By Dominique Patton

PARIS (Reuters) - L'Oreal's shares on Wednesday extended a deep sell-off after the cosmetics giant reported quarterly sales below expectations, citing reduced beauty products demand in China and slower growth for its dermatological division.

Shares were down 3.7% at 0844 GMT, hovering around their lowest levels since January 2023. They have plunged more than a fifth this year, including 20% since June.

Across a broad range of companies, China's economic weakness has curbed customer buying and the luxury sector, reliant on discretionary spending, has been hard hit.

After the market close on Tuesday, L'Oreal, which sells luxury labels including Lancome and Kiehls and mass market products such as Maybelline mascara, posted a 3.4% rise in sales for the three months to the end of September to 10.28 billion euros ($11.10 billion). That was below a Visible Alpha consensus of 6% cited by Jefferies.

Investors were nervous ahead of the results, but the numbers were worse than expected, said Barclays analysts.

"L'Oréal has missed three out of the last four quarters, with China consistently worse than we feared," they said in a note.

The China market deteriorated, with luxury beauty products in the "negative mid-teens," and as an expected improvement in travel retail did not materialise, Chief Executive Nicolas Hieronimus told analysts late on Tuesday.

"We expect a tough Q4 2024 and Q1 2025 ahead," wrote JP Morgan in a note on L'Oreal, while Deutsche Bank analysts reiterated their "sell" rating on L'Oreal.

BROADER ISSUES

Smaller, U.S.-based rival Coty last week warned its first quarter sales, publishing on Nov. 6, would be below forecast following tight order and inventory management by retailers in markets such as Australia and China and the United States.

Developed markets at L'Oreal "grew robustly", however, with strength in U.S. fragrance demand offsetting weakness in the U.S. make-up market, Barclays said.

Although the company's problems are mostly a result of difficult market conditions, Barclays said comment from L'Oreal management that more innovation was needed to appeal to younger customers, was "tacit acknowledgement that execution could tighten up".

Elswhere in the sector, Nivea-maker Beiersdorf reports third quarter results on Thursday, and Estee Lauder reports its first quarter for 2025 on Oct. 31.

On Wednesday, Beiersdorf shares also fell 1.5% at market open, before paring losses.

($1 = 0.9263 euros)

(Reporting by Dominique Patton; Editing by Sudip Kar-Gupta and Barbara Lewis)

GOP lawmaker explains why he supports dismantling the Department of Education

GOP lawmaker explains why he supports dismantling the Department of Education

Teen accused in deadly hit-and-run deemed a danger to others, as police arrest 3rd suspect

Teen accused in deadly hit-and-run deemed a danger to others, as police arrest 3rd suspect

What to know about Greenpeace after the Dakota Access protest case decision

What to know about Greenpeace after the Dakota Access protest case decision

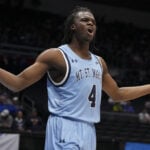

March Madness: Mount St. Mary's beats American 83-72 in First Four to earn date with No. 1 Duke

March Madness: Mount St. Mary's beats American 83-72 in First Four to earn date with No. 1 Duke

Anti-amyloid therapy may keep Alzheimer’s symptoms at bay in certain patients, study suggests

Anti-amyloid therapy may keep Alzheimer’s symptoms at bay in certain patients, study suggests

Researchers find a hint at how to delay Alzheimer's symptoms. Now they have to prove it

Researchers find a hint at how to delay Alzheimer's symptoms. Now they have to prove it

Exxon challenges Colonial Pipeline on proposed changes to fuel shipping terms

Exxon challenges Colonial Pipeline on proposed changes to fuel shipping terms

Investigators searching for "Super Bowl Scammer" accused of taking thousands from residents

Investigators searching for "Super Bowl Scammer" accused of taking thousands from residents

Injury in March Madness game ends storybook final season for Matt Rogers of American U.

Injury in March Madness game ends storybook final season for Matt Rogers of American U.