By Alden Bentley

(Reuters) - A look at the day ahead in Asian markets.

A warm reading on U.S. producer price inflation in October and hawkish comments by Federal Reserve chair Jerome Powell weighed on Wall Street and shouldn't distract Asian investors much from focusing on the incoming Trump administration.

Markets were muted ahead of an afternoon speech by Powell. Investors were right to be guarded, since he leaned more hawkish than in recent months, saying the central bank does not need to rush to lower rates and can carefully deliberate over the solid economy and job market and inflation that has yet to come back down to its 2% target.

After Powell's remarks, rate-futures contracts priced in about a 60% chance of another quarter-point policy rate cut next month. Those odds had already come down to 75% after the data, from about 80% prior to that.

On Wall Street, stocks fell a bit more than they had after the Producer Price Index news, while the dollar index moved back up a bit but not enough to clear its overnight highest level in about a year.

Bitcoin hovered on either side of $90,000 after Wednesday's surge above $93,000 as the election of Donald Trump spurred bets that friendlier U.S. regulation could usher in a new boom for all corners of the cryptocurrency sector.

Traders are not hanging as much on U.S. indicators due on Friday, and so spent most of the day digesting the Labor Department's report showing PPI for final demand rose 0.2% last month, after an upwardly revised 0.1% gain in September. That was in line with forecasts.

In the 12 months through October, the PPI increased 2.4% after advancing 1.9% in September. Data also showed initial claims for state unemployment benefits dropped 4,000 to a seasonally adjusted 217,000 for the week, a slightly better labor market than expected and than last week.

At the same time the Labor Department said initial claims for state unemployment benefits dropped 4,000 to a seasonally adjusted 217,000 for the week, slightly below expectations of economists polled by Reuters calling for 223,000 claims, suggesting a weak October government payrolls report was an anomaly.

Powell followed other Fed speakers on Thursday. Richmond Fed President Thomas Barkin said the Fed needs to keep building on its great progress and that the current level of unemployment is fine. Whether it is normalizing or weakening is still to be determined, he said

Fed governor Adriana Kugler said the central bank has made considerable progress toward achieving its job and inflation goals, but stopped short of offering firm guidance for the near-term monetary policy outlook.

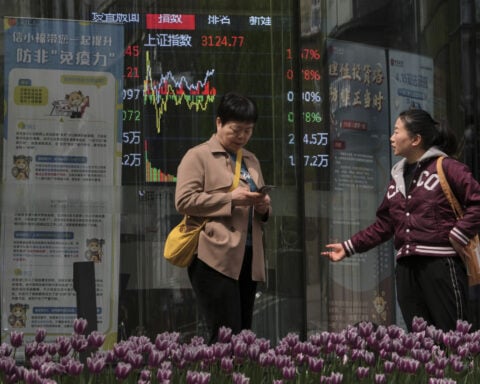

Worries about U.S.-China relations were already weighing on stocks in China, where the Shanghai Composite index and China's blue-chip CSI300 index both suffered their biggest retreats in nearly a month.

President-elect Trump has signaled with his choice of U.S. Senator Marco Rubio for Secretary of State that policy toward Beijing could go beyond tariffs and trade to a more hawkish stance on China as the United States' main strategic rival.

Republicans have criticized the outgoing Biden administration's approach of "managing competition" with Beijing as too conciliatory.

Other cabinet picks awaiting Senate confirmation might also upset China, such as Representative Mike Waltz as national security adviser and John Ratcliffe to lead the Central Intelligence Agency.

Concerns about U.S. alliances and trade policy are widespread and affecting international markets.

The greenback climbed above 156 yen for the first time since July, ending at 156.31, while the euro EUR=EBS was at $1.0513 after slumping to its weakest since October 2023. Euro/yen went up a smidge to 164.42. The offshore Chinese yuan was still trading at its weakest levels since August at 7.2554 per dollar.

Here are key developments that could provide more direction to markets on Friday:

- Japan GDP (Q3)

- China industrial output (Oct)

- U.S. retail sales (Oct)

- U.S. industrial production (Oct)

(Reporting by Alden Bentley; Editing by Bill Berkrot)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness