(Reuters) - Foreign investors withdrew the largest amount of money from Asian equities in about 15 years in the quarter to March ahead of U.S. President Donald Trump's major tariff announcement - and some say the region may see more selling as investors head for safe-haven assets.

Overseas investors divested stocks worth a net $43.73 billion in India, Taiwan, South Korea, Thailand, Indonesia, Vietnam, and the Philippines in the quarter - the largest quarterly net sales since at least March 2010, LSEG data showed.

On Wednesday, Trump introduced sweeping reciprocal tariffs on his country's trading partners, escalating a trade war that has heightened fears of a global economic slowdown, with particularly severe impacts on regional growth.

"Asia bears the brunt of these tariffs, with China, South Korea, and Taiwan seeing significant increases compared to lower rates for LATAM. Specifically, China will face a 34% tariff on top of the existing 20%, resulting in an effective tariff rate of 54%, which is close to the 60% rate pledged during Trump's campaign," said Ray Sharma-Ong, head of multi-asset investment solutions, at Aberdeen Investments.

In March alone foreigners offloaded a net $17.51 billion worth of the region's equities, the biggest net sales for a month since June 2022.

Taiwan stocks witnessed a net $14.13 billion worth of monthly cross-border outflows last month, the highest since at least January 2008.

South Korean stocks remained out of favor for an eighth successive month as foreigners divested local stocks worth a net $1.46 billion.

Meanwhile, monthly foreign outflows from Indian equity markets cooled to a three-month low of $401 million last month.

Foreign investors also sold Thai, Indonesian and Vietnamese stocks worth $647 million, $491 million and $426 million, respectively in the last month.

"The hardest-hit regions, including China, South Korea, and Taiwan, are expected to experience further de-risking as investors move towards safe haven assets such as U.S. Treasuries, yen, and gold," said Aberdeen's Sharma-Ong.

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Hugh Lawson)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

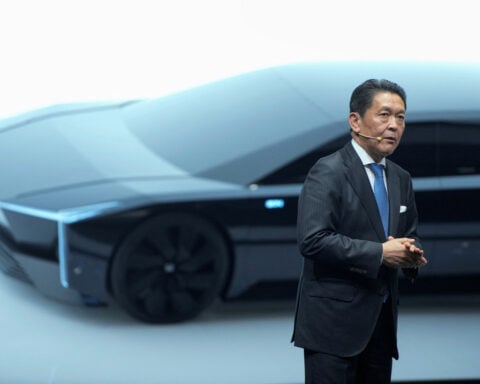

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness