By Danial Azhar

KUALA LUMPUR (Reuters) - Malaysia wants to leverage its location to become an energy and chip manufacturing hub this year, riding a recent jump in investments and a favourable outlook for the domestic economy, its premier and economic minister said on Thursday.

Malaysia is fast becoming a haven in Southeast Asia, with foreign investors returning as improving growth and a stable currency set it apart from peers grappling with political flux and economic uncertainty.

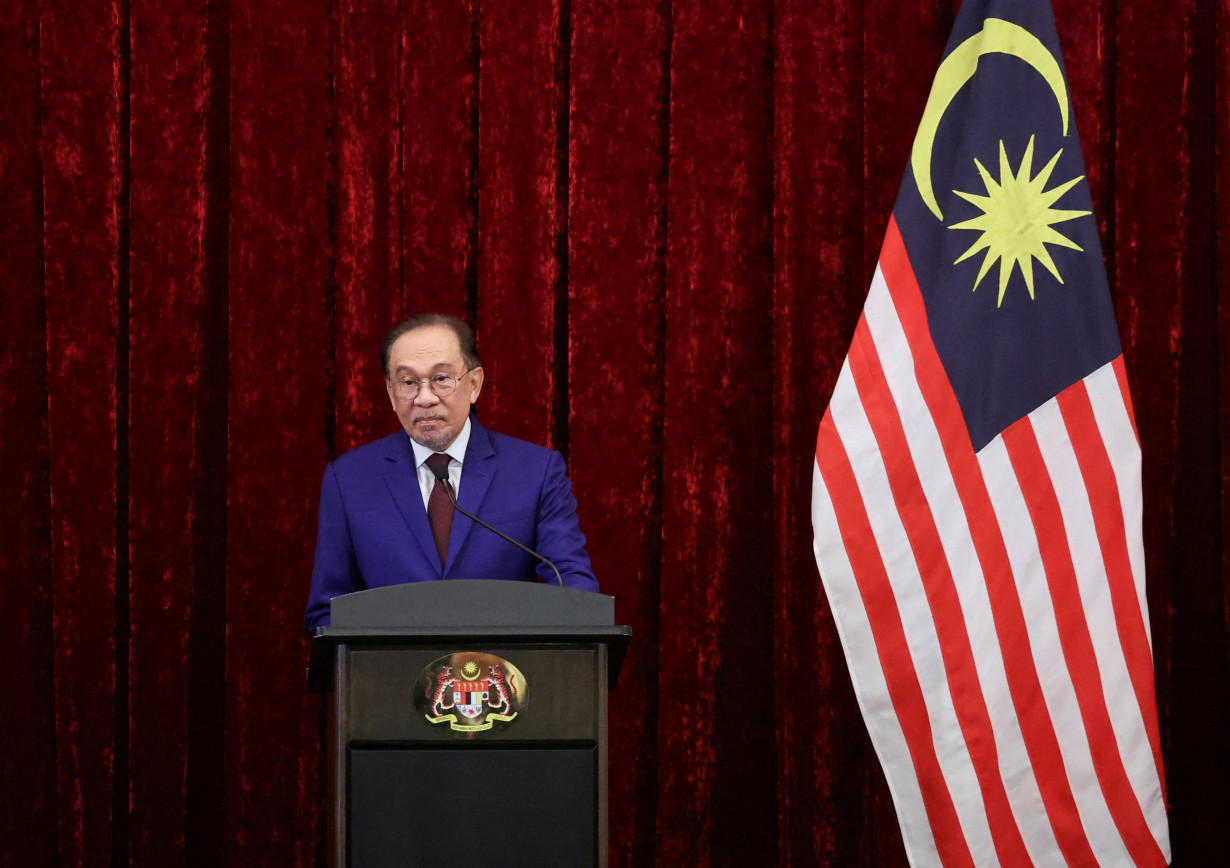

Prime Minister Anwar Ibrahim said Malaysia's economy rebounded dramatically last year, spurred by an influx of strategic investments, most substantially in renewable energy and artificial intelligence infrastructure. He added inflation and the ringgit were stable and the stock market was the region's top performer.

"In 2025, we want to double down on our geographical centrality, as a conduit for electricity, talent and supply chain diversification," he said at an economic forum.

Anwar said Malaysia will now aim to refine its expertise in oil and gas, semiconductors, and Islamic finance to become a global market leader in each field.

Economy minister Rafizi Ramli said Malaysia is looking to produce its own graphics processing unit chips as demand for artificial intelligence and data centres grows.

"We are hoping that we can start producing made-by-Malaysia GPUs and chips in the next five to 10 years," he said.

Malaysia, a major player in the semiconductor industry that accounts for 13% of global testing and packaging, is targeting over $100 billion in investment for the sector.

The Southeast Asian country is seen as well placed to attract more business as Chinese chip firms diversify overseas for assembling needs, and has attracted multibillion-dollar investments from leading firms in recent years, including Intel and Infineon.

Malaysia also received a slew of digital investments from major tech firms last year, including Alphabet's Google, helping to propel its economy with growth beating market expectations in the second and third quarters and the ringgit becoming one of Asia's top performers in 2024.

(This story has been refiled to fix formatting of links in paragraphs 9, 10)

(Reporting by Danial Azhar; Editing by Martin Petty and Saad Sayeed)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness