By Lawrence Delevingne and Naomi Rovnick

(Reuters) -Global shares pushed higher on Friday, adding to weekly gains, after encouraging U.S. economic data helped soothe fears of a recession in the world's largest economy.

On Wall Street, stocks extended their biggest weekly percentage gains of the year. The Dow Jones Industrial Average finished up about 0.25% - bringing its weekly gain to 2.7% - while the S&P 500 and Nasdaq Composite both increased 0.2%; they were up about 3.7% and 5% on the week, respectively.

MSCI's main world stock index rose 0.5%, adding to its recovery from market turmoil last week generated by U.S. recession fears and foreign exchange gyrations. The pan-European STOXX 600 index rose 0.3% on the day, still hovering at its two-week high and logging its best week since May 6, up 2.4%.

The VIX U.S. stock volatility index, broadly considered the market's fear gauge, sat at benign levels of about 15 after hitting a four-year high of 65 early last week.

The sharp turnaround in market sentiment came after a batch of U.S. data this week showed inflation was moderating and retail spending was robust.

That has helped the market narrative move away from recession concerns, sparked by a weak U.S. jobs report in early August, to confidence the economy can keep growing. Softer inflation data has also reinforced expectations of an interest rate cut by the U.S. Federal Reserve in September.

On Friday, a survey showed that U.S. consumer sentiment rose in August, driven by developments in the U.S. presidential race, while inflation expectations remained unchanged over the next year and beyond.

Scott Wren, a Wells Fargo Investment Institute strategist, said stocks were reacting to the likelihood that while the economy is slowing, the probability of a recession is low and earnings estimates have edged higher.

"Modest growth with moderating inflation is a good environment for stocks and bonds," Wren said in an email.

With central bankers from around the globe set to gather in Jackson Hole, Wyoming, next week, traders expect the Fed to lower borrowing costs from a 23-year high next month but have reduced their bets on an emergency 50-basis-point cut to 25%, down from 55% a week ago, the CME FedWatch tool showed.

Invesco multi-asset fund manager David Aujla said the U.S. is unlikely to go into recession. But markets likely would be more volatile through to the end of this year, Aujla said, particularly around November's U.S. presidential election.

Easier U.S. Treasury yields on Friday partly unwound the previous session's surges. The yield on the benchmark U.S. 10-year Treasury note declined 4 basis points to 3.883%.

DOLLAR, OIL DECLINE

In Asia, Japan's Nikkei share average climbed 3.6% on Friday and notched its best week in more than four years, while Hong Kong's Hang Seng Index rose 1.9%.

Japanese stocks gained following heavy losses last week after a surprise Bank of Japan rate cut sent the yen soaring against the dollar, wrecking yen-funded stock trades.

The dollar fell against the yen on Friday, and was softer against other major currencies after disappointing U.S. housing numbers. U.S. single-family homebuilding fell in July as higher mortgage rates and house prices kept prospective buyers on the sidelines, suggesting the market remained depressed at the start of the third quarter. The euro added 0.47% versus the dollar.

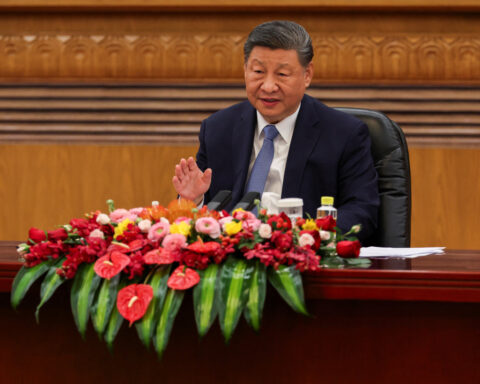

Oil prices settled down nearly 2%, with global benchmark Brent crude below $80 a barrel, but were little changed on the week as investors tempered expectations of demand growth from top oil importer China.

Brent fell $1.36, or 1.7%, to settle at $79.68 per barrel and U.S. crude dropped $1.51, or 1.9%, to $76.65.

Spot gold prices soared to an all-time high, rising more than 2%. [GOL/]

(Reporting by Lawrence Delevingne in Boston and Naomi Rovnick in LondonAdditional reporting by Rae Wee in SingaporeEditing by Kim Coghill, Frances Kerry, Will Dunham, Mark Potter and Marguerita Choy)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness