By Yuka Obayashi

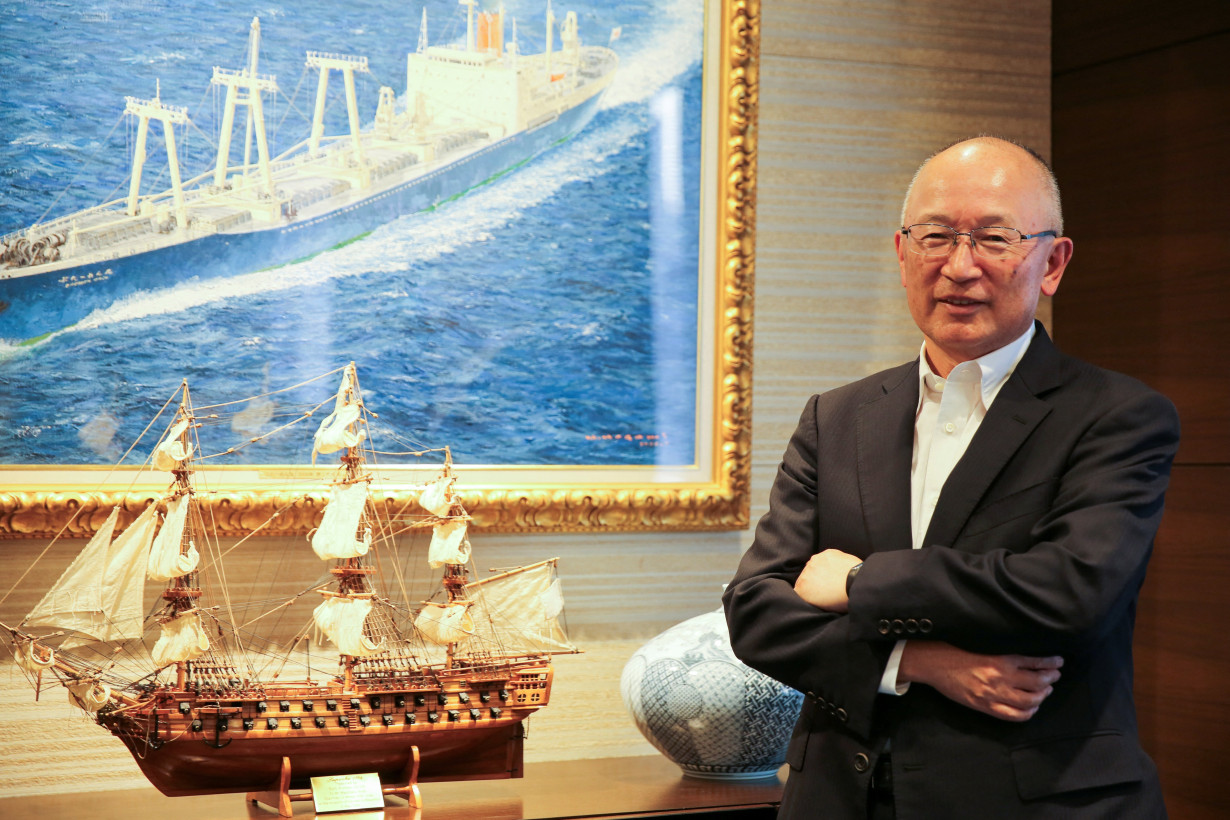

TOKYO (Reuters) - Mitsui O.S.K. Lines (MOL), Japan's second-largest shipping company, aims to capitalise on opportunities that emerge from a shift in trade routes driven by new U.S. tariffs, CEO Takeshi Hashimoto said.

The highest U.S. tariffs in more than a hundred years came into force on Wednesday, roiling global markets.

"Trade routes will inevitably be reshuffled," Hashimoto told Reuters in an interview on Tuesday.

"We'll likely see increased trade from low-tariff countries and declines from high-tariff ones," he said, noting some cargos could be rerouted through Mexico or Canada, where tariffs may be lower.

MOL plans to monitor shifting trade patterns and seize new opportunities, he said.

Hashimoto said U.S. energy and grain exports to Asia could be impacted, with countries like China potentially turning to Brazil or Argentina as alternative grain suppliers and to Qatar for liquefied natural gas (LNG).

MOL is considering opening an office in Washington to gather information and lobby, Hashimoto said.

He said that during the first Trump administration, trade routes were also reconfigured in response to tariffs. Some Chinese exports to the U.S. were rerouted through other countries like Vietnam, while China increased grain imports from Brazil and others while cutting back U.S. purchases.

The CEO believes Trump's goal is to strike favourable trade deals, making a full-scale tariff war unlikely.

LNG FLEET EXPANSION

MOL, the world's largest LNG carrier, plans to expand its LNG fleet from 108 vessels now to around 150 by 2030, expecting demand to grow into the 2030s before declining, Hashimoto said.

"LNG use will continue to rise through the 2030s, then gradually decline from around 2040," Hashimoto said, adding that significant volumes could still be used globally in 2050.

Between 2020 and early 2022, MOL signed charter deals for three ice-breaking LNG vessels and a condensate ice-breaker for the Arctic LNG 2 project in Russia, but delivery of vessels is on hold due to Western sanctions, Hashimoto said.

On Alaska LNG, which U.S. President Donald Trump is pushing to develop, MOL has had intermittent discussions with Alaska for quite some time, Hashimoto said, though pipeline issues remain unresolved.

He did not meet with the Alaskan delegation that recently visited Japan, but expressed willingness to participate in LNG transportation if the Alaska LNG development project progresses.

Hashimoto said the company may raise shareholder returns as early as in the 2025/06 financial year after generating strong profits over the past two years and a big increase in equity capital to more than 2.5 trillion yen ($17.20 billion).

"We are considering increasing shareholder returns a bit more," Hashimoto said, but said a decision would be made after assessing the impact of U.S. tariffs.

($1 = 145.3200 yen)

(Reporting by Yuka Obayashi. Editing by Jane Merriman)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness