By Carolina Mandl

NEW YORK (Reuters) -The Managed Funds Association, a private fund industry group, has urged the U.S. Securities Exchange Commission (SEC) to reform or withdraw regulations introduced over the past four years.

The recommendations, including changes to mandates involving Treasury trades and funds' disclosures, were made in a letter to acting chair Mark Uyeda, President Donald Trump's pick for the position.

The MFA said its 10 recommendations would "reduce costs and burdens on market participants and improve the efficiency of the financial markets."

The MFA's moves come as private fund associations have challenged in court to overturn new rules the SEC adopted in 2023 under chair Gary Gensler, with the groups scoring some victories.

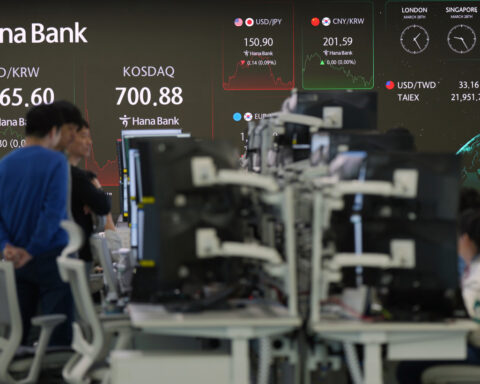

The industry recommended the regulator help improve market infrastructure before implementing a key reform introduced by the SEC in 2023 aimed at reducing systemic risk in the $28.5 trillion Treasuries market by forcing more trades through clearing houses.

Last month, Wall Street's top regulator delayed by a year the rollout of the new rules for some cash and repo Treasury transactions, agreeing with requests made by trade associations. The rules would initially be implemented in phases by June 2026.

Although MFA did not mention a specific new deadline, it said the SEC should only require Treasury clearing when the market infrastructure is in place, such as greater access to central clearing and cross-margining.

The fund industry group also asked the SEC to review an update of the "Form PF rule" from 2023 requiring funds to disclose more information, such as events that may indicate significant stress or otherwise signal the potential for systemic risk and investor harm, including significant margin calls or counterparty defaults, within 72 hours of the event.

While the private fund industry is in litigation with the SEC and awaits a court decision to vacate two other rules aimed at boosting transparency of short selling and securities lending, the MFA has asked the SEC to reduce the amount of information reported. When investors short a stock, they profit if its price falls.

Additionally, the MFA has asked the SEC to take steps to create a framework to govern digital asset securities and to ensure that private funds can invest in them without breaching custody requirements.

(Reporting by Carolina Mandl in New York; Editing by Jacqueline Wong)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness