By Lawrence Delevingne

(Reuters) -Stocks fell and the dollar gained on Thursday as traders digested fresh economic data and awaited confirmation from the U.S. Federal Reserve on Friday that it will soon start to cut interest rates.

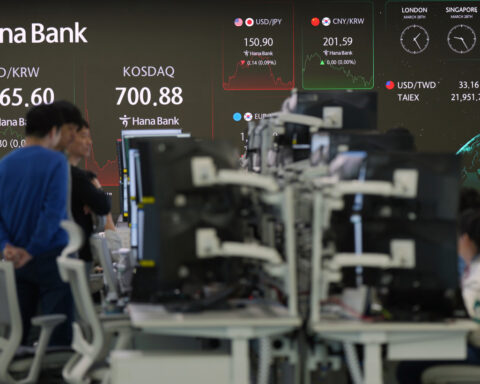

All three major U.S. stock indexes lost ground, weighed by technology shares. The Dow Jones Industrial Average fell 0.43%, to 40,712, the S&P 500 lost 0.89%, to 5,570 and the Nasdaq Composite lost 1.67%, to 17,619.

Fed meeting minutes, released on Wednesday, said the "vast majority" of policymakers felt that, if data came in as expected, a September cut was likely to be appropriate - validating market expectations.

On Thursday, fresh data showed the number of Americans filing new applications for unemployment benefits rose in the latest week, consistent with a gradual cooling of the labor market.

A slowdown in overall U.S. business activity this month added to the evidence that the economy is slowing and inflation is downshifting, which should allow Fed officials to focus more attention on jobs. Interest rates on home loans have already begun dropping, helping fuel a larger-than-expected rebound in existing home sales last month.

Steve Englander, a markets strategist for Standard Chartered Bank, said the minutes showed the Fed was in sight of its inflation target and unemployment is rising, putting a 50 bps rate cut "on the table".

"If they are not announcing that they have won on inflation, they are saying they expect to win relatively soon," Englander wrote in an email on Thursday.

Global stocks after a phenomenal rebound from early-month lows plumbed after a bout of volatility, fell about 0.6%.

European shares gained 0.35%, helped by retail and healthcare stocks, after a subdued trading session in Asia. They added to initial gains after data for the euro zone showed surprising strength in business activity this month.

Earlier, MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.3%.

Oil prices rallied after losses driven by investors worried about the global demand outlook. U.S. crude and Brent both gained about 1.4% on the day. [O/R]

Euro zone bond yields were higher after survey data showed the bloc's services sector fared better than expected in August, although a separate measure of wage pressures eased.

DOLLAR REBOUND

The dollar rebounded from a 13-month low against the euro before Federal Reserve Chair Jerome Powell is due to speak on Friday. The greenback's recent weakness was seen as being overdone. The dollar index, gained about 0.4%.

Lower U.S. rates would give central banks around the world room to move. On Thursday the Bank of Korea opened the door to a cut in October, while Bank Indonesia has lined up cuts in the fourth quarter.

Still, rates and currency markets see a U.S. easing cycle as having further to run than other countries.

Interest rate futures markets have priced in a 25-basis-point cut from the Fed next month, with a chance of a 50-bp cut. They project around 213 bps of U.S. easing by the end of 2025, to a rate of nearly 3.2%, against around 157 bps for Europe, a 2.09% rate.

U.S. Treasury yields recovered from two-week lows hit the previous session, in line with gains in the European bond market. The yield on benchmark 10-year notes rose 8.6 basis points to 3.862%, from 3.776% late on Wednesday. The 2-year note yield rose 9.4 basis points to 4.0161%, from 3.922% late on Wednesday.

The euro, which has made strong gains this month, fell about 0.4%.

In Britain, the pound initially rose to a new 13-month high on the dollar and also strengthened against the euro after British business activity data showed steady growth momentum going into the second half of 2024. The pound was last little changed at $1.3086. [GBP/]

Gold prices fell more than 1%, pressured by a rebound in the dollar and higher Treasury yields.

(Reporting by Lawrence Delevingne in Boston, Tom Wilson in London and Tom Westbrook in Singapore; Editing by Tom Hogue, Christina Fincher, Chizu Nomiyama, David Evans and David Gregorio)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness