Top Articles

Demonstrators gather at UCLA amid reports of student detained by CPB

Kings set to face Oilers in round one of Stanley Cup Playoffs: preview

US News

See all »Federal judge to consider case of Georgetown fellow arrested by ICE

Former Costa Rican president who compared Trump to ‘Roman emperor’ says US has revoked his visa

Attorneys for Tufts University student accuse government of ‘secretive’ effort to move her across state lines

Two infants die of whooping cough in Louisiana as cases climb nationally

World News

See all »Israel to seize parts of Gaza as military operation expands

Middle East latest: Israel is establishing a new military corridor across Gaza

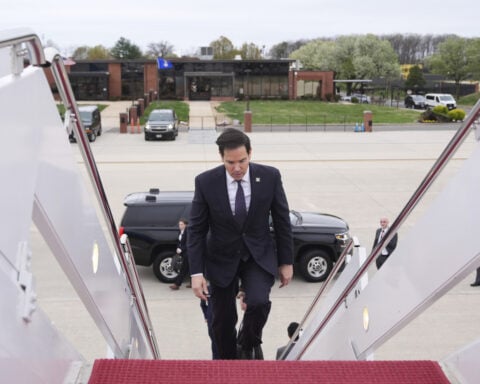

A wary Europe awaits Rubio with NATO's future on the line

China’s military launches live-fire exercise in escalation of blockade drills near Taiwan

Latest

Wall Street ends higher on earnings, hopes of easing tariff tensions

See the moment Vatican announces death of Pope Francis

A video released by Vatican media shows the moment the pope's death was announced on Monday morning by Cardinal Kevin Farrell, the Vatican camerlengo. The camerlengo — or chamberlain — is the acting head of the Vatican in the period between the death or resignation of a pope and appointment of the next leader of the Catholic Church.

Former CDC official reveals why he left after RFK Jr. took over

CNN's Anderson Cooper speaks with former CDC communications director Kevin Griffis about his decision to step down after President Donald Trump's pick to lead the agency, Robert F. Kennedy Jr., took over.

Cory Booker’s historic speech energizes a discouraged Democratic base

Cory Booker’s historic speech energizes a discouraged Democratic base

Trump's tariffs roil company plans, threatening exports and investment

Businesses around the globe on Thursday faced up to a future of higher prices, trade turmoil and reduced

Stock futures plunge as investors digest Trump’s tariffs

Hear Trump break down tariffs on various countries

President Donald Trump announced during a speech at the White House plans for reciprocal tariffs. A group of countries will be charged a tariff at approximately half the rate they charge the United States.

Attorney for father deported in 'error' says this is what's 'new, unique and terrifying' about case

CNN's Erin Burnett speaks with Simon Sandoval-Moshenberg, the attorney for a Maryland father the Trump administration conceded it mistakenly deported to El Salvador “because of an administrative error.”

Federal judge to consider case of Georgetown fellow arrested by ICE

Federal judge to consider case of Georgetown fellow arrested by ICE

California & Local

See all »Pope Francis dies at the Vatican at age 88

Kings set to face Oilers in round one of Stanley Cup Playoffs: preview

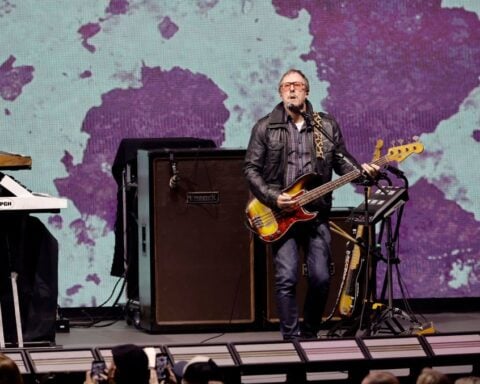

Weezer bassist to play Coachella despite wife’s arrest

Technology

See all »Meta’s oversight board rebukes company over policy overhaul

Chinese automaker Zeekr debuts first hybrid model at Shanghai auto show

Trade war and safety concerns take centre stage at Shanghai auto show

Mercedes CEO urges EU to find equitable solution to China-made EV tariff dispute

Lifestyle

See all »Tennessee board recommends that governor pardon country star Jelly Roll

First phase of turning former water park into nature park expected to finish this summer

Family of man who drowned in river remembers his love for life

Andre Agassi will play at the US Open Pickleball Championships next week

Entertainment

See all »‘Hope the money is worth it’: Tapper sounds the alarm on CBS caving to Trump over ’60 Minutes’

Ryan Coogler thanks audiences for seeing ‘Sinners’ in the theater after big box office debut

Tennessee board recommends that governor pardon country star Jelly Roll

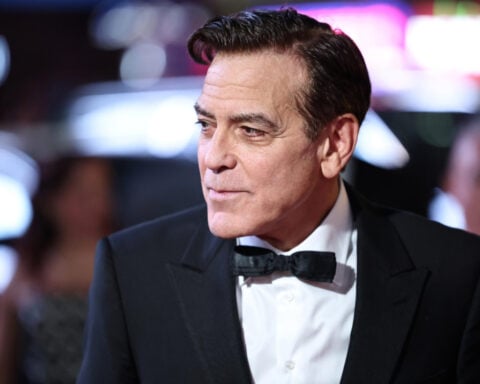

George Clooney is optimistic America has better days ahead. Patti LuPone is everyone else

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness