By Amanda Cooper and Koh Gui Qing

NEW YORK/LONDON (Reuters) -The U.S. dollar slid on Friday and was set for its biggest weekly loss in over a year after President Donald Trump suggested a softer stance on tariffs against China, adding to uncertainty about the trade policy that kept equity markets on edge.

Trump told Fox News on Thursday his recent conversation with President Xi Jinping was friendly and he thought he could reach a trade deal with China.

"We have one very big power over China, and that's tariffs, and they don't want them, and I'd rather not have to use it, but it's a tremendous power over China," he said.

The U.S. dollar dropped as much as 0.8% against a basket of currencies on Friday, before narrowing losses at the end of the day to be down 0.65%. But it still had its biggest weekly loss since November 2023, having lost 1.8% since Monday.

Some analysts warned that the dollar could rise again if the U.S. tariff and interest rate policies shifted.

"We think that the dollar has further to climb," said Simon MacAdam, deputy chief global economist at Capital Economics.

"Its appreciation so far has reflected both the strength of the economic data in the U.S. relative to peer economies and investors’ assessment of Trump’s policies, both of which have contributed to a shift in interest rate differentials that has been favourable to the dollar."

The MSCI index for world stocks ended little changed, while stocks on Wall Street were lackluster. The S&P 500 index was down 0.3%, the Dow Jones Industrial Average lost 0.3%, and the Nasdaq Composite shed 0.5%.

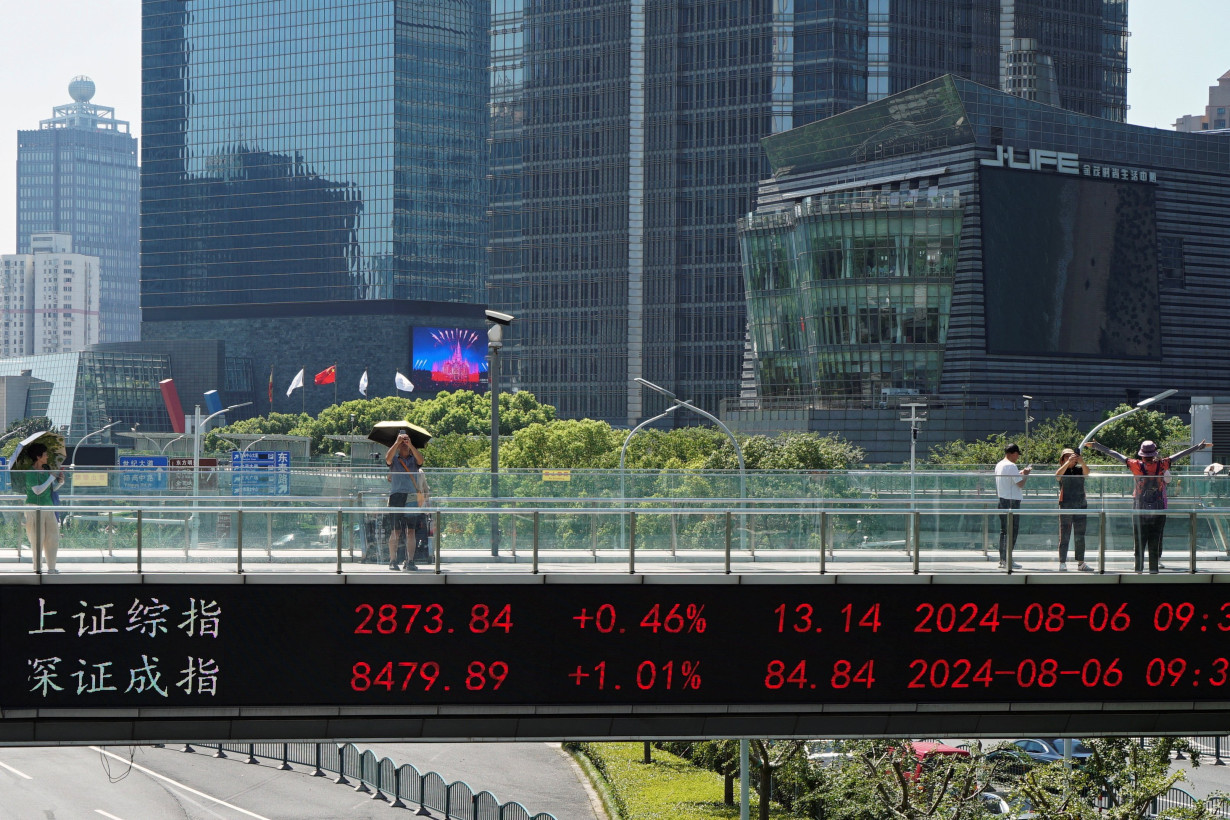

China's stock markets and currency rallied on the back of Trump's comments, leaving the blue chip index up 0.8% and the yuan strengthened against the dollar, which fell 0.7% to 7.239 in the offshore market.

Oil prices stabilised and pared losses that were incurred after Trump said he will be asking Saudi Arabia and OPEC to lower oil prices.

U.S. crude futures edged higher to $74.66 a barrel and Brent crude was up 0.3% at $78.50.

LOW OIL PRICE BENEFITS

Amelie Derambure, senior multi-asset portfolio manager at Amundi in Paris, said Trump's pro-America policies require lower oil prices.

"These types of policies could also benefit other players in the world, like Europe for instance, if we have a lower oil price that’s going to benefit Europe as well – so at last there is something that he wants to implement that is not detrimental to Europe," she said.

"It shows that he’s willing to negotiate and he wants to be maybe a bit more subtle this time."

European stocks reflected this greater optimism. The STOXX 600 initially rose 0.3% on the day, driven by a burst higher in luxury goods retailers after solid earnings from Burberry. It retreated by midday in New York to be flat.

BlackRock CEO Larry Fink told a panel at the World Economic Forum in Davos that it could be time to start investing in Europe again.

"There's too much pessimism on Europe," he said during a panel debate on the global economic outlook. "I believe it's probably time to be investing back into Europe," he said, adding there was still progress to be made in areas such as capital markets union.

Surveys earlier on Friday showed euro zone businesses saw a modest return to growth at the start of the new year.

In currency markets, the yen gained 0.2% against the dollar to 155.7 after the Bank of Japan raised interest rates to their highest since the 2008 global financial crisis.

BOJ Governor Kazuo Ueda said the central bank will keep raising interest rates as wage and price increases broaden, adding that there was scope to push up borrowing costs further before they reach levels deemed neutral to the economy.

Treasury yields, which have retreated from January's highs as some of the worry about a renewed spike in inflation has faded, were steady on Friday.

The U.S. 10-year Treasury yield edged lower to 4.6194%, below last week's 14-month high of 4.809%. [US/]

The European Central Bank and the Federal Reserve are due to meet next week as policymakers digest early moves of the Trump administration.

The Fed is expected to keep interest rates on hold but the larger story unfolding will be how the central bank confronts early moves by Trump that are likely to shape the economy this year, including demands the Fed continue lowering borrowing costs.

(Additional reporting by Elizabeth Howcroft in Paris; Editing by Toby Chopra, Nick Zieminski and Rod Nickel)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness