By Carolina Mandl

NEW YORK (Reuters) -Hedge funds unwound positions in single stocks on Friday at the largest amount in over two years, with some activity comparable to March 2020, when portfolio managers cut market exposure during the pandemic, Goldman Sachs said in a note on Monday.

U.S. major stock indexes plummeted on Monday, with the Nasdaq down 4%, amid fears that President Donald Trump's tariff policy will drive the world's largest economy into a recession.

“It was a classic de-leveraging crunch,” said James Koutoulas, CEO at hedge fund Typhon Capital Management.

Goldman Sachs detailed that hedge funds' sale of single name stocks was the biggest in over two years. It added some hedge funds' large de-risking moves in concentrated trades could be compared to what was seen in March 2020. It also cited January 2021, when hedge funds covered short positions in so-called meme stocks, popular among retail investors.

Hedge funds' unwinding comes at a time when leverage in the industry is at a record level. A separate Goldman Sachs note showed overall hedge funds' leverage in equity positions was at 2.9 times their books, a record level over the last five years.

Some investors told Reuters they were concerned that some high-leverage hedge fund could keep de-risking in the coming days, impeding a potential market recovery.

Hedge funds unwound long and short positions that Goldman Sachs said were crowded, or common among many investors.

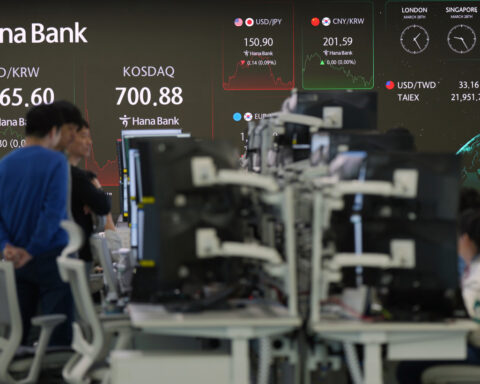

Goldman Sachs saw a risk-off trend in 10 of the 11 global sectors, mainly in industrials. The risk-off trend was seen across all regions, but mainly in the U.S.

On Monday morning, before the major indexes dipped even further, equities long/short hedge funds were down 1.5%, while systematic managers were down 0.3%, according to the bank.

(Reporting by Carolina Mandl, in New York; Editing by David Gregorio)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness