By Michael S. Derby

(Reuters) -The Federal Reserve appears to be on the threshold of ending a historic streak of losses, which in turn could get it back on track to returning cash to the Treasury somewhere down the line, analysts at Morgan Stanley said in a note on Monday.

At issue is the relationship between how the Fed makes money to fund its operations and the cash it pays as part of the system to maintain control over short-term interest rates. Aggressive rate rises starting three years ago tipped Fed books deeply into the red and now, with short-term rates down, the investment bank believes the Fed is hovering near the point where it can earn money again.

The bank argued there’s a “breakeven rate” where Fed income meets its expenses that is derived from the average interest payment it gets from bonds it holds divided by its interest liabilities. “As of March 12, the weighted average coupon for the Fed was 2.66%, and reserves and (reverse repo) were roughly 55% of the balance sheet, so the breakeven rate is about 4.8%,” Morgan Stanley economists wrote.

“Not surprisingly, then, the Fed is now on the verge of no longer running a loss on a flow basis,” they said, adding “the smaller balance sheet combined with the lower policy rate has brought the Fed out of the red.”

Continuing to shrink the size of Fed bond holdings as well as the prospect of more rate cuts “means the Fed will start earning a profit again.” If the Fed meets expectations and cuts rates again in the future, that and changes in the interest flows from securities it owns should help accelerate the return to profitability, the researchers wrote.

The Morgan Stanley report follows the Fed’s release on Friday of its financial situation for 2024, which showed a smaller loss after the record red ink reported for 2023. The U.S. central bank said that the total distribution of its comprehensive net loss for 2024 stood at $77.5 billion versus $114.6 billion in 2023. The Fed last turned a profit in 2022.

Fed officials have said repeatedly that losses do not affect the institution’s ability to conduct monetary policy or its operations. For the vast majority of its history the Fed has been a big profit maker, as the income it earned primarily from interest on bonds it owns outstripped what it had to pay to banks and money market funds, as part of technical work to set the level of short-term rates.

That began to change in 2022 when the Fed pushed up its interest rate target dramatically as part of efforts to tame inflation. That caused its interest expenses to surge above what it was earning from its bonds, preventing it from returning cash to the Treasury.

The Fed has been capturing its loss via what it calls a deferred asset, an accounting measure that it must use future profits to pay down before it can once again hand profits back to the Treasury. As of last Wednesday, the deferred asset was $224.4 billion.

Analysts expect it will take years to pay off the deferred asset, but if Morgan Stanley is right, the central bank may now finally be moving in the direction of making that happen.

(Reporting by Michael S. Derby; Editing by Andrea Ricci)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

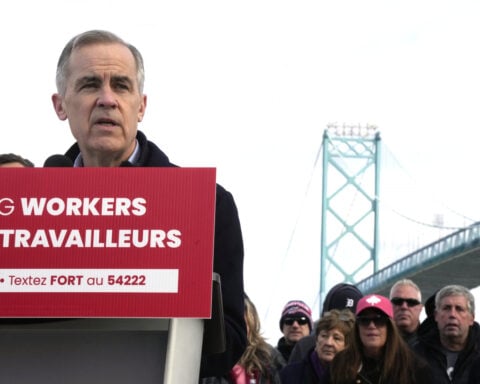

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness