By Pete Schroeder

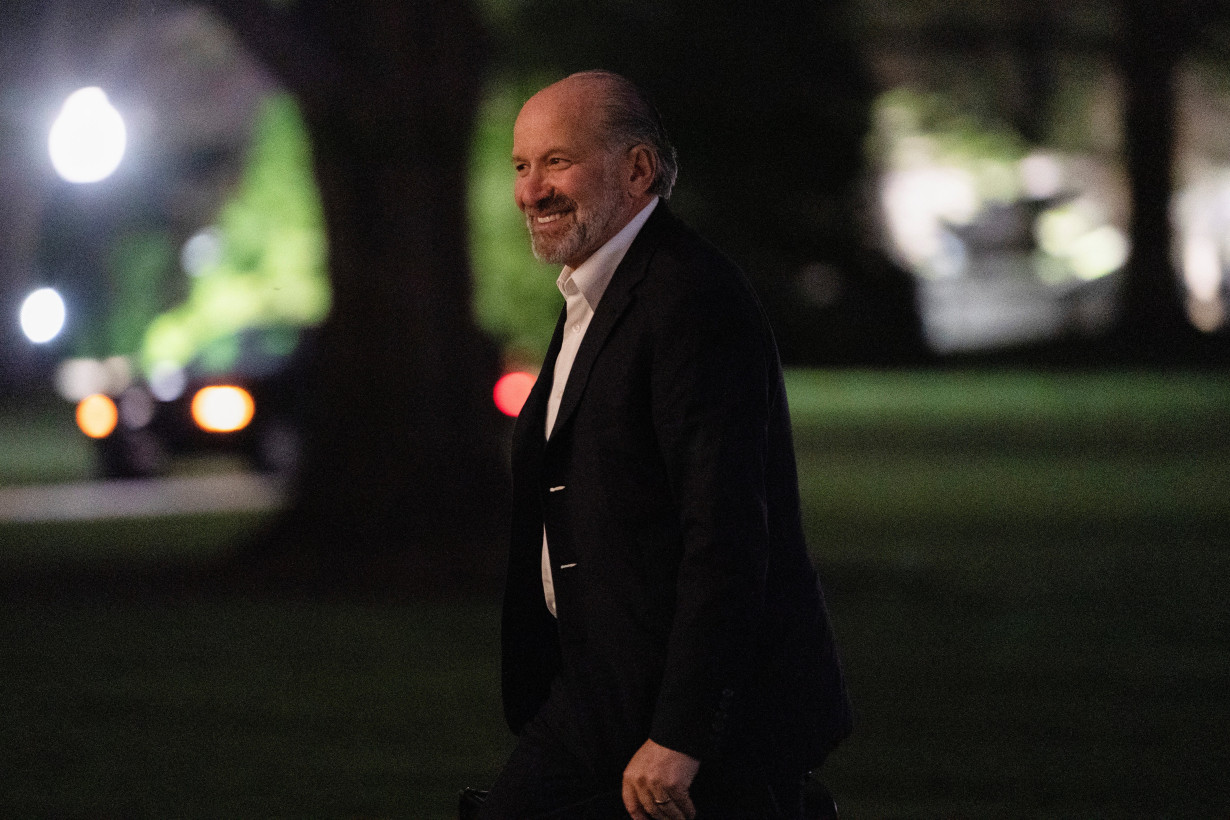

WASHINGTON (Reuters) -The heads of the largest U.S. banks met with Commerce Secretary Howard Lutnick last week and discussed President Donald Trump's tariff plans a day after they were announced.

CEOs from the nation's largest banks met with Lutnick in Washington on Thursday as part of a regularly scheduled meeting hosted by the Financial Services Forum, an industry lobbying group. Lutnick discussed the administration's strategy toward tariffs and the CEOs asked questions, according to two sources familiar with the meeting.

A spokesperson for the Forum confirmed the meeting, saying the executives "meet regularly with policymakers to discuss a range of issues, including the strength and resiliency of the nation’s largest banks, and the need for appropriate policy and regulation to support economic growth and job creation.”

An administration official confirmed the meeting. A spokesperson for the Commerce Department did not immediately respond to a request for comment.

Lutnick's meeting with the group, which includes CEOs from the nation's eight largest banks, lasted about a half hour, one source said. It came one day after Trump announced sweeping tariffs across the globe, setting off a chaotic selloff on Wall Street.

JPMorgan Chase CEO Jamie Dimon, who attended the meeting, warned in his annual letter to shareholders on Monday that tariffs could have lasting negative consequences.

Bank executives followed up that meeting with a separate call on Sunday, where they discussed the potential tariff fallout and repercussions. That call was convened by the Bank Policy Institute, another industry trade group.

Shares of banks, whose fortunes are closely tied to the state of the economy, have been ravaged as investors fear that the tariffs could weaken consumer spending, raise recession risks and slow down capital markets activity.

The KBW Bank index has dropped about 15.2% since the new levies were announced on April 2, which Trump touted as "Liberation Day".

(Reporting by Pete Schroeder; Editing by Alistair Bell and Sharon Singleton)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness