By Brijesh Patel and Daksh Grover

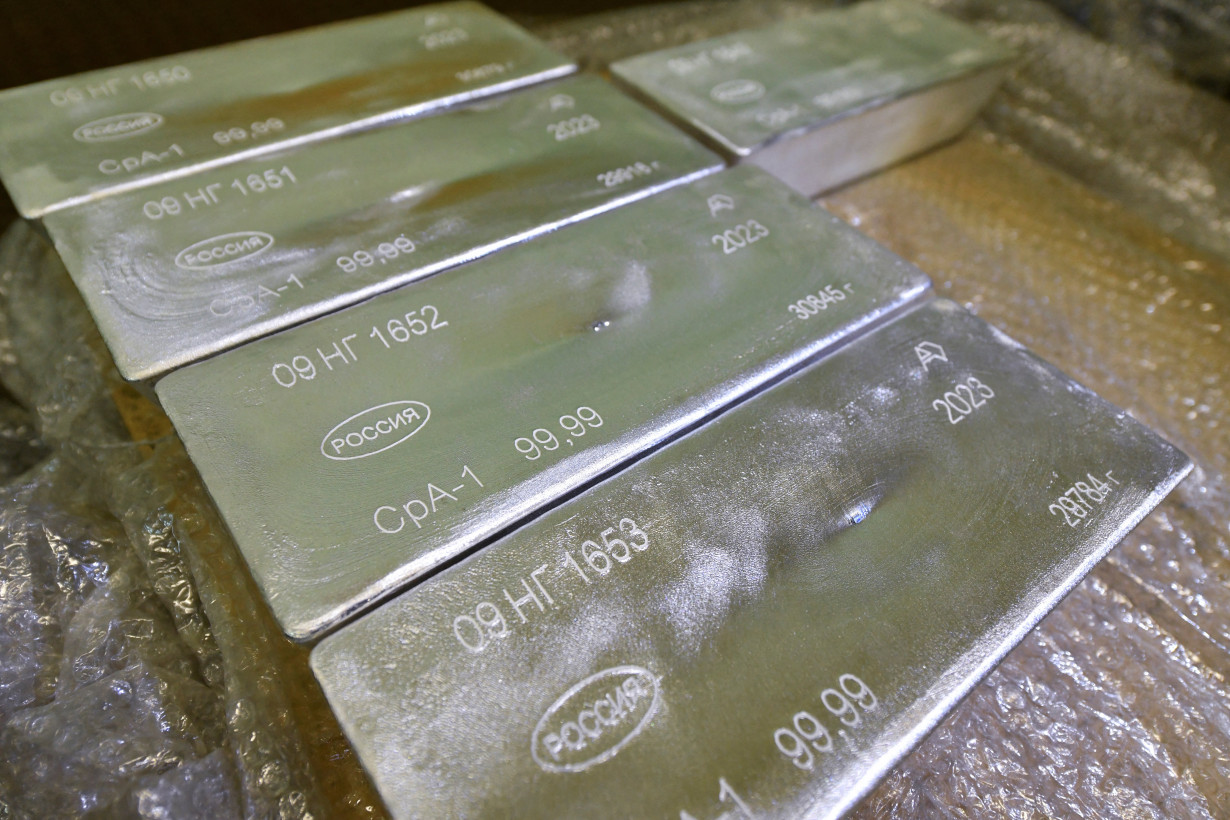

(Reuters) -Silver prices hit their highest since late October on Friday, latching on to factors that drove gold to successive record highs, with some analysts suggesting investors in the metal may aim to challenge a 10-year high just shy of $35 per ounce.

However some analysts were cautious on the market's trajectory, given higher volatility in silver and a failure to reach similar dizzying heights as gold in 2024.

Spot silver was last up 2% at $33 per ounce, having hit its highest level since late October at $33.41. The white metal scaled a more than 10-year peak of $34.87 per ounce on October 22. [GOL/]

"Silver's been a laggard, and some would refer to it as the Cinderella metal, because it always misses the ball. Having said that, silver has finally woken up and broken above some key technical resistance," independent analyst Ross Norman said.

If current momentum continued, silver could challenge the $35 level, he added.

After rising 21% in 2024, silver, both a precious and industrial metal, has gained 14% so far in 2025 supported by similar factors to gold - a jump in U.S. Comex futures prices on concerns of a possible trade war sparked by proposed U.S. import tariffs. The U.S. March silver contract was last up 3.3% at $33.79.

In recent weeks the spread between Comex gold futures and London spot prices has widened significantly, while the spot gold price hit a record $2,942.70 per ounce on Tuesday. [GOL/]

Providing additional support to silver, copper prices hit their highest in more than three months in London on Friday. [MET/L]

The unusually high premium between CME futures and London spot prices caused volatility in the part of the market known as the exchange of futures for physical (EFP), used as a hedge to general precious business activity, and attracted massive inflows to the silver stocks in COMEX-approved warehouses.

CME silver stocks jumped by 22% to 375.8 million ounces since November 24 when U.S. President Donald Trump pledged steep tariffs on all products from Mexico and Canada. Trump later delayed the tariffs until March.

CME gold stocks had seen a sharper growth since November partly because gold is flown around by plane and silver is usually transported by sea or land.

"Elevated EFPs continue to draw metal from London into the COMEX, with the threat of tariffs inadvertently accelerating the drain on LBMA inventories towards critical levels," TD Securities said.

The amount of silver stored in the London vaults fell by 8.6% from December to 23,528 tons in January, worth $23.9 billion, the London Bullion Market Association said last week.

The monthly decline was the largest since the LBMA records began in mid-2016.

VOLATILE

Despite some bullish-looking factors, analysts noted the silver market's propensity to be volatile - injecting a note of caution.

"Silver has a long history of higher volatility than gold, and that when gold makes a decisive move, silver's amplitude is usually 2.0-2.5 times that of gold," StoneX analyst Rhona O'Connell said in a recent note.

Prices also looked slightly vulnerable from a technical perspective.

"Last year's range was $22-35; unusually wide. The previous year was $19-27 and that range was made in the first handful of months," said Tai Wong, an independent metals trader.

"It feels disappointing because gold made 40 historic highs in 2024 and silver 0," he added.

About half of silver usage comes from industrial use, which may be subject to headwinds if a trade war has a chilling effect on global economic growth.

There may be fewer rate cuts than previously expected by the U.S. Federal Reserve and slowing growth in China, said Hamad Hussain, assistant climate and commodities economist at Capital Economics.

(Reporting by Brijesh Patel, Daksh Grover and Anjana AnilAdditional reporting by Ashitha Shivaprasad, Anushree Mukherjee and Polina DevittEditing by Veronica Brown and Frances Kerry)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness