By Elena Fabrichnaya and Gleb Bryanski

MOSCOW (Reuters) -Russia's central bank hiked its key interest rate by 200 basis points to 18% on Friday, the highest level in more than two years, and vowed to continue tightening until inflation rates in an overheated economy come down.

The bank also raised its inflation forecast for 2024 to 6.5–7.0%, well above its 4% target. It sees annual price growth declining to 4.0–4.5% in 2025.

The market was expecting the hike, a Reuters poll of economists showed, though some dissenting voices in the Russian elite had favoured a more dovish approach, criticising the bank for stifling economic growth.

The key rate is now at its highest since April 2022. The Bank of Russia raised rates to 20% in an emergency move soon after the Kremlin sent Russian troops into Ukraine in February 2022.

"For inflation to begin decreasing again, monetary policy needs to be tightened further," the bank said in a statement. Its next rate-setting meeting is due on Sept. 13.

Annual inflation, the bank's main area of concern, grew to 9.0% as of 22 July from 8.6% in June, the bank said. Inflation stood at 7.4% in 2023, compared with 11.9% in 2022.

"Returning inflation to the target requires considerably tighter monetary conditions than presumed earlier," the bank said. "The Bank of Russia will consider the necessity of further key rate increase at its upcoming meetings."

SUBSTANTIALLY OVERHEATED

Central bank governor Elvira Nabiullina said the economy remained "substantially overheated", while noting a broad consensus among board members regarding the rate decision, with some even suggesting a more significant hike.

Nabiullina dismissed an earlier suggestion from Igor Sechin, CEO of oil giant Rosneft, to take cues from the People's Bank of China, which embarked on an easing cycle this week. She emphasised that economic conditions in Russia and China were different.

"Currently, China is balancing around zero inflation, they are pursuing a policy diametrically opposed to ours because our task is to reduce inflation, while their task is to avoid deflation," she said.

Nabiullina said she expected monthly inflation rates to start coming down in July but it would take longer to achieve a sustainable decline in price growth, noting that the central bank underestimated the impact of budget spending on inflation in the first half of the year.

The central bank noted an "upward deviation of the Russian economy from a balanced growth path" and pointed to labour shortages and the continued expansion of retail and corporate lending as key factors behind high inflation.

The bank raised its forecast for GDP growth in 2024 to 3.5%-4.0% from 2.5%-3.5%. President Vladimir Putin has estimated that the Russian economy grew by over 5% in the first half of this year.

Just before the rate announcement, the Kremlin said there were "various views regarding the overheating of the economy". It added that "necessary measures are being taken".

The Bank of Russia raised rates by 850 basis points in the second half of 2023, including an unscheduled emergency hike in August as the rouble tumbled past 100 to the dollar and the Kremlin called for tighter monetary policy.

(Reporting by Elena Fabrichnaya and Gleb Bryanski; additional reporting by Alexander Marrow; Editing by Toby Chopra)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

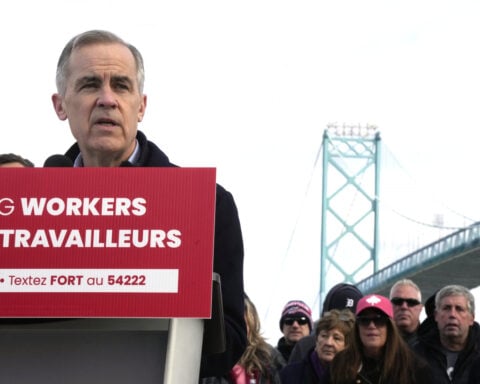

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness