By Cynthia Kim

SEOUL (Reuters) -South Korea's finance ministry said on Wednesday it was ready to deploy "unlimited" liquidity into financial markets after President Yoon Suk Yeol lifted a martial law declaration he imposed overnight that pushed the won to multi-year lows.

The announcement came after Finance Minister Choi Sang-mok and Bank of Korea Governor Rhee Chang-yong held emergency talks overnight, and as the central bank board abruptly met to approve rescue measures for the local credit market.

While financial markets found their footing in Wednesday trade, with the won higher and stocks trimming some losses, investors remain wary about longer-term political stability in South Korea, which has been seeking to make its markets more global.

"All financial, FX markets as well as stock markets will operate normally," the government said in a statement.

"We will inject unlimited liquidity into stocks, bonds, short-term money market as well as forex market for the time being until they are fully normalised."

The BOK said it will start special repo operations from Wednesday for local financial institutions to support smooth market functioning.

It also said it would loosen repo collateral policies by accepting bank debentures issued by some state-run enterprises.

The financial regulator added it was ready to deploy 10 trillion won ($7.07 billion) in a stock market stabilisation fund any time, the Yonhap news agency said.

South Korea's won gained 0.8% as of 0212 GMT, coming off the two-year low of 1,442.0 hit overnight after Yoon's shock martial law declaration.

Local foreign exchange dealers suspected authorities sold dollars as part of smoothing operations, intervening hard as soon as markets opened to limit a decline in the won.

South Korea's parliament, with 190 of its 300 members present, unanimously passed a motion early Wednesday requiring the martial law be lifted.

Korean shares fell 2% on Wednesday with chipmaker Samsung Electronics down 1.31% and battery maker LG Energy Solution off 2.64%.

The KOSPI index and won are among Asia's worst performing assets this year.

Overnight, U.S.-listed South Korean stocks fell, while exchange-traded products in New York including iShares MSCI South Korea ETF and Franklin FTSE South Korea ETF lost about 1% each.

Daniel Tan, a Singapore-based portfolio manager at Grasshopper Asset Management, said over the longer-term, the incident would accentuate the "Korean Discount", which refers to a tendency for local companies to have lower valuations than global peers.

"A reflection of the 'Korean Discount', Korea's equity benchmark KOSPI currently trades at 0.8 times one-year forward estimated book value, while the MSCI World Index trades at closer to 3 times," Tan said. "Investors could require a bigger risk premium to invest in the won and Korean equities."

FISCAL RISKS

The political turmoil comes as Yoon and the opposition-controlled parliament clash over the budget and other measures.

The opposition Democratic Party last week cut 4.1 trillion won from the Yoon government's proposed 677.4 trillion won ($470.7 billion) budget, putting parliament in a deadlock over spending.

The parliamentary speaker on Monday stopped the revised budget from going to a final vote.

A successful budget intervention by the opposition would deal a major blow to Yoon's minority government and risk shrinking fiscal spending at a time when export growth is cooling.

"The negative impact to the economy and financial market could be short-lived as uncertainties on political and economic environment could be quickly mitigated on the back of proactive policy response," Citi economist Kim Jin-wook said in a report.

(Reporting by Cynthia Kim, Jihoon Lee; Editing by Andrew Cawthorne, Mark Heinrich, Lincoln Feast and Sam Holmes)

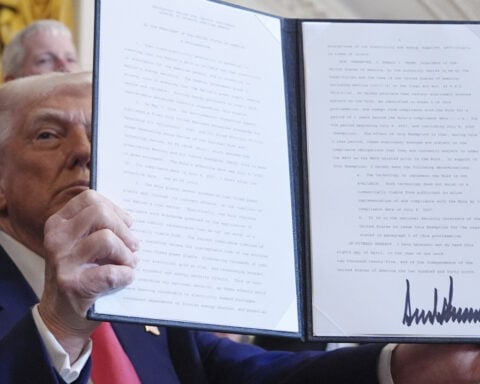

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness