By Scott DiSavino

(Reuters) -U.S. natural gas futures jumped about 5% to a one-week high on Wednesday on record flows to liquefied natural gas (LNG) export plants and a second drop in daily output.

Front-month gas futures for April delivery on the New York Mercantile Exchange rose 19.5 cents, or 4.8%, to settle at $4.247 per million British thermal units (mmBtu), their highest close since March 11.

The price increase occurred despite forecasts for less demand over the next two weeks than previously expected with the weather forecast to remain seasonally mild through early April.

That decline in demand should reduce the amount of gas utilities need to pull from storage in coming weeks.

Gas stockpiles, however, were already around 11% below normal levels for this time of year after extreme cold weather in January and February forced energy firms to pull large amounts of gas out of storage, including record amounts in January. [EIA /GAS] [NGAS/POLL]

SUPPLY AND DEMAND

Financial firm LSEG said average gas output in the Lower 48 U.S. states rose to 105.8 billion cubic feet per day (bcfd) so far in March, up from a record 105.1 bcfd in February.

On a daily basis, output over the past two days was on track to drop by around 2.8 bcfd to a preliminary three-week low of 103.9 bcfd on Wednesday.

Traders said the daily drop was likely related to spring pipeline maintenance in Texas and other states, which helped cause spot prices at the Waha Hub in West Texas to turn negative in recent days. The traders noted that preliminary output data is often updated later in the day.

Meteorologists projected weather in the Lower 48 states would remain mostly near normal through April 3.

LSEG forecast average gas demand in the Lower 48, including exports, will rise from 106.7 bcfd this week to 109.8 bcfd next week. Those forecasts were lower than LSEG's outlook on Monday.

The amount of gas flowing to the eight big U.S. LNG export plants rose to an average of 15.7 bcfd so far in March, up from a record 15.6 bcfd in February, as new units at Venture Global's 3.2-bcfd Plaquemines LNG export plant under construction in Louisiana enter service.

The U.S. became the world's biggest LNG supplier in 2023, surpassing Australia and Qatar, as surging global prices fed demand for more exports due in part to supply disruptions and sanctions linked to Russia's 2022 invasion of Ukraine.

Gas was trading around $14 per mmBtu at both the Dutch Title Transfer Facility (TTF) benchmark in Europe and the Japan Korea Marker (JKM) benchmark in Asia. [NG/EU]

Week ended Week ended Year ago Five-year

Mar 14 Mar 7 Mar 14 average

Forecast Actual Mar 14

U.S. weekly natgas storage change (bcf): -3 -62 +5 -31

U.S. total natgas in storage (bcf): 1,695 1,698 2,331 1,897

U.S. total storage versus 5-year average -10.6% -11.9%

Global Gas Benchmark Futures ($ per mmBtu) Current Day Prior Day This Month Prior Year Five-Year

Last Year Average Average

2024 (2019-2023)

Henry Hub 4.15 4.05 1.75 2.41 3.52

Title Transfer Facility (TTF) 13.60 13.06 8.54 10.95 15.47

Japan Korea Marker (JKM) 13.11 13.18 8.95 11.89 15.23

LSEG Heating (HDD), Cooling (CDD) and Total (TDD) Degree Days

Two-Week Total Forecast Current Day Prior Day Prior Year 10-Year 30-Year

Norm Norm

U.S. GFS HDDs 235 240 255 246 244

U.S. GFS CDDs 21 19 10 20 17

U.S. GFS TDDs 256 259 265 266 261

LSEG U.S. Weekly GFS Supply and Demand Forecasts

Prior Week Current Next Week This Week Five-Year

Week Last Year (2020-2024)

Average For

Month

U.S. Supply (bcfd)

U.S. Lower 48 Dry Production 105.7 105.9 105.9 101.6 97.5

U.S. Imports from Canada 9.1 8.8 9.2 N/A 7.8

U.S. LNG Imports 0.0 0.0 0.0 0.0 0.1

Total U.S. Supply 114.7 114.7 115.1 N/A 105.4

U.S. Demand (bcfd)

U.S. Exports to Canada 3.8 4.0 4.0 N/A 3.3

U.S. Exports to Mexico 6.2 5.7 6.1 N/A 5.4

U.S. LNG Exports 15.5 15.9 15.7 13.1 11.8

U.S. Commercial 11.2 10.3 11.3 11.9 11.8

U.S. Residential 17.2 15.4 16.6 17.7 18.3

U.S. Power Plant 25.9 24.4 24.4 30.8 27.5

U.S. Industrial 23.7 23.4 24.0 24.5 23.8

U.S. Plant Fuel 5.2 5.2 5.2 5.2 5.2

U.S. Pipe Distribution 2.3 2.2 2.2 2.5 3.3

U.S. Vehicle Fuel 0.1 0.1 0.1 0.1 0.2

Total U.S. Consumption 85.6 81.0 83.9 92.7 90.1

Total U.S. Demand 111.1 106.7 109.8 N/A 110.6

N/A is Not Available

U.S. Northwest River Forecast Center (NWRFC) at The Dalles Dam 2025 2025 2024 2023 2022

(Fiscal year ending Sep 30) Current Day Prior Day % of Normal % of Normal % of Normal

% of Normal % of Normal Actual Actual Actual

Forecast Forecast

Apr-Sep 93 93 74 83 107

Jan-Jul 89 90 76 77 102

Oct-Sep 90 91 77 76 103

U.S. weekly power generation percent by fuel - EIA

Week ended Week ended 2024 2023 2022

Mar 21 Mar 14

Wind 18 15 11 10 11

Solar 6 7 5 4 3

Hydro 7 7 6 6 6

Other 1 1 1 2 2

Petroleum 0 0 0 0 0

Natural Gas 33 34 42 41 38

Coal 14 16 16 17 21

Nuclear 20 20 19 19 19

SNL U.S. Natural Gas Next-Day Prices ($ per mmBtu)

Hub Current Day Prior Day

Henry Hub 4.17 4.15

Transco Z6 New York 3.10 3.25

PG&E Citygate 3.83 3.86

Eastern Gas (old Dominion South) 3.05 3.09

Chicago Citygate 3.34 3.32

Algonquin Citygate 3.38 3.42

SoCal Citygate 3.82 3.78

Waha Hub 0.08 1.53

AECO 1.45 1.61

ICE U.S. Power Next-Day Prices ($ per megawatt-hour)

Hub Current Day Prior Day

New England 38.50 41.54

PJM West 46.58 49.44

Mid C 56.78 40.26

Palo Verde 18.00 14.36

SP-15 11.01 4.83

(Reporting by Scott DiSavino; Editing by Paul Simao and Diane Craft)

Sepp Blatter and Michel Platini acquitted again at second trial of financial wrongdoing at FIFA

Sepp Blatter and Michel Platini acquitted again at second trial of financial wrongdoing at FIFA

Brazil top court to weigh whether Bolsonaro will stand trial

Brazil top court to weigh whether Bolsonaro will stand trial

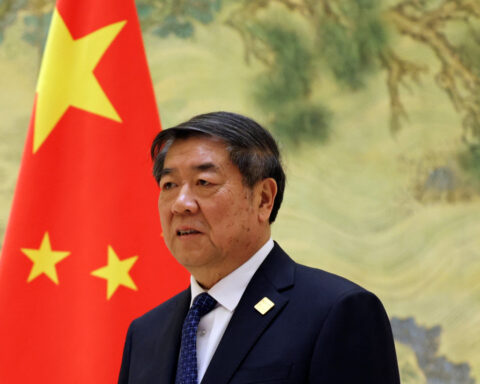

China's vice premier meets Blackstone chairman in Beijing

China's vice premier meets Blackstone chairman in Beijing

Relief rally starts to fizzle

Relief rally starts to fizzle

Citigroup appoints Akira Hoshino as head of markets for Japan

Citigroup appoints Akira Hoshino as head of markets for Japan

Josh Pastner agrees to become UNLV's coach, AP sources say

Josh Pastner agrees to become UNLV's coach, AP sources say

Baseball star Shohei Ohtani’s ex-interpreter has prison start postponed

Baseball star Shohei Ohtani’s ex-interpreter has prison start postponed