A look at the day ahead in European and global markets from Ankur Banerjee

The euro hit a five-month peak and European bourses were poised to open higher on Wednesday as progress towards a ceasefire in Ukraine bolstered investor sentiment, but worries lingered that tit-for-tat tariffs could trigger a recession.

The U.S. said it would restore military aid and intelligence sharing to Ukraine after Kyiv said it would accept a U.S. ceasefire proposal, although Russia has yet to respond.

Futures point to a strong start on Wednesday for the pan-European STOXX 600, which dropped nearly 3% in the first two days of the week as recession worries gripped markets.

Adding to the markets' jittery mood over tariffs, U.S. President Donald Trump reversed course on Tuesday afternoon on a pledge just hours earlier to double tariffs on steel and aluminium from Canada to 50%.

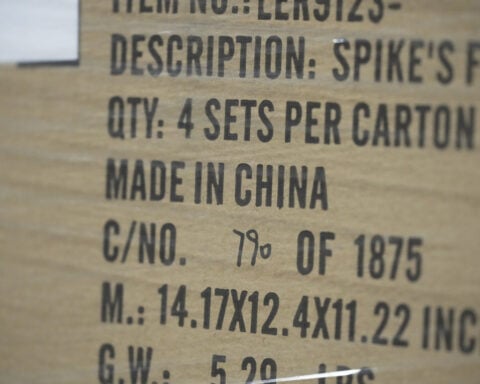

Trump's 25% tariffs on steel and aluminium imports took effect on Wednesday as prior exemptions, duty-free quotas and product exclusions expired.

The will-he-or-won't-he conundrum on tariffs has battered stocks, with the S&P 500 wiping out an eye-watering $4 trillion in market value from its recent peak hit last month. U.S. futures stabilised in early Asian hours.

Trump defended his tariff moves during a meeting on Tuesday with the CEOs of the biggest U.S. companies, and said they could multiply.

The Republican president spoke to about 100 CEOs at a regular meeting of the Business Roundtable, which included the heads of Apple, JPMorgan Chase and Walmart.

Recession worries have led traders to add to bets on the Federal Reserve cutting rates, with markets pricing in 76 basis points of easing this year. That has put the spotlight firmly on U.S. inflation data due later in the day.

Key developments that could influence markets on Wednesday:

- Possible details on Russia-Ukraine ceasefire

- U.S. inflation

- Possible tariff-related news

(By Ankur Banerjee; Editing by Edmund Klamann)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness