Top Articles

Cost of living is top concern in L.A. residents' quality of life: UCLA study

Experts warn against direct Chinese factory purchases promoted on TikTok

US News

See all »China vows to counter Trump’s ‘bullying’ tariffs as global trade war escalates

Key takeaways from Trump’s ‘Liberation Day’ tariffs

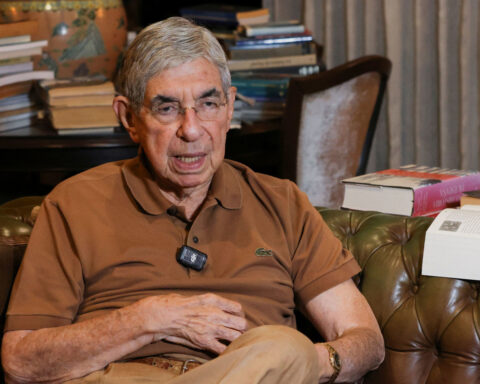

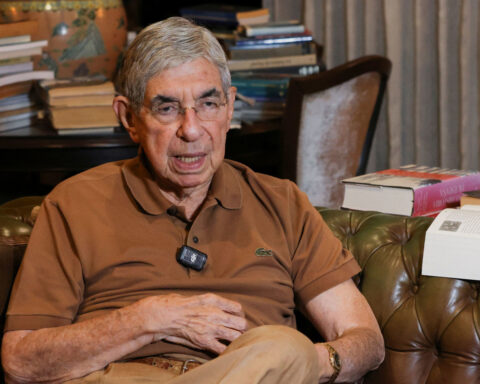

Former Costa Rican president who compared Trump to ‘Roman emperor’ says US has revoked his visa

‘The most powerful type of liar’: Tapper asks Anna Delvey how she views her criminal past

World News

See all »Former Costa Rican president who compared Trump to ‘Roman emperor’ says US has revoked his visa

Israel to seize parts of Gaza as military operation expands

World leaders react to Trump's tariffs

A wary Europe awaits Rubio with NATO's future on the line

Latest

US Treasury's Bessent urges IMF, World Bank to refocus on core missions

U.S.

Wall Street ends higher on earnings, hopes of easing tariff tensions

U.S. stocks rebounded on Tuesday as a spate of quarterly earnings reports and hints at the de-escalation of U.S.-China trade tensions brought buyers in from the sidelines.

See the moment Vatican announces death of Pope Francis

Former CDC official reveals why he left after RFK Jr. took over

CNN's Anderson Cooper speaks with former CDC communications director Kevin Griffis about his decision to step down after President Donald Trump's pick to lead the agency, Robert F. Kennedy Jr., took over.

Trump said he didn’t sign controversial proclamation. The Federal Register shows one with his signature

President Donald Trump downplayed his involvement in invoking the Alien Enemies Act of 1798 to deport Venezuelan migrants, saying for the first time that he hadn’t signed the proclamation, but that he stood by his administration’s move. The proclamation invoking the Alien Enemies Act appears in the Federal Register with Trump’s signature at the bottom. CNN’s Kaitlan Collins reports.

Cory Booker’s historic speech energizes a discouraged Democratic base

Trump's tariffs roil company plans, threatening exports and investment

Businesses around the globe on Thursday faced up to a future of higher prices, trade turmoil and reduced

Stock futures plunge as investors digest Trump’s tariffs

Stock futures plunge as investors digest Trump’s tariffs

Hear Trump break down tariffs on various countries

President Donald Trump announced during a speech at the White House plans for reciprocal tariffs. A group of countries will be charged a tariff at approximately half the rate they charge the United States.

California & Local

See all »Pope Francis dies at the Vatican at age 88

Kings set to face Oilers in round one of Stanley Cup Playoffs: preview

Technology

See all »Vehicle carriers seek relief from broad US port fees

Ex-CISA boss says Trump actions risk 'dangerously degrading' US cyber defenses

DOGE is building a master database for immigration enforcement, sources say

With all the changes at the IRS, how likely are you to be audited? It’s unclear

Lifestyle

See all »Jensen McRae makes authentic folk-pop the internet can't resist

Gwyneth Paltrow has started eating carbs and cheese again

Local photographer uses drone to find missing pets

Blake Lively addresses workplace safety in remarks at Time 100 Gala

Entertainment

See all »Jensen McRae makes authentic folk-pop the internet can't resist

Gwyneth Paltrow has started eating carbs and cheese again

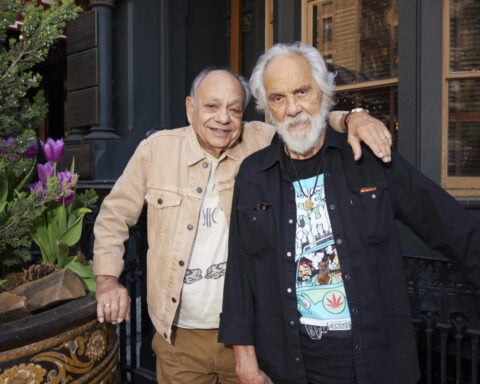

Cheech and Chong ride once more

Blake Lively addresses workplace safety in remarks at Time 100 Gala

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness