By Satoshi Sugiyama

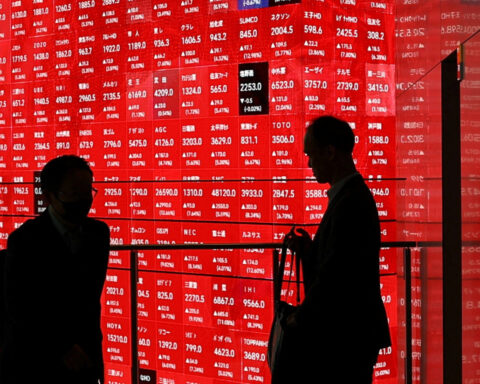

TOKYO (Reuters) - Japan's economy is expected to have slowed sharply in the third quarter hurt by sluggish consumption and capital spending, a Reuters poll showed, which could complicate the central bank's plans to hike rates further.

Japan's inflation-adjusted gross domestic product (GDP) is forecast to have risen an annualised 0.7% in July-September, according to a median forecast of economists polled by Reuters, cooling significantly from the 2.9% rate in the second quarter.

Private consumption, which accounts for more than half of economic output, remained tepid, likely up just 0.2% and well behind the 0.9% growth in the previous quarter.

Analysts say persistently elevated prices have offset wage increases, with the high cost-of-living a major drag on the economy and a worry for policymakers.

"The recovery is still halfway," analysts at SMBC Nikko Securities said in their analyst report.

Capital expenditure is expected to have decreased 0.2% after a 0.8% rise in the second quarter, the poll showed.

The slowdown in overseas economies has put downward pressure on machinery investment particularly in the manufacturing sector, said Saisuke Sakai, senior economist at Mizuho Research and Technologies.

One-time factors such as a typhoon in August that hampered factory operations and supply disruptions due to labour shortage might have also hurt capital investment and goods supply, Sakai said.

Net external demand likely contributed a 0.1 percentage point to GDP, reversing a 0.1-point negative contribution in the April-June period.

The Cabinet Office will release the preliminary third-quarter GDP data at 8:50 a.m. on Friday, Nov. 15 (2350GMT on Thursday, Nov. 14).

The Bank of Japan maintained ultra-low interest rates on Thursday but said risks around the U.S. economy were somewhat subsiding, signalling that conditions are falling into place to raise interest rates again.

Yet, any prolonged period of subdued domestic and global demand is likely to slow BOJ's plans to fully exit from a decade of easy monetary conditions.

That risk was underlined by economists' expectations on Japanese household spending, which was forecast to have slipped 2.1% in September year-on-year, following a 1.9% decline in August.

On a seasonally-adjusted, month-on-month basis, household spending likely fell 0.7% in September, reversing a 2.0% jump in the previous month, with consumers remaining reluctant to loosen their purse strings in the face of high prices.

The internal affairs ministry will publish the consumer spending data at 8:30 a.m. on Friday, Nov. 8 (2330 GMT on Thursday, Nov. 7).

(Reporting by Satoshi Sugiyama; Editing by Shri Navaratnam)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness