By David Lawder

WASHINGTON (Reuters) - The Internal Revenue Service said on Wednesday it plans to crack down on wealthy executives who may be using company jets for personal trips but claiming the costs as business expenses for tax purposes, as part of a new audit push to boost revenue collections.

The IRS announced that it will begin dozens of audits involving personal use of business aircraft, focusing on large corporations, large partnerships and high-income taxpayers.

The agency said it would use "advanced analytics" and other resources from the 2022 Inflation Reduction Act, which provided $80 billion in new funding over a decade for the IRS to modernize, improve taxpayer services and beef up enforcement and compliance.

The IRS said the audits aim to determine "whether for tax purposes, the use of jets is being properly allocated between business and personal reasons." Audits could increase based on initial results and as the agency hires more examiners.

The use of business aircraft is an allowable expense against a company's profit, reducing its tax liability. But U.S. tax laws require that such costs be allocated between business and personal use, requiring detailed record-keeping.

IRS Commissioner Danny Werfel said this was a complex audit area where the agency's work has been stretched thin by more than a decade of reduced funding and declining staffing.

"With expanded resources, IRS work in this area will take off. These aircraft audits will help ensure that high-income groups aren't flying under the radar with their tax responsibilities," Werfel said in a statement.

The IRS did not specify how much additional taxes could be collected from the audits. But for an executive using the company jet for personal travel, the costs should be included as additional personal income, and may reduce the firm's ability to deduct expenses associated with the flight.

The Inflation Reduction Act funds allowed the IRS to hire more than 5,000 staff to answer phones and process tax returns promptly, modernize antiquated technology and rebuild enforcement by hiring thousands of staff capable of handling audits of sophisticated partnerships and tax avoidance schemes.

Republicans in the U.S. Congress have accused the Biden administration of building an "army" of IRS agents to harass Americans over their tax bills and have sought to rescind the funding at every opportunity. A bipartisan top-line spending deal for fiscal 2024 would cut $20 billion from the total over a year.

After an initial success of collecting $38 million from more than 175 high-income taxpayers, the IRS is pursuing audits of 1,600 other wealthy taxpayers, with $482 million collected so far.

The Treasury and IRS now estimate that spending the full $80 billion would increase tax collections by $561 billion over 10 years.

(Reporting by David Lawder in Washington; Editing by Matthew Lewis)

US weighing in on Lebanon's next central bank chief, sources say

US weighing in on Lebanon's next central bank chief, sources say

Tornadoes, wildfires and blinding dust sweep across U.S. as massive storm leaves at least 32 dead

Tornadoes, wildfires and blinding dust sweep across U.S. as massive storm leaves at least 32 dead

Astronaut crew docks with space station to replace 'Butch and Suni'

Astronaut crew docks with space station to replace 'Butch and Suni'

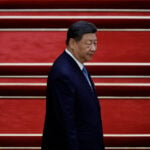

China's Xi declines invitation to EU-China anniversary summit, FT reports

China's Xi declines invitation to EU-China anniversary summit, FT reports

Young scientists see career pathways vanish as schools adapt to federal funding cuts

Young scientists see career pathways vanish as schools adapt to federal funding cuts

McLaren's Lando Norris wins wet and wild Australian Grand Prix. Hamilton finishes 10th

McLaren's Lando Norris wins wet and wild Australian Grand Prix. Hamilton finishes 10th

St. Patrick's Day parade celebrates Boston heritage in America’s most Irish big city

St. Patrick's Day parade celebrates Boston heritage in America’s most Irish big city

Bickerstaff blasts officials after Pistons receive 5 technical fouls in loss to Thunder

Bickerstaff blasts officials after Pistons receive 5 technical fouls in loss to Thunder