By Carolina Mandl

NEW YORK (Reuters) - Global hedge funds accelerated the unwinding of stock positions on Monday, and this trend is likely to continue, as portfolio managers seek to reduce risk amid a selloff in U.S. stocks, according to Goldman Sachs.

"Through yesterday, our best guess is that we are currently in the middle innings of this (de-risking) episode," said Goldman Sachs Vice President Vincent Lin in a note about hedge funds' flows, although he pointed out determining a de-risking duration is difficult.

Portfolio managers usually try to minimize their losses by unwinding trades over an extended period amid a selloff. It's a way to avoid flooding the market with mammoth blocks of stocks, a move that could help move stock prices further down.

The prolonged de-risking means it could take a while for stocks to recover.

The unwinding on Friday and Monday represented the largest two-day deleveraging in four years, with industrials leading the pack, Goldman Sachs said in a separate note, adding that the exit from industrials was at a record high.

The bank said that the de-risking had accelerated from Friday, a trend it had previously compared with some early COVID pandemic unwinding.

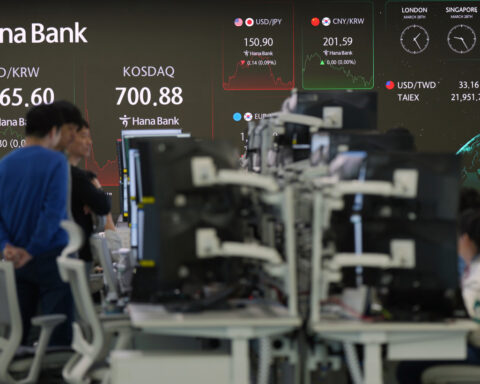

Hedge funds cut their equity exposure on Monday as a steep selloff drove the S&P 500 index to its biggest one-day drop since December 18 and the Nasdaq Composite Index plunged 4% on fears of a recession triggered by U.S. President Donald Trump's tariffs on imports.

Tariffs have spooked investors, with fears of an economic downturn sparking a selloff in equities that has wiped out roughly $4 trillion from the S&P 500's peak last month.

Goldman Sachs said portfolio managers ditched both long and short bets on specific stocks on Monday.

Hedge funds' risk-shedding strategy seems to be paying off. Fundamental long/short, systematic and multi-strategy hedge funds posted positive returns on Tuesday, the bank said.

(This story has been refiled to clarify that Vincent Lin's statement was said in a note, in paragraph 2)

(Reporting by Carolina Mandl in New York; Editing by Richard Chang and Lisa Shumaker)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness