10% and 7%, respectively, surging around 27% and 21.5% so far this year.

Funds targeting gold miners drew their first net monthly inflow in six months in March, according to Lipper data, attracting $555.3 million, the highest since November 2023.

“In recent years, gold mining companies have faced cost pressures, but are now increasingly able to benefit from higher gold prices. We are adding to them,” said Shaniel Ramjee, a multi-asset co-head at Pictet Asset Management, based in London.

“At current gold prices, the profitability returns,” he added.

Barrick Gold announced a $1 billion share buyback offer after reporting a solid profit and doubling its free cash flow in the fourth quarter.

AngloGold Ashanti said its balance sheet was the strongest in more than a decade and declared a final dividend of 91 U.S. cents per share - nearly five times higher than for the prior year.

Gold Fields has also indicated it could initiate a share buyback this year, while Harmony Gold plans to self-fund the construction of a new copper mine in Australia.

“Investors looking to diversify their portfolios and hedge against market uncertainty and inflation may finally turn their attention to gold mining equities,” said Imaru Casanova, portfolio manager for gold and precious metals at VanEck.

“We have a positive outlook on the gold price, and given the low valuations for the gold miners, we are even more constructive on the equities.”

(Reporting By Patturaja Murugaboopathy and Gaurav Dogra in BengaluruEditing by Vidya Ranganathan, Kirsten Donovan)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

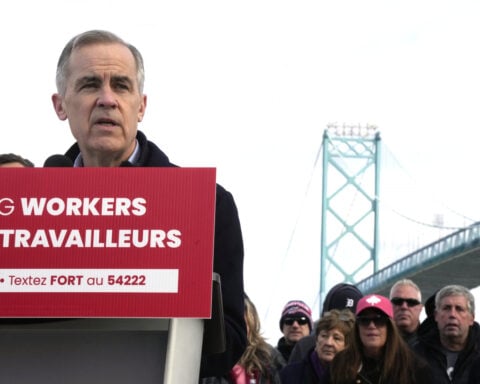

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness