By Lucia Mutikani

WASHINGTON (Reuters) - U.S. producer prices unexpectedly fell in December amid declining costs for goods such as diesel fuel and food, suggesting inflation would continue to subside and allow the Federal Reserve to start cutting interest rates this year.

The report from the Labor Department on Friday, which also showed prices for services were unchanged for the third straight month, implied that a pick-up in consumer prices last month was likely a blip. It led economists to anticipate that the key price measures tracked by the U.S. central bank for its 2% inflation target rose moderately in December from the prior month.

"The inflation pipeline is clearing and consumer prices will gradually get to the Fed's 2% target," said Jeffrey Roach, chief economist at LPL Financial in Charlotte, North Carolina.

The producer price index for final demand dipped 0.1% last month, the Labor Department's Bureau of Labor Statistics said. Data for November was revised to show the PPI falling 0.1% instead of being unchanged as previously reported. The PPI has now declined for three consecutive months.

Economists polled by Reuters had forecast the PPI rebounding 0.1%. Goods prices dropped 0.4%, with a 12.4% decline in the cost of diesel fuel accounting for half of the decrease.

Goods prices fell 0.3% in November. They have dropped for three straight months. Excluding food and energy, goods prices were unchanged after edging up 0.1% in November.

The weakness also suggested that goods deflation remained in force despite an uptick in consumer goods prices in December following two straight monthly decreases.

Food prices slipped 0.9% last month, with the cost of eggs tumbling 20.5%, but reversing only a fraction of the 71.2% surge in November. An outbreak of avian flu at some commercial farms was behind the spike in prices in November. Wholesale passenger car prices fell 3.0%. But gasoline prices increased 2.1%.

In the 12 months through December, the PPI increased 1.0% after advancing 0.8% in November. Data on Thursday showed consumer prices increased more than expected in December, driven by solid gains in shelter and healthcare costs.

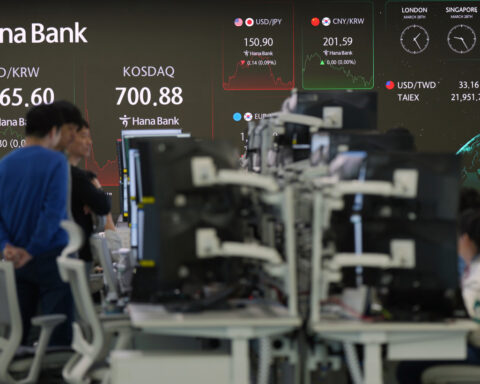

The dollar fell against a basket of currencies. U.S. Treasury prices were mostly higher, while stocks were mixed.

SERVICES PRICES UNCHANGED

Financial markets remain hopeful that the Fed will start cutting interest rates in March, though most economists are leaning towards May or June, given the labor market's resilience. The central bank has hiked its policy rate by 525 basis points to the current 5.25%-5.50% range since March 2022.

Services prices were curbed by declines in margins for machinery and motor vehicle wholesaling. Prices for hotel and motel rooms rose 2.1%. There were also decreases in the costs of transporting freight by road, automobiles and parts retailing, and apparel wholesaling.

But portfolio management fees rebounded 1.5%, reflecting recent stock market gains. Airline fares increased 2.1%. Health and medical insurance costs edged up 0.1%.

With supply chains mostly normalized after severe disruptions during the COVID-19 pandemic, services are at the core of the inflation battle. Services inflation, partly driven by a tight labor market, is less responsive to rate hikes.

Portfolio management fees, healthcare, hotel and motel accommodation, and airline fares are among components in the calculation of the personal consumption expenditures price indexes, the inflation measures monitored by the Fed for monetary policy.

Based on the CPI and PPI data, economists estimated the PCE price index excluding food and energy rose 0.2% in December after gaining 0.1% in November and October. In the 12 months through December, the so-called core PCE price was forecast increasing 3.0%. That would be the smallest year-on-year gain since March 2021 and follow a 3.2% rise in November.

The overall PCE price index is also seen climbing 0.2% in December, with the annual increase forecast to come in at about 2.6%, unchanged from November's advance.

Some economists worried that war in the Middle East and attacks on container ships by Iran-aligned Houthi militants in the Red Sea, which have forced companies to reroute vessels, driving up costs sharply along with insurance premiums, could push up prices of oil and other goods.

But others expected increased oil production in the United States to blunt the impact on consumers.

The narrower measure of PPI, which strips out food, energy and trade services components, rose 0.2% in December after gaining 0.1% in the prior month. The so-called core PPI rose 2.5% on a year-on-year basis after increasing 2.4% in November.

"The key upside risk to inflation is from the war in the Middle East and potential disruptions to trade flows and global energy supplies," said Bill Adams, chief economist at Comerica Bank in Dallas. "But petroleum and renewables output are growing faster than GDP in the U.S., which so far has offset the impact of geopolitical risk and kept energy prices well behaved."

(Reporting by Lucia Mutikani; Editing by Chizu Nomiyama and Andrea Ricci)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness